Qualifying Plant

Found 8 free book(s)Super-deduction and other first-year allowances - GOV.UK

assets.publishing.service.gov.uk15. The super-deduction is a 130% first-year allowance for qualifying plant and machinery expenditure which would ordinarily be relieved at the main rate writing down allowance at 18%. The 50% special rate first-year allowance provides relief for qualifying expenditure that would ordinarily be relieved at the special rate writing down allowance ...

Bill No. 1201 - Connecticut General Assembly

www.cga.ct.gov36 parts, of a plant of the genus cannabis, other than cannabis flower, that 37 have been harvested, dried and cured, and prior to any processing 38 whereby the plant material is transformed into a cannabis product. ... 64 dispensary facilities to qualifying patients, caregivers and research 65 program subjects, as defined in section 21a-408 of ...

INLAND REVENUE BOARD OF MALAYSIA DISPOSAL OF …

lampiran1.hasil.gov.my3.9 “Qualifying expenditure” means capital expenditure incurred on the provision, construction or purchase of plant and machinery used for the purpose of a business other than assets that have an expected life span of less than two (2) years. 4. Application of the Law

GENERAL INSTRUCTIONS - Louisiana

www.revenue.louisiana.gov1. Qualifying to do business in Louisiana or actually doing business within this state; or, 2. Exercising or continuing the corporate charter within this state; or, 3. Owning or using any part or all of the corporate capital, plant, or other property in this state in a corporate capacity.

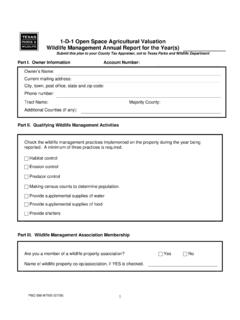

Owner’s Name: Current mailing address: City, town, post ...

tpwd.texas.govQualifying Wildlife Management Activities . Check the wildlife management practices implemented on the property during the year being reported. A minimum of three practices is required. ... Plant type established: Trees Shrubs Forbs Grasses . Hay meadow, pasture and cropland management for wildlife . Acres treated:

Departmental Interpretation And Practice Notes - No. 49

www.ird.gov.hkQualifying expenditure 26 Timing of deduction One-off deduction in the year of purchase 28 ... (topography) rights, protected plant variety rights, registered designs and registered trade marks. SCOPE OF THE TAX DEDUCTION . 5. IPRs are intangible assets, representing the exclusive rights offered by law to protect a person’screation.

Research and Development (R&D) Tax Credit - Revenue

www.revenue.iedevelopment (R&D) activities, plant and machinery and buildings. Credit is given at 25% of allowable expenditure. For accounting periods commencing prior to 1/1/2015 the amount of qualifying expenditure is restricted to incremental expenditure over expenditure in a base year (2003) defined as the “threshold amount”.

Roofing: Premium Credits Product Listing

static1.st8fm.comFeb 01, 2022 · Malibu (Phoenix Plant) FM Class 3 Ponderosa FM Class 3 Ponderosa (Phoenix Plant) FM Class 3 Page 4 of 51 PLEASE NOTE: Use of pre-qualified impact resistant products may qualify for premium discounts in some states/provinces. State Farm does not endorse or recommend roofing products, nor is the