Taxpayer Identification

Found 8 free book(s)On-Line Taxpayer Identification Number (TIN) MATCHING …

www.irs.gov6. “TIN” – means the taxpayer identification number that a payee is required to furnish to a payor. The TIN may be an Employer Identification Number (EIN), a Social Security Number (SSN), or an Internal Revenue Service Individual Taxpayer Identification Number (ITIN), per IRC section 6109. 7.

W-9 Request for Taxpayer Identification Number and ...

benevate.blob.core.windows.nettaxpayer identification number (ATIN), or employer identification number (EIN), to report on an information return the amount paid to you, or other amount reportable on an information return. Examples of information returns include, but are not limited to, the following.

W-9 Request for Taxpayer Identification Number and ...

www.cms.govtaxpayer identification number (ATIN), or employer identification number (EIN), to report on an information return the amount paid to you, or other amount reportable on an information return. Examples of information returns include, but are not limited to, thefo llowing.

Request Taxpayer Identification Number Certification

www.doa.virginia.govtaxpayer identification number (TIN) to report, for example, income paid to you, payments made to you in settlement of payment card and third party network transactions, real estate transactions, mortgage interest you paid, acquisition or abandonment of secured property, cancellation of

Individual Taxpayer Identification Number (ITIN)

www.irs.govIndividual Taxpayer Identification Number (ITIN) Publication 4757 (Rev. 10-2021) Catalog Number 53053X Department of the Treasury Internal Revenue Service www.irs.gov. Introduction Revisions to Internal Revenue Code 6109 created the …

Request for Taxpayer ID Number Certification (W-9)

doa.wi.govRequest for Taxpayer Identification Number and Certification. Give Form to the requester. Do not send to the IRS. Print or type . See. Specific Instructions . on page 2. 1. Name (as shown on your income tax return). Name is required on this line; do not leave this line blank. 2. Business name/disregarded entity name, if different from above. 3

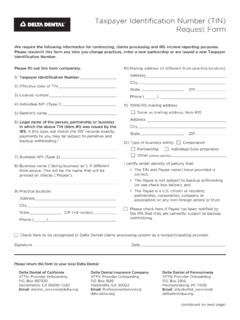

Taxpayer Identification Number (TIN) Request Form

www1.deltadentalins.comTaxpayer Identification Number (TIN) Request Form. We require the following information for contracting, claims processing and IRS income reporting purposes. Please resubmit this form any time you change practices, enter a new partnership or are issued a new Taxpayer . Identification Number. Please fill out this form completely.

Taxpayer Identification Country TIN Format Where to find ...

www.nab.com.auCountry Taxpayer Identification Numbers (TIN) TIN Format Where to find it Canada Social Insurance Number (SIN) 999 999 999 (9 characters) • Ta x Returns and Assessments China China ID Number 99999999999999999(X/9) - (18 character) • ID Card Denmark CPR Number 999999 -9999 (10 character) • Passport • Health Insurance