Transcription of GENERAL INSTRUCTIONS - Louisiana

1 CIFT-620 (01-03)Department of Revenue Page 13 IMPORTANTThe Louisiana Revenue Account Number must be used on all tax documentsand use the return supplied by the Department and attach the pre-printedname and address label. Any change of address should be noted in theaddress area, and the box indicating that the address has changed should bemarked. If a pre-printed return is unavailable, indicate the Louisiana RevenueAccount Number, complete name, and current address on the tax return. If theaddress is different from that of the last return filed, mark the box indicatingthat the address has changed. Returns and INSTRUCTIONS are available at alloffices listed on page 24 and via the Department s website, COMPLETE ALL APPLICABLE LINES AND SCHEDULES OFTHE RETURN.

2 Failure to furnish complete information will cause processingof the return to be delayed and may necessitate a manual review of the corporation should retain, for inspection by a revenue auditor, workingpapers showing the balance in each account on the corporation s books usedin preparing the return until the taxes to which they relate have MUST FILE?DOMESTIC CORPORATIONS Corporations organized under the laws ofLouisiana must file an income and franchise tax return (Form CIFT-620) eachyear unless exempt from both franchise tax for domestic corporations continues to accrue,regardless of whether any assets are owned or any business operations areconducted, until a Certificate of Dissolution is issued by the LouisianaSecretary of CORPORATIONS Corporations organized under the laws of astate other than Louisiana that derive income from Louisiana sources mustfile an income tax return (Form CIFT-620)

3 , whether or not there is any foreign corporation is subject to the franchise tax if it meets any one of thecriteria listed below:1. qualifying to do business in Louisiana or actually doing business within thisstate; or,2. Exercising or continuing the corporate charter within this state; or,3. Owning or using any part or all of the corporate capital, plant, or otherproperty in this state in a corporate corporation will be subject to the franchise tax if it meets the above criteria,even if it is not required to pay income tax under Federal Public Law franchise tax for foreign corporations continues to accrue as longas the corporation exercises its charter, does business, or owns or uses anypart of its capital or plant in Louisiana , and in the case of a qualifiedcorporation.

4 Until a Certificate of Withdrawal is issued by the LouisianaSecretary of ENTITIES Any entity taxed as a corporation for federal income taxpurposes will also be taxed as a corporation for state income tax GROUPS Louisiana law does not provide for filingconsolidated returns. Generally, separate corporate income and franchisetax returns must be filed by all corporate entities liable for a Louisiana CORPORATIONS Louisiana law does not recognize S corporationstatus, and an S corporation is required to file in the same manner as aC corporation. However, in certain instances, all or part of the corporationincome can be excluded from Louisiana tax.

5 For information on theS corporation exclusion of net income, refer to the INSTRUCTIONS for Line CORPORATIONS Louisiana Revised Statute 47 providesthat an organization described in Internal Revenue Code Sections 401(a) or501 shall be exempt from income taxation to the extent the organization isexempt from income taxation under federal law, unless the contrary isexpressly provided. An organization claiming exemption under La. must submit a copy of the Internal Revenue Service rulingestablishing its exempt status. Refer to La. 47 for additionalexemptions provided for banking corporations.

6 Refer to La. 47 ,526, 527, and 528 for information concerning the treatment of farmers cooperatives, other cooperatives, shipowners protection and indemnityassociations, political organizations, and homeowners to La. 47:608 for information concerning those corporationsexempt from franchise tax. Those corporations that meet the prescribedstandards of organization, ownership, control, sources of income, anddisposition of funds must apply for and secure a ruling of exemption from AND PLACE FOR FILINGOn or before the 15th day of the fourth month (April 15, on a calendar yearbasis) following the close of an accounting period, an income tax return for theperiod closed and a franchise tax return for the succeeding period must befiled with the Secretary of Revenue, Post Office Box 91011, Baton Rouge,LA 70821-9011.

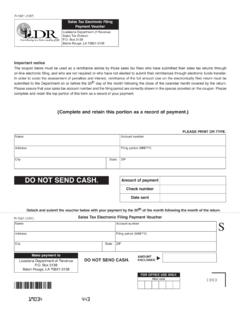

7 If the due date falls on a weekend or holiday, the return isdue the next business day and becomes delinquent the first day payments to Louisiana Department of Revenue. DO NOT SENDCASH. Cash may be paid in person only if an official receipt is received fromthe Department of OF TIME FOR FILINGThe Secretary may grant a reasonable extension of time to file the combinedcorporation income and franchise tax return not to exceed seven months fromthe due date of the tax return. Louisiana will recognize and accept the federalextension authorizing the same extended due date as the federal. A copy ofthe request filed with the Internal Revenue Service must be attached to theLouisiana return.

8 If a federal extension has not been obtained or additionaltime is needed beyond the extended due date of the federal return, then FormCIFT-620 EXT (Application for Automatic Extension of Time to File CorporationIncome and Franchise Taxes Return) should be filed with the Department bythe due date of the return for which the extension applies. (See inside backcover.)PERIODS TO BE COVEREDThe return must be filed for either a calendar year, a fiscal year (12-monthaccounting period ending on the last day of any month other than December),or a 52 - 53 week accounting period. The dates on which the period reportedon the return begins and ends must be plainly stated in the appropriate spaceat the top of the return.

9 The accounting period must be the same as that usedfor federal income tax FOR PART OF THE YEARFor information concerning returns filed for part of the year, refer to theinstructions for Lines 2 and 9 on Pages 14 and 16 of this booklet forinstructions on annualization and RETURNSIn order to amend the amounts reported for the computation of income orfranchise taxes, the taxpayer must file a revised Page 1 of Form CIFT-620,along with a detailed explanation of the changes, and a copy of the federalamended return (Form 1120X), if applicable. The AMENDED RETURN boxon the Louisiana form should be clearly INSTRUCTIONSPage 14 Department of RevenueCIFT-620 InstructionsREPORT OF FEDERAL ADJUSTMENTSLa.

10 47 requires every taxpayer whose federal return isadjusted to furnish a statement disclosing the nature and amounts of suchadjustments within 60 days after the adjustments have been made andaccepted. This statement should accompany the amended OF ESTIMATED TAXLa. 47 requires every corporation that can reasonably expectits estimated income tax for the year to be $1,000 or more to makeinstallment payments of its liability. The term estimated tax means theamount the taxpayer estimates to be the Louisiana income tax imposed forthe period less the amount it estimates to be the sum of any credits allowableagainst the the INSTRUCTIONS pertaining to Form CIFT-620ES for further information,including the addition to the tax for underpayment or nonpayment ofestimated income TO WHOLE DOLLARSR ound cents to the nearest whole dollar on Page 1 of Form CIFT-620.