Schedule C Ez

Found 9 free book(s)2021 Schedule C (Form 1040) - IRS tax forms

www.irs.govSchedule C (Form 1040) 2021 . Schedule C (Form 1040) 2021. Page . 2 Part III Cost of Goods Sold (see instructions) 33 . Method(s) used to value closing inventory: a . Cost . b . Lower of cost or market . c . Other (attach explanation) 34 . Was there any change in determining quantities, costs, or valuations between opening and closing inventory?

2018 Schedule C-EZ (Form 1040) - IRS tax forms

www.irs.govSchedule C-EZ instead of Schedule C only if you: • Had business expenses of $5,000 or less, • Use the cash method of accounting, • Did not have an inventory at any time during the year, • Did not have a net loss from your business, • Had only one business as either a sole proprietor, qualified joint venture, or statutory employee,

Blue Easy Reader Thermostat - Emerson US

climate.emerson.com4 Programming and Configuration Items 1 “Heat" “A/C” “Off” identifies button. When filled indi-cates system mode selected. 2" " indicates thermostat configured for Heat Pump. "Aux" indicates Auxiliary (Emergency) stage is selected. 3 "Adv Day" identifies button when in schedule mode. 4 "Time" identifies button when in schedule mode. 5 "Fan" identifies button.

2020 I-016a Schedule H & H-EZ Instructions - Wisconsin ...

www.revenue.wi.govcompleting Schedule H or H-EZ: • Do not submit photocopies to the department. Photocopies can cause unreadable entries. • Use BLACK INK. Pencils, colored ink, and markers do not scan well. • Write your name and address clearly using CAPITAL LETTERS like this

05-908 2020 Texas Franchise Tax Report Information and ...

comptroller.texas.govschedule. Additionally, if the disregarded entity is organized in Texas or has nexus in Texas, it will be required to file the appropriate information report (Form 05-102 or 05-167). Margin. Unless a taxable entity qualifies and chooses to file using the EZ computation or …

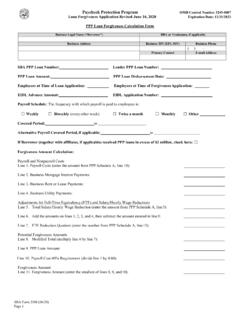

PPP Loan Forgiveness Application - Front page

home.treasury.govPayroll Schedule: The frequency with which payroll is paid to employees is: ... SBA-guaranteed loan is punishable under the law, including 18 U.S.C. 1001 and 3571 by imprisonment of not more than five years and/or a fine of up to $250,000; under 15 U.S.C. 645 by imprisonment of not more than two years and/or a fine ...

Starting a 501(c)(4) Organization

nlihc.org990-EZ or 990-N. Even a 501(c)(4) organization that did not apply for exemption by filing a Form 1024 must submit annual information reports. When preparing your 990, you will need to provide financial ... and or political activity you will also need to file Schedule C of the 990. NOTE: Failure to file Form 990 for three consecutive years will ...

SCHEDULE C-EZ Net Profit From Business (Form 1040) (Sole ...

www.nd.govSchedule C-EZ (Form 1040) 2005 Page 2 Line 2 If you claim car or truck expenses, be sure to complete Schedule C-EZ, Part III. Instructions You can use Schedule C-EZ instead of Schedule C if you operated a business or practiced a profession as a sole proprietorship or you were a statutory employee and you

2019 Form 100S California S Corporation Franchise or ...

www.ftb.ca.gov3611193 Form 100S 2019 Side 1 B 1. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this corporation or any of its subsidiaries that owned California real property (i.e., land, buildings), leased