Of Pa Quarterly Unemployment Compensation Wage And Tax

Found 5 free book(s)File Layouts and Formats for Electronic Reporting of PA ...

www.uc.pa.govOFFICE OF UNEMPLOYMENT COMPENSATION TAX SERVICES File Layouts and Formats for Electronic Reporting of PA Quarterly Unemployment Compensation Wage and Tax Data UC-2010 REV 06-21 Auxiliary aids and services are available upon request to individuals with disabilities. Equal Opportunity Employer/Program www.uc.pa.gov

CONTACT INFORMATION EMPLOYER WITHHOLDING

www.revenue.pa.govEmployers are required to withhold PA personal income tax at a flat rate of 3.07 percent of ... and register for unemployment compensation accounts from the Department of Labor and ... Paper returns are accepted for the PA W2 wage forms and form REV-1667 Annual Withholding Reconciliation Statement. Employers filing 10

EFFECTIVE JANUARY 1, 2022

abacuspay.comNew Jersey Unemployment Tax The wage base is computed separately for employers and employees. For em-ployers for 2022, the wage base increas - es to $39,800 for unemployment insur-ance, disability insurance and workforce development. Employee’s unemployment and workforce development wage base increase to $39,800, maximum withhold - ing $169.15.

OVER-THE-ROAD TRUCKER EXPENSES LIST - PSTAP

www.pstap.orgdocument), you may received Form W-2, Wage and Tax Statement, for income from wages you receive as an employee. If you received a Form W-2 and the “Statutory employee” check box in Box 13 is marked, report that income on Schedule C, Profit and Loss from Business. Statutory employees include also certain agent or commission drivers.

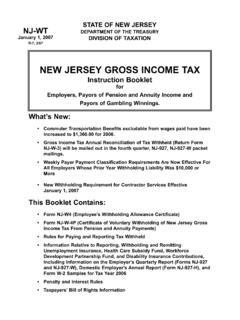

NEW JERSEY GROSS INCOME TAX - Government of New …

www.nj.govPA, DE, and MD) or 609-826-4400 (Touch-tone phones anywhere), or contact the Division of Taxation Customer Service Center at 609-292-6400. DUE DATES FOR PAYING AND REPORTING GROSS INCOME TAX WITHHELD PAYMENT/FILING PERIOD QUARTERLY REMITTANCE - Your withholding tax liability is less than $500 in each of the first two months …