Of Medical Expenses

Found 12 free book(s)Tax Guide on the Deduction of Medical Expenses

www.mdacc.co.zaThe medical allowance in respect of these contibutions and expenses is subject to the “capping of contributions” and “7.5% of taxable income” limitations discussed in 3.1.2 and 3.2. 3.1 Contributions to medical schemes

HEALTH CARE FSA ELIGIBLE EXPENSES

partners.tasconline.comThe following expenses are eligible only when incurred to treat a diagnosed medical condition. Such expenses require a Letter of Medical Necessity from your physician, including the diagnosed condition, onset of the condition, explanation for the medical necessity of the expense, and physician’s signature. Ear plugs Massage treatments

10-447 Reimbursement of Non-VA Medical Expenses for ...

www.va.govVeterans may file a claim for private medical expenses with their local VA health care facility’s Community Care medical care office. For Further Information Contact your local VA health care facility’s Community Care medical care office or VA at 1-877-222-VETS (8387). Authorities: Title 38, United States Code, §1728 and

Part I Section 213.--Medical, Dental, etc., Expenses Rev ...

www.irs.govSection 213(a) allows a deduction for expenses paid during the taxable year, not compensated for by insurance or otherwise, for medical care of the taxpayer, spouse, or dependent, to the extent the expenses exceed 7.5 percent of adjusted gross income. Under § 213(d)(1)(A), medical care includes amounts paid for the diagnosis, cure,

Amounts Paid for Certain Personal Protective Equipment ...

www.irs.govthe taxpayer’s total medical expenses exceed 7.5 percent of adjusted gross income. Because these amounts are expenses for medical care under § 213(d) of the Code, the amounts are also eligible to be paid or reimbursed under health flexible spending arrangements (health FSAs), Archer medical savings accounts (Archer MSAs), health

CLAIMANT'S RECORD OF MEDICAL AND TRAVEL EXPENSES …

www.wcb.ny.govnecessary expenses going to and from your doctor's office or the hospital. To help you keep a record of such expenses we have provided this form. In order to help insure that you are properly reimbursed, list each item of expense below--whether or not you obtained a receipt (wherever possible obtain receipts). Submit the completed form

4 Programs that Can Help You Pay Your medical expenses.

www.medicare.govMedical Expenses. Revised April 2020. There are federal and state programs available for people with Medicare who have income and resources below certain limits. These programs may help you . save on your health care and prescription drug costs. This fact sheet includes information about the following programs: • Medicaid • Medicare Savings ...

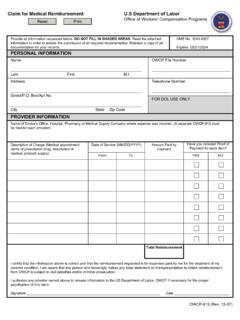

Claim for Medical Reimbursement U.S Department of Labor ...

www.dol.govForm OWCP-915 can be used to seek reimbursement for expenses in regard to medical treatment, prescription medication and medical supplies. • Please submit a separate reimbursement claim for each provider where an out of pocket expense was incurred. • Please print clearly and legibly. Reference your OWCP file number on all documentation.

Allowable Expenses One Pager - HHS.gov

www.hrsa.govproviders as they categorize expenses for reporting on use of funds. Use of funds guidance: The . June 11 Notice of Reporting Requirements. states that PRF payments can be usedby any provider of health care, services, and support in a medical setting, at home, or in the community towards health care-related expenses attributable to coronavirus

Request for Reimbursement

www.myuhc.comFor medical expenses: Name and address of provider Amount charged a highlighter.Type of service Date of service Patient’s name Now it’s time to attach the papers that confirm the expenses. These can include receipts from health care providers or an Explanation of Benefit (EOB) forms from your insurance plan.

CIGNA HDHP WITH HSA

www.cigna.comIt combines traditional medical coverage with a tax-free1 savings account and consists of these key components: 1. 100% coverage for preventive care when provided by an in-network physician. No cost to you or your account. 2. A savings account you establish through your employer and can use to pay health care expenses.

Fixed Expenses, Periodic Fixed Expenses, Flexible Expenses ...

www.freddiemac.comFixed Expenses, Periodic Fixed Expenses, Flexible Expenses and Indebtedness. Depending on your situation, some expenses (for example, long distance calls or a cell phone) may be considered flexible rather than fixed expenses. Be sure to adjust the budget categories to best reflect your needs and lifestyle. (Report all expenses as monthly ...