State Department Of Assessments And Taxation

Found 7 free book(s)2019 State & Local Tax Forms & Instructions

www.marylandtaxes.gov• State Department of Assessments and Taxation Information NEW FOR 2019 A new checkbox on the Form 502 has been added for taxpayers to indicate they are claiming the Maryland Earned Income Credit, but do not qualify for the federal Earned Income Credit. This is a result of House Bill 856 (Acts of 2018)

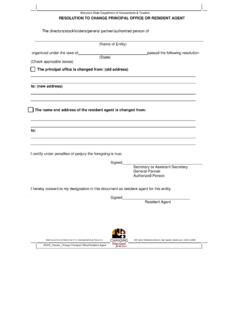

Maryland State Department of Assessments & Taxation ...

dat.maryland.govState Department of Assessments & Taxation staff cannot offer business counseling or legal advice. 2. Regarding annual documents to be filed with the Department of Assessments & Taxation: All domestic and foreign legal entities must submit a Business Personal Property Return to the Department.

MARYLAND DEPARTMENT OF ASSESSMENTS

dat.maryland.govMARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION ADDRESS CHANGE REQUEST FORM I, the undersigned, hereby request a permanent change of mailing address for the property listed below in _____ (Enter county name) (Please type or print legibly, you may also fill this form out on your pc.)

Affidavit of Consideration for Use By Seller - State

www.state.nj.usSTATE OF NEW JERSEY . PO BOX 251 . TRENTON, NJ 08695-0251 . ATTENTION: REALTY TRANSFER FEE UNIT. The Director of the Division of Taxation in the Department of the Treasury has prescribed this form as required by law, and may not be altered or amended without prior approval of the Director.

PROPERTY REASSESSMENT AND TAXATION

stc.mo.govlocated outside the state is not assessed in the state. Personal property owned by non-residents of the state is taxed in the county where it is located on January 1. Taxation of the personal property of Military personnel is governed by federal law enacted in 1940 to prevent double taxation. It provides that their

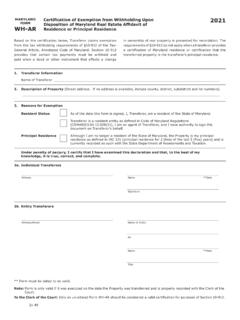

MARYLAND Certification of Exemption from Withholding pon ...

marylandtaxes.govPrincipal Residence Although I am no longer a resident of the State of Maryland, the Property is my principal residence as defined in IRC 121 (principal residence for 2 (two) of the last 5 (five) years) and is currently recorded as such with the State Department of …

STATEOFNEWJERSEY TAX MAPS

www.state.nj.us(N.l.SA 52:18A-46), the Director, Division of Taxation, Department of the Treasury, has adopted these rules for the preparation of tax maps. The following general provisions apply: 1. Modifications of these rules may be desirable in some cases to meet special conditions and will be author-ized upon application in writing to the Director if adequate