Search results with tag "Taxpayer identification"

United States - Information on Tax Identification Numbers ...

www.oecd.orgA taxpayer must provide the taxpayer identification number (SSN, EIN or ITIN) on all tax returns and other documents sen to the IRS. t taxpayer must also A provide its identification number to other persons who use the identification number on any returns or documents that are sent to the IRS.

On-Line Taxpayer Identification Number (TIN) MATCHING …

www.irs.gov6. “TIN” – means the taxpayer identification number that a payee is required to furnish to a payor. The TIN may be an Employer Identification Number (EIN), a Social Security Number (SSN), or an Internal Revenue Service Individual Taxpayer Identification Number (ITIN), per IRC section 6109. 7.

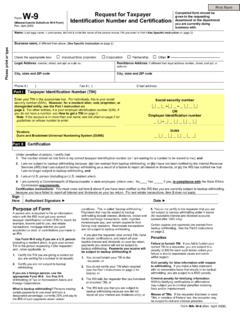

W-9 Request for Taxpayer Identification Number and ...

www.mass.govfor IRS Individual Taxpayer Identification Number, to apply for an ITIN or Form SS-4, Application for Employer Identification Number, to apply for an EIN. You can get Forms W-7 and SS-4 from the 3676) or from the IRS’s Internet Web Site . www.irs.gov. the space for the TIN, sign and date the form, and give it to the requester.

W-9 Request for Taxpayer Identification Number and ...

www.cms.govtaxpayer identification number (ATIN), or employer identification number (EIN), to report on an information return the amount paid to you, or other amount reportable on an information return. Examples of information returns include, but are not limited to, thefo llowing.

Form W-9 Request for Taxpayer - ah-az.com

www.ah-az.comForm W-9 (Rev. 1-2003) Page 3 Part I. Taxpayer Identification Number (TIN) Enter your TIN in the appropriate box. If you are a resident alien and you do not have and are not eligible to get an SSN, your TIN is your IRS individual taxpayer identification

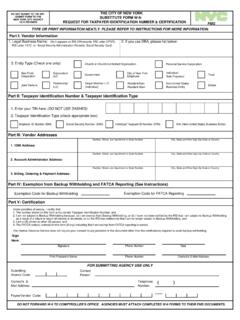

Part II: Taxpayer Identification Number & Taxpayer ...

www.nyc.govdo not submit to the irs - submit form to the new york city agency 10/14 revision the city of new york substitute form w-9: request for taxpayer identification number & …

Part II: Taxpayer Identification Number & Taxpayer ...

comptroller.nyc.govdo not submit to the irs - submit form to the new york city agency 10/14 revision the city of new york substitute form w-9: request for taxpayer identification number & certification

Request Taxpayer Identification Number Certification

www.doa.virginia.gov, Application for a Social Security Card, from your local Social Security Administration office. Get . Form W-7, Application for IRS Individual Taxpayer Identification Number, to apply for an ITIN or . Form SS-4, Application for Employer Identification -. : Number). 2

W-9 Request for Taxpayer Identification Number and ...

benevate.blob.core.windows.nettaxpayer identification number (ATIN), or employer identification number (EIN), to report on an information return the amount paid to you, or other amount reportable on an information return. Examples of information returns include, but are not limited to, the following.

Summary of EIC Eligibility Requirements - IRS tax forms

apps.irs.gov¹ If the taxpayer’s Social Security card says “VALID FOR WORK ONLY WITH INS OR DHS AUTHORIZATION,” the taxpayer can use the Social Security number to claim EIC if they otherwise qualify. If taxpayer (or spouse, if filing a joint return) or dependent has an individual taxpayer identification number (ITIN), they can’t get the EIC.

Form W-9 Request for Taxpayer Name - Indiana

www.in.govForm W-9 Request for Taxpayer (Rev. January 2003) Identification Number and Certification Department of the Treasury Internal Revenue Service Name List account number(s) here (optional) Address (number, street, and apt. or suite no.) City, state, and ZIP code Print or type See Specific Instructions on page 2. Taxpayer Identification Number (TIN)

AP-152 Application for Texas Identification Number

www.tdcj.texas.govApplication for Texas Identification Number • See instructions on back. Who Must Submit This Application - This application must be submitted by every person (sole owner, individual recipient, partnership, corporation or other organization) who ... Employer Identification, Individual Taxpayer Identification or Comptroller's assigned numbers ...

Form W-9 Request for Taxpayer - IRS tax forms

www.irs.govForm W-9 Request for Taxpayer (Rev. January 2003) Identification Number and Certification Department of the Treasury Internal Revenue Service Name List account number(s) here (optional) Address (number, street, and apt. or suite no.) City, state, and ZIP code Print or type See Specific Instructions on page 2. Taxpayer Identification Number (TIN)

Individual Taxpayer Identification Number (ITIN)

www.irs.govIndividual Taxpayer Identification Number (ITIN) Publication 4757 (Rev. 10-2021) Catalog Number 53053X Department of the Treasury Internal Revenue Service www.irs.gov. Introduction Revisions to Internal Revenue Code 6109 created the …

AP-152 Application for Texas Identification Number

gov.texas.govIndividual Taxpayer Identification Number (ITIN) (9 digits) Comptroller's assigned number (FOR STATE AGENCY USE ONLY) (11 digits) ... Social Security numbers (SSN). If a partner is a corporation, use the corporation's Employer Identification Number (EIN). N - …

Information About Filing a Case in the United States Tax ...

www.ustaxcourt.govG Statement of Taxpayer Identification Number (Form 4) (See PRIVACY NOTICE below) G The Request for Place of Trial (Form 5) G The filing fee PRIVACY NOTICE: Form 4 (Statement of Taxpayer Identification Number) will not be part of the Court’s public files.

W-9 Request for Taxpayer - California

www.nvta.ca.govfor IRS Individual Taxpayer Identification Number, to apply for an ITIN or Form SS-4, Application for Employer Identification Number, to apply for an EIN. You can get Forms W-7 and SS-4 from the IRS by calling 1-800-TAX-FORM (1-800-829-3676) or from the IRS’s Internet Web Site at www.irs.gov. If you do not have a TIN, write“Applied For”

Individual Taxpayer Identification Number ITIN

www.irs.gov“9”, has a range of numbers from "50" to "65", "70" to "88", “90” to “92” and “94” to “99” for the fourth and fifth digits and is formatted like a SSN (i.e. 9XX-7X-XXXX). The ITIN is only available to individuals who are required to have a taxpayer identification number for …

Request for Taxpayer ID Number Certification (W-9)

doa.wi.govRequest for Taxpayer Identification Number and Certification. Give Form to the requester. Do not send to the IRS. Print or type . See. Specific Instructions . on page 2. 1. Name (as shown on your income tax return). Name is required on this line; do not leave this line blank. 2. Business name/disregarded entity name, if different from above. 3

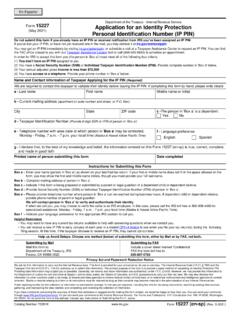

Form 15227 Application for an Identity Protection Personal ...

www.irs.govIndividual Taxpayer Identification Number (ITIN). Provide complete number in ‘Box d’ below. (3) Your annual adjusted gross . income is less than $72,000 (4) You have . access to a telephone. Provide your phone number in ‘Box e’ below. Name and Contact Information of Taxpayer Applying for the IP PIN (Required)

Form 4506-C (9-2020) - Bank of America

homeloanhelp.bankofamerica.comRequest may be rejected if the form is incomplete or illegible. . For more information about Form 4506-C, visit . www.irs.gov. and search IVES. 1a. Name shown on tax return (if a joint return, enter the name shown first) 1b. First social security number on tax return, individual taxpayer identification number, or employer identification number

Immigration and Taxation - IRS tax forms

www.irs.govTaxpayer Identification Number • The same guidance further provides that the individual who provides the employer with false identification documents to obtain employment has violated 18 U.S.C. §1028(a)(1).

IRS Transcript Cheat Sheet

www.astps.orgCAF Numbers: CAF Numbers can be assigned to individuals and businesses. ... Taxpayer name and address Taxpayer identification number(s) Daytime telephone number Plan number (if applicable) hereby appoints the following representative(s) as attorney(s)-in-fact: 2 Representative(s) must sign and date this form on page 2, Part II.

Form W-9 (Rev. October 2018) - IRS tax forms

www.irs.govEmployer identification number – Part II Certification. Under penalties of perjury, I certify that: 1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me); and 2.

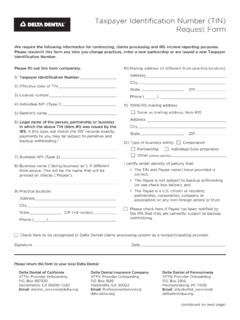

Taxpayer Identification Number (TIN) Request Form

www1.deltadentalins.comTaxpayer Identification Number (TIN) Request Form. We require the following information for contracting, claims processing and IRS income reporting purposes. Please resubmit this form any time you change practices, enter a new partnership or are issued a new Taxpayer . Identification Number. Please fill out this form completely.

Taxpayer Identification Country TIN Format Where to find ...

www.nab.com.auCountry Taxpayer Identification Numbers (TIN) TIN Format Where to find it Canada Social Insurance Number (SIN) 999 999 999 (9 characters) • Ta x Returns and Assessments China China ID Number 99999999999999999(X/9) - (18 character) • ID Card Denmark CPR Number 999999 -9999 (10 character) • Passport • Health Insurance

Similar queries

Identification, Taxpayer, Taxpayer Identification, Taxpayer Identification Number TIN, For Taxpayer Identification, Form W-9, Taxpayer Identification Number, Part II: Taxpayer Identification Number, Form, New york city, New york substitute form w-9, New york, New york substitute form w, Application, IRS tax forms, W-9 Request for Taxpayer, Indiana, Application for Texas Identification Number, Texas Identification, Numbers, Request, For Taxpayer, Individual Taxpayer Identification Number, Bank of America, Taxpayer . Identification, TIN Format Where to find