Itemized Fee Worksheet

Found 10 free book(s)Schedule A – Itemized Deductions

apps.irs.govThe itemized deduction for state and local taxes and sales and property taxes is limited to a combined, total deduc-tion of $10,000 ($5,000 if Married Filing Separately). Enter amount paid with last year’s state return and any other state and local income tax payments not entered elsewhere. Click here to open the sales tax worksheet.

Chapter 8. Borrower Fees and Charges and the VA Funding ...

www.benefits.va.govto the loan, if the funding fee is paid from loan proceeds (except Interest Rate Reduction Refinancing Loans (IRRRLs). Note: For IRRRLs, use VA Form 26-8923, IRRRL Worksheet, for the calculation. The lender’s flat charge is intended to cover all of the lender’s costs and services which are not reimbursable as “itemized fees and charges.”

2017 Schedule CA (540) California Adjustments - Residents

www.ftb.ca.govComplete the Itemized Deductions Worksheet in the instructions for Schedule CA (540), line 43 44 Enter the larger of the amount on line 43 or your standard deduction listed below Single or married/RDP filing separately.

FAST Aid Parent User Guide

ismfast.comPaper Worksheet If you want to compile your information before filling out online, ... • Schedule A—Itemized Deductions • Business–Schedule C or C-EZ (Form 1040) • Farm–Schedule F (Form 1040) ... all questions are completed and the filing fee has been paid. Help is only a phone call or email away. Call Centers are open 24/7/365.

2019 Schedule CA (540) California Adjustments - Residents

www.ftb.ca.govComplete the Itemized Deductions Worksheet in the instructions for Schedule CA (540), line 29..... 30 Enter the larger of the amount on line 29 or your standard deduction listed below Single or married/RDP filing separately.

Itemized Deductions Detail Worksheet (PDF) - IRS tax forms

apps.irs.govWorksheet A, Capital Expense Worksheet, in Pub. 502) • Diagnostic devices • Expenses of an organ donor • Eye surgery (to promote the correct function of the eye) • Fertility enhancement, certain procedures • Guide dogs or other animals aiding the blind, deaf, and disabled • Hospital services fees (lab work, therapy, nursing

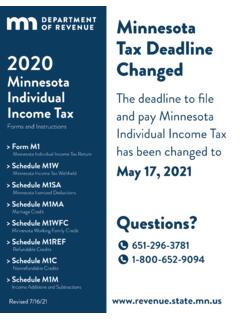

2020 M1SA, Minnesota Itemized Deductions

www.revenue.state.mn.usJul 16, 2021 · for certain Minnesota itemized deductions such as charitable contributions, casualty and theft losses, and certain miscellaneous deductions. If you entered amounts on lines 2 through 7 of Form 1040-NR, Schedule A, see instructions for lines 15-19 and line 24 of this schedule to determine your Minnesota itemized deduction. Line Instructions

Minnesota Tax Deadline 2020 Changed

www.revenue.state.mn.usMinnesota Itemized Deductions. For more information, see page 11.You may itemize deductions on your Minnesota income tax return even if you claimed the standard deduction on your federal income tax return. Itemized deductions are reduced if your income exceeds $197,850 ($98,925 if you are married and filing a separate return). Dependent Exemptions

Userid: CPM Schema

www.irs.govThe overall limit on itemized deductions has been eliminated. For details on these and other changes see What s New in these instructions. See IRS.gov and IRS.gov/Forms and for the latest information about developments related to Form 1040 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form1040.

Itemized Deductions Checklist - Affordable Tax

www.affordable-tax.comItemized Deductions Checklist Medical Expenses Medical expenses are generally deductible if they exceed 10% of your income or 7.5% of your income if you are over the age of 65. Some common medical expenses: Doctor/Dentist Fees Drug/Alcohol Treatment Cost of Guide Dogs Handicap Access Devices for Disabled Hospital Fees