Profit Or Loss From Business

Found 9 free book(s)SCHEDULE C Profit or Loss From Business 2019

www.irs.govProfit or Loss From Business ... 31 Net profit or (loss). Subtract line 30 from line 29. • If a profit, enter on both . Schedule 1 (Form 1040 or 1040-SR), line 3 (or . Form 1040-NR, line 13) and on . Schedule SE, line 2. (If you checked the box on line 1, see instructions). Estates and

SCHEDULE C Profit or Loss From Business 2015

www.irs.govSCHEDULE C (Form 1040) 2015 Profit or Loss From Business (Sole Proprietorship) Department of the Treasury Internal Revenue Service (99) Information about Schedule C and its separate instructions is at

(EX) 09-20 20 PA Department of Revenue PA-40 or PA-41

www.revenue.pa.govProfit or Loss from Business or Profession PA-40 C IN (EX) 09-20 (Sole Proprietorship) 2 PA-40 C www.revenue.pa.gov explanation of gain/loss items, but do not submit the federal schedule. FORM 8271 Do not report or deduct any transactions related to tax shelters. FORM 8594

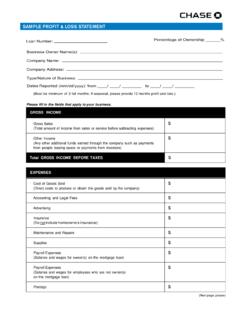

SAMPLE PROFIT & LOSS STATEMENT - Chase

www.chase.comIf seasonal, please provide 12 months profit and loss.) Please fill in the fields that apply to your business. GROSS INCOME. Gross Sales (Total amount of income from sales or service before subtracting expenses) $ Other Income (Any other additional funds earned through the company such as payments

CHAPTER 7 PROFIT & LOSS ACCOUNT AND BALANCE SHEET …

www.accaglobal.comThe profit and loss account can be prepared for any period. A business may prepare its profit and loss account annually. A profit and loss account is prepared for the period for which the business wants to evaluate its performance. In Table 7.1 'Faisal Furniture Shop' is the name of the business. The name of the business is always shown on all the

Profit and Loss Statement - Wells Fargo

www08.wellsfargomedia.comthe business or from January of this calendar year: Please complete the information below that applies to your business . Gross Income . Gross Sales (Total amount of income from sales or services before subtracting expenses) $ ... profit, loss, profit and loss statement Created Date:

SAMPLE PROFIT & LOSS STATEMENT OF HOTEL BUSINESS

www.frcs.org.fjSAMPLE PROFIT & LOSS STATEMENT OF HOTEL BUSINESS NOTES Each component of financial statement is to be valued at VEP amount. 1. Sales - Restaurant -Total sales (credit and cash) made during the year. 2. Sales – Bar- Total sales (credit and cash) made during the year. 3. Total Sales- Restaurant sales plus bar sales. 4.

PROFIT AND LOSS STATEMENT - Bank of America

homeloanhelp.bankofamerica.comPROFIT AND LOSS STATEMENT Please complete a separate Profit and Loss Statement for each business owned by the borrower(s). Name(s) of Borrower(s): Company Name: Type of Business: For the Period: through DD/MM/YYYY DD/MM/YYYY

Components of a Business Balance Sheet

www.oregonianscu.comBusiness Lines of Credit are used by businesses to service some short term needs and are paid generally from the collection of the businesses accounts receivable. The current portion of long term debt is the amount scheduled to be paid on long term obligations over the next 12 months. Long term debt are loans incurred by the business to