Oklahoma tax commission

Found 9 free book(s)Oklahoma Tax Commission Employee’s …

www.ok.govOklahoma Tax Commission Employee’s Withholding Allowance Certificate Your First Name and Middle Initial Employee’s Signature (Form is not valid unless you sign it) …

Operating a Commercial Motor Vehicle or …

www.occeweb.comOperating a Commercial Motor Vehicle or Operating as a For-Hire or as a Private Motor Carrier or TNC in and/or through the State of Oklahoma

Oklahoma Franchise Tax Frequently Asked Questions

www.hccpas.netOklahoma Franchise Tax – Frequently Asked Questions Who files and pays franchise tax? All regular corporations and subchapter-S corporations are required to file Form 200, Annual Franchise Tax Return,

Assessor Ken YazelAssessor Ken Yazel - Tulsa …

www.assessor.tulsacounty.org2 Tulsa County Assessor 2 TABLE OF CONTENTS 3 The Basics of Ad Valorem Property Taxes 3 How is property tax generated? 3 Setting property tax rates

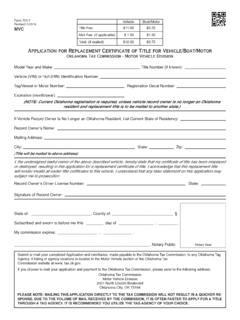

Application for Replacement Certificate of Title for ...

www.ok.govVehicle Title Fee: $11.00 $2.25 Mail Fee: (if applicable) $ 1.50 $1.50 Total: (if mailed) $12.50 $3.75 Boat/Motor Model Year and Make: Title Number (if known):

Appendix VI - S T A I . o r g

www.stai.orgAVI-1 Guidelines of The securiTies Transfer associaTion Appendix VI State Inheritance Tax Waiver List This paGe revised april 2016 1 Per the Alabama Department of Revenue. The information in this Appendix is based on information published

Streamlined Sales and Use Tax Agreement …

www.streamlinedsalestax.orgStreamlined Sales and Use Tax Agreement Certificate of Exemption . This is a multi-state form. Not all states allow all exemptions listed on this form. Purchasers are responsible for knowing if they qualify to

INSTRUCTIONS FOR COMPLETING HEIRSHIP …

www.swn.cominstructions for completing heirship affidavit. read instructions below before completing this form. important – remove this page …

UNIFORM SALES & USE TAX EXEMPTION/RESALE …

www.dandh.com1 REVISED 1/19/2018 UNIFORM SALES & USE TAX EXEMPTION/RESALE CERTIFICATE — MULTIJURISDICTION. The below-listed states have indicated that this certificate is acceptable as a resale/exemption certificate for sales and use tax…

Similar queries

Oklahoma Tax Commission, Operating a Commercial Motor Vehicle, Oklahoma, Oklahoma Franchise Tax Frequently Asked Questions, Oklahoma Franchise Tax – Frequently Asked Questions, Assessor Ken YazelAssessor Ken Yazel, Application for Replacement Certificate of, Appendix VI, INSTRUCTIONS FOR COMPLETING HEIRSHIP, Instructions for completing heirship affidavit, TAX EXEMPTION/RESALE CERTIFICATE — MULTIJURISDICTION