Search results with tag "Section 408a"

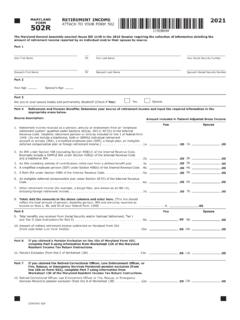

MARYLAD RETIREMET IOME 2021 FORM 0 502R

www.marylandtaxes.govIRA under Section 408(p) of the Internal Revenue Code and a traditional IRA X X X 3 An IRA consisting entirely of contributions rolled over from a defined benefit plan X 4 A simplified employee pension (SEP) under Section 408(k) of the Internal Revenue Code X 5 A Roth IRA under Section 408A of the Internal Revenue Code X

2020 Limitations Adjusted as Provided in Section 415(d), etc.

www.irs.govThe adjusted gross income limitation under section 408A(c)(3)(B)(ii)(I) for determining the maximum Roth IRA contribution for married taxpayers filing a joint return or for taxpayers filing as a qualifying widow(er) is increased from $198,000 to $204,000. The adjusted gross income limitation under section

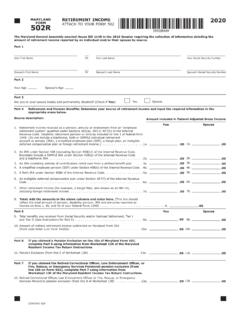

MARYLAD RETIREMET IOME 2020 FORM 0 502R - …

marylandtaxes.govIRA under Section 408(p) of the Internal Revenue Code and a traditional IRA X X X 3 An IRA consisting entirely of contributions rolled over from a defined benefit plan X 4 A simplified employee pension (SEP) under Section 408(k) of the Internal Revenue Code X 5 A Roth IRA under Section 408A of the Internal Revenue Code X

Plan Agreement 2 Plan Disclosure 6 Financial Disclosure 13

www.capitalone.comrecharacterized contribution described in section 408A(d)(6), the custodian will accept only cash contributions up to $5,500 per year for tax years 2013 through 2017. For individuals who have reached the age of 50 by the end of the year, the contribution limit is increased to $6,500 per

INDIVIDUAL RETIREMENT TRUST ACCOUNT AGREEMENT

iradirect.ascensus.comrecharacterized contribution described in section 408A(d)(6), the trustee will accept only cash contributions up to $5,500 per year for tax years 2013 through 2017. For individuals who have reached the age of 50 by the end of the year, the contribution …

Safe Harbor Explanation – Eligible Rollover …

www.irs.gov4 could only accept rollover contributions from another Roth IRA, a non-Roth IRA, or a designated Roth account described in § 402A. Section 408A(d…