Section 408a

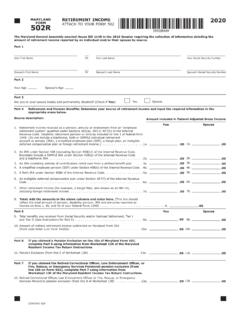

Found 10 free book(s)MARYLAD RETIREMET IOME 2020 FORM 0 502R - …

marylandtaxes.govIRA under Section 408(p) of the Internal Revenue Code and a traditional IRA X X X 3 An IRA consisting entirely of contributions rolled over from a defined benefit plan X 4 A simplified employee pension (SEP) under Section 408(k) of the Internal Revenue Code X 5 A Roth IRA under Section 408A of the Internal Revenue Code X

2020 Limitations Adjusted as Provided in Section 415(d), etc.

www.irs.govThe adjusted gross income limitation under section 408A(c)(3)(B)(ii)(I) for determining the maximum Roth IRA contribution for married taxpayers filing a joint return or for taxpayers filing as a qualifying widow(er) is increased from $198,000 to $204,000. The adjusted gross income limitation under section

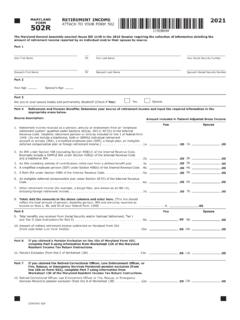

MARYLAD RETIREMET IOME 2021 FORM 0 502R

www.marylandtaxes.govIRA under Section 408(p) of the Internal Revenue Code and a traditional IRA X X X 3 An IRA consisting entirely of contributions rolled over from a defined benefit plan X 4 A simplified employee pension (SEP) under Section 408(k) of the Internal Revenue Code X 5 A Roth IRA under Section 408A of the Internal Revenue Code X

INDIVIDUAL RETIREMENT TRUST ACCOUNT AGREEMENT

iradirect.ascensus.comrecharacterized contribution described in section 408A(d)(6), the trustee will accept only cash contributions up to $5,500 per year for tax years 2013 through 2017. For individuals who have reached the age of 50 by the end of the year, the contribution …

Plan Agreement 2 Plan Disclosure 6 Financial Disclosure 13

www.capitalone.comrecharacterized contribution described in section 408A(d)(6), the custodian will accept only cash contributions up to $5,500 per year for tax years 2013 through 2017. For individuals who have reached the age of 50 by the end of the year, the contribution limit is increased to $6,500 per

DOL-74 (R ev 5/13) CONNECTICUT DEPARTMENT OF LABOR …

www.ctdol.state.ct.usfor contributions attributable to automatic enrollment, as defined in section 2 of this act, in a retirement plan described in Section 401(k), 403(b ), 408, 408A, or 457 of the Internal Revenue Code of 1986, or any subsequent corresponding internal revenue code of the United

2021 Limitations Adjusted as Provided in Section 415(d ...

www.irs.govapplicable dollar amount under § 408A(c)(3)(B)(ii)(III) for a married individual filing a separate return is not subject to an annual cost-of-living adjustment and remains $0. Accordingly, under § 408A(c)(3)(A), the adjusted gross income phase-out range for taxpayers making contributions to a Roth IRA is $198,000 to $208,000 for married

A Guide to WAGE AND WORKPLACE STANDARDS …

www.ctdol.state.ct.usattributable to automatic enrollment, as defined in section 2 of this act, in a retirement plan, described in Section 401(k), 403(b), 408, 408A, or 457 of the Internal Revenue Code, established by the employer. The employer can submit a sample form to the Wage and Workplace Standards Division or use the sample form on our website.

DEPARTMENT OF THE TREASURY Internal Revenue Service

public-inspection.federalregister.gov408A(a) and (c)(5), those rules apply to a Roth IRA only after the death of the IRA owner. 2 Pursuant to sections 403(a)(1) and 404(a)(2), qualified annuity plans also must comply with the requirements of section 401(a)(9).

Application for Assistance Medicare Assets Accounts

www.harrishealth.org403(b), 408, 408A, 457(b), 501(c)(18), Federal Thrift Savings Plan, Section 8439, Title 5, United States Code, and Other retirement accounts determined to …