Tax Liability Of Forgiven Mortgage Debt

Found 3 free book(s)Paycheck Protection Program Borrower Application Form

home.treasury.govMar 30, 2020 · (select more than one): ☐Payroll ☐Lease / Mortgage Interest ... and not more than 25% of the forgiven amount may be for non-payroll costs. _____ During the period beginning on February 15, 2020 and ending on December 31, 2020, the Applicant has not and will not rece ive another ... For limited liability companies, ...

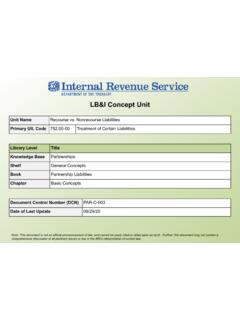

LB&I Concept Unit - IRS tax forms

www.irs.gov2. Unrepaid recourse debt forgiven by a creditor gives rise to ordinary cancellation -of-debt income. Nonrecourse debt forgiven by a creditor is generally treated as an amount realized on the sale or exchange of the asset securing the nonrecourse debt. The debt forgiveness can potentially result in taxable gain. Practice Unit -

CARES ACT - Greg Abbott

gov.texas.govpayroll, certain portions of the loans can be forgiven, including payroll, interest on mortgage obligations, rent and utility payments. Details: PPP provides cash-flow assistance through 100% federally guaranteed loans to employers who maintain their payroll during this emergency. Loans are available through June 30, 2020.