Us Tax

Found 10 free book(s)Tax Considerations In Structuring US-Based Private Equity ...

www.akingump.comThe basic US tax regime applicable to non-US investors in US-based private equity funds is that they are exempt from taxation on gains from portfolio investment activities, making the United States a tax haven of sorts for foreign private equity capital.

Guide to completing W-8BEN US tax forms - Macquarie

www.macquarie.com.auUnited States Tax Withholding. Investors who are a non-resident of the US for tax purposes are subject to a maximum withholding tax rate of 30 per cent on income they derive from US sources. Where the requisite forms are completed in full by investors, a withholding tax of 15 per cent may apply for Australian tax residents who derive

UNITED STATES-THE PEOPLE'S REPUBLIC OF CHINA INCOME …

www.irs.govforeign tax even if, in fact, that tax has been reduced or waived as an incentive. It is a firm element of U.S. policy that a foreign tax credit be given only …

TAX CONVENTION WITH THE FEDERAL REPUBLIC OF GERMANY

www.irs.govJan 01, 1990 · Republic, with a credit for United States tax, effective in 1991, one year after the general effective date for the Convention's provisions. The additional year is intended to allow German investors to adjust to the change in a way which would minimize market disruption. A similar rule will apply to certain German

US estate and gift tax rules for resident and nonresident ...

www2.deloitte.comUS estate and gift tax rules for resident and nonresident aliens 8. Computing. US estate and gift tax. US estate and gift taxes. Once any available annual exclusions or marital or other deductions are utilized, the available exemption will offset taxable gifts or bequests. As mentioned earlier, the

Renter's Property Tax Refund Program

www.house.leg.state.mn.usRenter’s Property Tax Refund Program . in 2010, the percentage returned to 19 percent. The 2011 tax law reduced the rate to 17 percent beginning for …

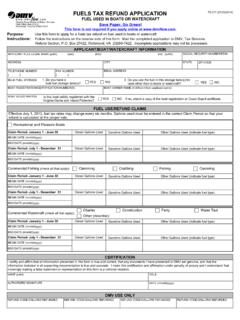

FUELS TAX REFUND APPLICATION FUEL USED IN BOATS OR ...

www.dmv.virginia.govUse this form to apply for a fuels tax refund on fuel used in boats or watercraft. Instructions: Follow the instructions on the reverse side of this form. Mail the completed application to DMV, Tax Services Refund Section, P.O. Box 27422, Richmond, VA 23269-7422. Incomplete applications may not be processed.

Instructions for the NJ-1040

www.state.nj.usNew Jersey Tax Rate Schedules 2020 FILING STATUS: Single Table A Married/CU partner, filing separate return STEP 1 STEP 2 STEP 3 Enter Multiply If Taxable Income (Line 41) is: Line 41 Line 41 by: Subtract Your Tax Over But not over $ 0 $ 20,000 _____ .014 = _____ – $ 0 = _____

Tax Deduction Worksheet - Oxford University Press

global.oup.comTax Deduction Worksheet . This worksheet allows you to itemize your tax deductions for a given year. Tax deductions for calendar year 2 0 ___ ___ HIRED HELP SPACE $_____ Accountant

Income Tax Deduction on Timber and ... - US Forest Service

www.fs.fed.usIncome Tax Deduction on Timber and Landscape Tree Loss from Casualty Linda Wang, National Timber Tax Specialist, USDA Forest Service October 2018 Timber or landscape trees destroyed by the hurricane, fire, earthquake, ice, hail, tornado, and other storms are “casualty losses” that may allow the property owners