Spending account claim

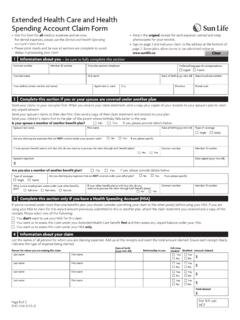

Found 9 free book(s)Extended Health Care and Health Spending Account Claim …

www.sunlife.caTitle: Extended Health Care and Health Spending Account Claim Form Author: Sun Life Created Date: 5/20/2021 12:19:19 PM

Flexible Spending Account (FSA) Frequently Asked Questions

www.flexiblebenefit.comFlexible Spending Account (FSA) Frequently Asked Questions 1. ... You can use your account to pay for eligible health care expenses for your family, regardless of the health insurance plan in which they are enrolled. 4. ... and that person must claim the income. 9. My spouse is a stay at home parent, can I use the Dependent Care FSA to pay for ...

IBM Reimbursement Request Form Health Care Spending …

www.acclarisonline.comany other plan or insurance. I understand that expenses reimbursed from my IBM Health Care Spending Account cannot be taken as tax deductions. I further understand that any person who, knowingly and with intent to defraud or deceive any claims reimbursement company, files a statement of claim containing any materially false or

Your Health Care Spending Card Debit MasterCard or ...

benefits.cat.com• It’s connected to your flexible spending account (FSA). • There’s no need to write checks or submit claim forms. • Use it for eligible medical, dental, vision and pharmacy expenses. • Use it for eligible dependent care expenses (if it applies). I’ve lost my card or it was stolen! Call Customer Care immediately at 1-866-755-2648 ...

DISPOSITION OF ABANDONED AND UNCLAIMED PROPERTY …

www.patreasury.govThe term shall not include debit cards linked to a deposit account or prepaid telephone calling cards. The term also shall not include flexible spending arrangements, including health reimbursement arrangements, as defined in section 106(c)(2) of the Internal Revenue Code of 1986 (Public Law 99-514,

Health Flexible Spending Account – Frequently Asked …

mybenefits.wageworks.comHealth Flexible Spending Account Health Flexible Spending Account – Frequently Asked Questions What is a health flexible spending account? A health flexible spending account (FSA) is part of your benefits package. This plan lets you use pre-tax dollars to pay for eligible health care expenses for you, your spouse, and your eligible dependents.

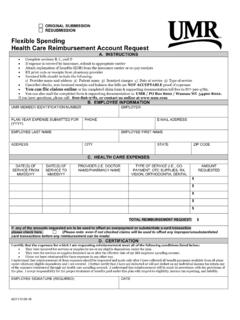

Flexible Spending Health Care Reimbursement Account …

fhs.umr.comFlexible Spending Health Care Reimbursement Account Request. A. INSTRUCTIONS • Complete sections B, C, and D • If expense is covered by insurance, submit to appropriate carrier • Attach explanation of benefits (EOB) from the insurance carrier or co-pay receipts • Rx print outs or receipts from pharmacy provider

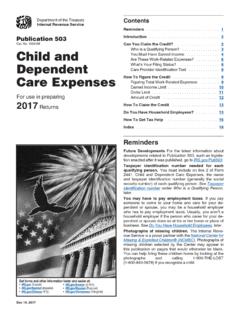

2021 Publication 503 - IRS tax forms

www.irs.govTo be able to claim the credit for child and dependent care expenses, you must file Form 1040, 1040-SR, or 1040-NR, and meet all the tests in Tests you must meet to claim a credit for child and dependent care expenses next. Tests you must meet to claim a credit for child and dependent care expenses. To be able to claim the

Online Paystubs Federal tax - Kroger

ess.kroger.comNon-taxable income includes: • Medical/dental/health plans (employer contributions) • Qualified employee discounts on employer goods or services • Qualified moving expenses • Educational assistance for job-related courses (up to a $5,250 annual limit) • Reimbursed qualified business expenses (if accounted for in a timely manner) • Cost of group term insurance premium ($50,000 or ...