Statement Of Wage Earnings

Found 10 free book(s)EMPLOYER'S STATEMENT OF WAGE EARNINGS

www.wcb.ny.govTo determine Average Weekly Wage, the Board needs the gross weekly earnings for the 52 weekly periods immediately preceding the date of the injury/ illness.€ This information can be provided by 1) attaching detailed payroll information that indicates days paid and gross weekly earnings; 2) if injured worker is

EJ-165 Financial Statement - California

www.courts.ca.govAn earnings withholding order is now in effect with respect to my earnings or those of my spouse or dependents named in item 1 (specify each person's name and monthly amount): 7. 8. A wage assignment for support is now in effect with respect to my earnings or those of my spouse or dependents named in

Employees’ RETIREMENT SYSTEM

www.rsa-al.govAnnual Statement of Account Your personal Annual Statement of Account is mailed to your home address in early December. You may view your account statement online at our website. The purpose of the annual statement is to provide information pertaining to your beneficiary, member contributions, accumulated interest, creditable service, and earnings.

How to read your payroll stub and yearly W2 earnings …

doa.alaska.govJan 24, 2019 · Page 1 of 4 Revised 1/24/2019 . How to Read Your Payroll Advice and Yearly W-2 Earnings Statement . UNDERSTANDING YOUR PAY ADVICE . A cross section of a Payroll Advice (paystub) below shows dollar amounts received by an employee.

DEPARTMENT OF LABOR AND EMPLOYMENT WAGE …

cdle.colorado.gov“Average daily earnings,” as used in C.R.S. § 84-109(3)(b), will be calculated as follows, unless - the Division identifies a legitimate reason to use a different method of calculation: Division of Labor Standards and Statistics, Wage Protection Rules (effective Jan. 1, 2021) 7 CCR 1103-7

How to read your payroll stub and yearly W2 earnings …

doa.alaska.govJan 24, 2019 · Page 1 of 4 Revised 1/24/2019 . How to Read Your Payroll Advice and Yearly W-2 Earnings Statement . UNDERSTANDING YOUR PAY ADVICE . A cross section of a Payroll Advice (paystub) below shows dollar amounts received by an employee.

FOR COURT USE ONLY EMPLOYEE INSTRUCTIONS (FORM WG …

www.courts.ca.govEarnings Withholding Order. The top left space is for your name or your attorney's name and address. The original and one copy of this form with the Financial Statement attached must be filed with the levying officer. DO NOT FILE WITH THE COURT. 1. My name is: 2. I need the following earnings to support myself or my family (check a or b): a ...

North Carolina Industrial Commission S D WORKED AND ...

www.ic.nc.govstatement of days worked and earnings of this employee during the 52 weeks immediately preceding the injury (or during the above weeks and parts thereof, if employed for less than 52 weeks) and while engaged in the occupation in which the employee was allegedly injured. Employer By Authorized Signature / /20 Date Signed

Part III - Administrative, Procedural, and Miscellaneous ...

www.irs.govthe 2-percent shareholder-employee’s Form W-2, Wage and Tax Statement. The 2-percent shareholder-employee, if an eligible individual as defined in section 223(c)(1), is entitled under sections 223(a) and 62(a)(19) to deduct the amount of the contributions made to the 2-percent shareholder-employee’s HSA during the taxable year as an

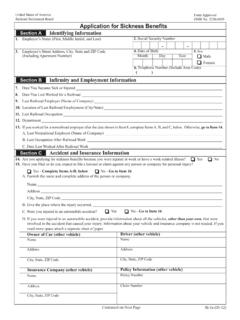

United States of America OMB No. 3220-0039 Application for ...

www.rrb.govStatement of Sickness Instructions: This form is to be executed by (1) a doctor trained in medical, surgical, dental or psychological diagnosis of the infirmity described, (2) a certified nurse/midwife in cases of pregnancy or childbirth, (3) a supervisory official of a