Respect Of Specified Domestic Transactions

Found 10 free book(s)FORM NO. 3CEB - Income Tax Department

www.incometaxindia.gov.inby the assessee in respect of the international transaction(s) and the specified domestic transactions entered into so far as appears from *my/our examination of the records of the assessee. 3. The particulars required to be furnished under section 92E …

Advance Pricing Agreement Frequently Asked Questions

www2.deloitte.comdomestic tax law and treaty provisions and government regulations; ... is mandatory, and specified information has to be filed as part of the pre-filing application. ... international transactions in respect of which an APA is proposed. Accordingly, the fees shall be based

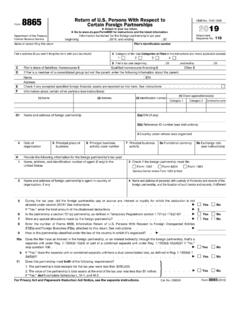

2021 Form 8865 - IRS tax forms

www.irs.govReturn of U.S. Persons With Respect to ... from transactions with or by the foreign partnership that the filer included in its computation of foreign-derived deduction ... (foreign or domestic) in which the foreign partnership owns a direct interest or indirectly owns a 10% interest. Name:

Instructions for Form 8993 (Rev. January 2022) - IRS tax forms

www.irs.govA domestic corporation’s QBAI is the average of the aggregate of its adjusted bases, determined as of the close of each quarter of the tax year, in specified tangible property used in its trade or business and of a type with respect to which a deduction is allowable under section 167. See Regulations section 1.250(b)-2. Information From ...

TRANSACTIONS OF EXEMPT PERSONS - FFIEC BSA/AML

bsaaml.ffiec.govbusinesses and payroll customers) whose currency transactions that meet specific criteria may be exempted from reporting requirements. (6) To the extent of their domestic operations and only with respect to transactions conducted through their exemptible accounts, any other commercial enterprise (referred to as “non-listed businesses”) that:

Frequently Asked Questions about Regulation S

media2.mofo.comRule 903 distinguishes three categories of transactions based on the type of securities being offered and sold, whether the issuer is domestic or foreign, whether the issuer is a reporting issuer under the Securities Exchange Act of 1934, as amended (the Exchange Act ), and whether there is a substantial U.S. market

MAT AND AMT - Income Tax Department

www.incometaxindia.gov.in(a) the capital gains arising on transactions in securities; or (b) the interest, dividend royalty or fees for technical services chargeable to tax at the rate or rates specified in Chapter XII if such income is credited to the statement of profit and loss and the income-tax payable on above income is less than the rate of MAT. XXXXX

[4830-01-p] that claim a deduction for FDII ...

public-inspection.federalregister.govforeign law transactions on the earnings and profits of a foreign corporation. 85 FR at 72079. A comment noted that proposed §1.245A(d)-1(a) explicitly treated as specified earnings and profits the portion of a U.S. return of capital amount that is deemed to arise pursuant to §1.861-20(d)(3)(i) in a section 245A subgroup under the asset method

UNITING AND STRENGTHENING AMERICA BY PROVIDING ... - …

www.congress.govtransactions of primary money laundering concern. Sec. 312. Special due diligence for correspondent accounts and private banking ac-counts. Sec. 313. Prohibition on United States correspondent accounts with foreign shell banks. Sec. 314. Cooperative efforts to deter money laundering. Sec. 315.

Request Taxpayer Identification Number Certification

www.doa.virginia.gov• A domestic trust (as defined in Regulations section 301.7701-7). Foreign person. If you are a foreign person or the U.S. branch of a foreign bank that has elected to be treated as a U.S. person, do not use Form W-9. Instead, use the appropriate Form W-8 or Form 8233 (see Publication 515, Withholding of Tax on

![[4830-01-p] that claim a deduction for FDII ...](/cache/preview/4/f/4/1/d/d/2/6/thumb-4f41dd2648bb10e454f6ff8179cbc3fa.jpg)