Michigan Corporate Business Tax

Found 4 free book(s)5156, Request for Tax Clearance Application - Michigan

www.michigan.govMichigan. A corporation is any business entity that has filed and incorporated with the Michigan Department of Licensing and Regulatory Affairs (LARA). NOTE: A Tax Clearance Certificate must be requested from Treasury within 60 days of dissolution or withdrawal of business from Michigan. Corporate Identification Number: Enter the business’

Tax Year 2020 Mailing Addresses - Michigan

www.michigan.govOct 01, 2020 · 4913, Michigan Corporate Income Tax Quarterly Return (previously 4548) Corporate Income Tax 4576, MBT-V, Michigan Business Tax e-file Annual Return Payment Voucher Michigan Business Tax

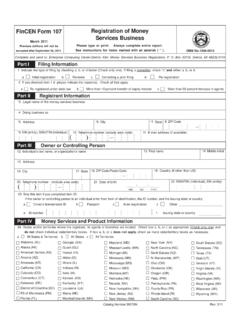

Part II Registrant Information - IRS tax forms

www.irs.govCFR Part Chapter X. The money services business listed in Part II maintains a current list of all agents, an estimate of its business volume in the coming year, and all other information required to comply with 31 U.S.C. 5330 and the regulations thereunder. The signature of the owner, controlling person or authorized corporate officer is mandatory.

Kentucky Tax Registration Application and Instructions

revenue.ky.govSECTION A REASON FOR COMPLETING THIS APPLICATION (Must Be Completed) SECTION B BUSINESS / RESPONSIBLE PARTY / CONTACT INFORMATION (Must Be Completed) 4. Legal Business Name 5. Doing Business As (DBA) Name (See instructions) 6. Federal Employer Identification Number (FEIN) (Required, complete prior to submitting)