State Employer

Found 6 free book(s)Form NYS-100, New York State Employer Registration for ...

www.paycoinc.comItem 2 Any person or organization qualifying as an employer on the basis of instructions contained in federal Circular E that maintains an office or transacts business in New York State is an employer for NewYork State withholding tax purposes and must withhold from compensation paid to its employees.

KY Income Tax Employer’s State KY State Wages Withheld ...

revenue.ky.govDo not include other state withholding or local income tax. Employee’s Social Security Number Employer’s Identification Number (EIN) KY State Wages (Box 16 of Form W-2) KY Income Tax Withheld (Box 17 of Form W-2) Employer’s State I.D. Number (Box 15 of Form W-2) State TOTAL FROM ALL W-2s

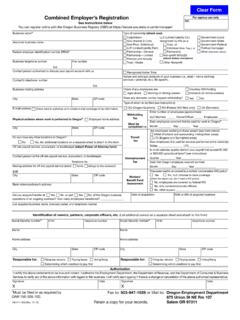

Combined Employer’s Registration - State of Oregon

www.oregon.govState unemployment tax State unemployment tax is an employer paid tax that finances the Oregon unemployment insurance program. Generally employers must pay into the Unemployment Insurance Trust Fund if they: • Have one or more employees in each of 18 weeks during a cal-endar year, or

INF 1102, Commercial or Government Employer Pull Notice ...

www.dmv.ca.govTitle: INF 1102, Commercial or Government Employer Pull Notice. Enrollment of Out-of-State Licensed Drivers Author: CA DMV Subject: index-ready The INF 1102 form: is used when an employer needs to add an out-of-state licensed driver to the EPN program, is not used to delete drivers, will provide information on the "Driver Record Report" containing only information from …

State of Missouri Employer’s Tax Guide

dor.mo.govThe term employer means the person, including all government agencies, who controls the payment of the compensation. An employer required to withhold Missouri income tax is personally. liable for the tax. Any amount of tax actually deducted and. withheld by an employer is a special fund in trust for the Director of Revenue (Section 143.241 ...

State of California STATE COMPENSATION INSURANCE …

content.statefundca.comworkers' compensation or other insurance claim; and under certain circumstances to a public health or law enforcement agency or to a consultant hired by the employer (CCR Title 8 14300.30). CCR Title 8 14300.40 requires provision upon request to certain state and federal workplace safety agencies.