Tax Payment System

Found 8 free book(s)Publication 4169 (Rev. 7-2009) - IRS tax forms

www.irs.govTAX PAYMENT SYSTEM ELECTRONIC FEDERAL Tax Professional Guide to the Electronic Federal Tax Payment System www.eftps.gov. 1 www.eftps.gov TAX PAYMENT SYSTEM ELECTRONIC FEDERAL. 1.800.945.0966 2 EFTPS is a secure, easy, and accurate electronic system for paying all federal taxes for businesses and

Enterprise Electronic Payment System (EEPS)

epayment.ky.govauthorized, send an email to KRCWEBRESPONSEE-PAYMENT@KY.GOV or contact the E-Commerce Branch at 502-546-5370, option 2, to request the debit block be removed. I attempted to make a payment for my withholding or sales tax account but received a message stating that a payment had already been made for this period. What do I need to do?

MAURITIUS INCOME TAX SYSTEM

www.mra.muthe due date for submission of return and payment of tax is 31 January of the following year (section 116). Taxable income - (section 10) Income that is taxable includes – An Outline of MAURITIUS INCOME TAX SYSTEM 03 Chapter 1 General Principles Both individuals and companies (including any other taxable body corporate) are taxable

Part 08-03-06 - Payment and Receipt of Interest without ...

www.revenue.ietax rate applied to the payment of a royalty to a resident of a treaty partner can be reduced to the DTA rate. 2 Meaning of bona fide bank ... Where the relevant territory provides for a territorial system of taxation, the law of the . Tax and Duty Manual Part 08-03-06 companies.

Form 656-PPV Offer in Compromise - Periodic Payment …

www.irs.govAmount of Your Payment (Dollars) $ Note: Round up to the nearest whole dollar. If you want your payment to be applied to a specific tax year and a specific tax debt, such as a Trust Fund Recovery Penalty, tell us the form number or name (i.e., 1040 or . …

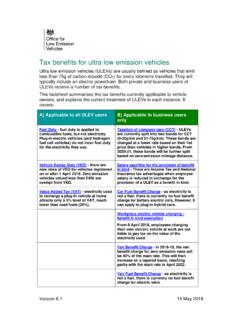

Tax benefits for ultra low emission vehicles

assets.publishing.service.gov.ukpayment against the full purchase price of the basic vehicle including number plates, vehicle excise duty, and VAT, but excluding any optional extras, delivery charges and first registration fee. The grant payment is applied on the customer invoice below the VAT line.2 3.3 Alongside petrol and diesel, hydrogen used as fuel attracts the standard

SA370 Notes – Self Assessment: Penalties for late filing ...

assets.publishing.service.gov.ukPayment deadlines You need to pay any tax you owe by the 31 January following the end of the tax year. If you do not pay the tax you owe on time, you must pay a penalty. You’ll also have to pay interest on the amount you owe and on any penalties. Paying the tax you owe For more information about ways ...

Understanding Federal Estate and Gift Taxes

www.cbo.govPayment of estate tax liability is generally due nine months after the owner’s death. Under certain conditions, however, executors can apply for an extension. For example, estates of farms and closely held businesses can defer their tax liability and pay the amount due over 10 years.