Real Estate Withholding

Found 6 free book(s)November 2021 Tax News

www.ftb.ca.govCalifornia law requires withholding when California real estate is sold or transferred unless a full or partial exemption applies. It is important for the seller to report the correct name and identification number on the Real Estate Withholding Statement (Form 593) when title is held in the name of a trust. ...

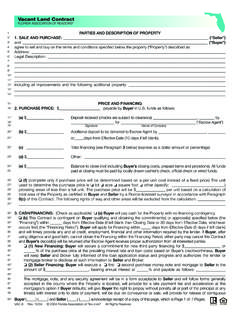

Vacant Land Contract - FLORIDA REAL ESTATE

www.highlightrealty.comeliminated withholding, or (3) the gross sales price is $300,000 or less, Buyer is an individual who purchases the Property to use as a residence, and Buyer or a member of Buyer’s family has definite plans to reside at the Property for at least 50% of

1 Date of transfer Statement of Withholding on ...

www.irs.govPrepare Form 8288-A for each foreign person subject to withholding. Attach Copies A and B to Form 8288, U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests. Copy B will be stamped by the IRS and sent to the person subject to withholding if the form is complete, including the transferor’s

Residential Sale and Purchase Contract

www.unlimitedmls.com(e) Tax Withholding: Buyer and Seller will comply with the Foreign Investment in Real Property Tax Act, which may require (f) Home Warranty: Buyer Seller Seller to provide additional cash at closing if Seller is a “foreign person” as defined by federal law. N/A will pay for a home warranty plan issued by _____ at a

CERTIFICATE OF NON FOREIGN STATUS - Foundation Title

ftnj.comthat withholding of tax is not required upon the disposition of a U.S. real property interest by (the “Transferor”), the undersigned hereby certifies the following on behalf of the Transferor: 1. That the Transferor is the owner of the following described property, to wit:

FREQUENTLY ASKED QUESTIONS ON TAX MATTERS DURING …

phl.hasil.gov.myProperty Trusts, Co-operative Societies, Trust Bodies, Real Estate Investment Trusts / Property Trust Funds and Business Trusts with accounting period ending 1 October 2020 until 31 October 2020: Extension time of two (2) months will be given from the due date of submission. ii. Return form for year of assessment 2020 involving