Use Registration Permit

Found 11 free book(s)STATE PERMIT PRICES

nationwideexpressservices.weebly.comA registration permit is $1 per axle per 50 miles traveled. Motor carrier fees are $48 per trip for over 50 miles, and $12 per trip of 50 miles or fewer. The fee for use fuel is $65 per trip for over 50 miles traveled, and $16 per trip for 50 miles or fewer.

In-Transit Permit/Title Application

dmv.ny.govVehicle and Traffic Law. If I am applying for replacement registration items, I certify that the registration is not currently under suspension or revocation. If I am using a credit card for payment of any fees in connection with this application, I understand that my signature below also authorizes use of my credit card. Print Name Here . X ...

Kentucky Tax Registration Application and Instructions

revenue.ky.govKentucky Tax Registration Application. and Instructions. www.revenue.ky.gov. COMMONWEALTH OF KENTUCKY. DEPARTMENT OF REVENUE. FRANKFORT, KENTUCKY 40620. 10A100(P) (06-21) Employers ’ Withholding Tax Account. Sales and Use Tax Account/Permit Transient Room Tax Account. Motor Vehicle Tire Fee Account

Please see instructions regarding form detail and online ...

ui.nv.govNEVADA BUSINESS REGISTRATION Please see instructions regarding form detail and online registration options. 1 I Am Applying For: *SEND A COPY TO EACH AGENCY Unemployment Insurance *(Employment Security Division - ESD) Sales/Use Tax Permit Modified Business Tax *(Department of Taxation) Local Business License 2 New Business OtherChange in ...

Sample Reseller Permit - Wa

dor.wa.govThis permit is no longer valid if the business is closed. The business named on this permit acknowledges: • It is solely responsible for all purchases made under this permit • Misuse of the permit: – Subjects the business to a penalty of 50 percent of the tax due, in addition to the tax, interest, and penalties imposed (RCW 82.32.291)

BUILDING DEPARTMENT MASTER, SUB OR REVISION PERMIT …

www.cityofdoral.commaster permit #: _____ applicant’s initials: _____ bd_2021-master sub or revision permit application v3 version: 2021.11.23 page 1 of 3 building department master, sub or revision permit application directions: use this form to apply for a building or …

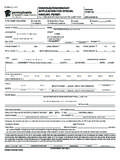

PennDOT Home

www.dot.state.pa.usPERMIT FEE: The Permit Fee will be determined at the time of issuance. The permit fee is the sum of the issuance fee and any ton-mile, escort or other established fees (e.g., $1 wire fee). See reverse of Form M-936A for the formula used to compute ton-mile fees.

Public Health Permit/License Application

publichealth.lacounty.govAfter issuance of the public health permit/license, I hereby consent to all necessary inspectionsconducted by the Department of Public Health, Environmental Health Division. I understand that Public Health Permits/License are not transferable and not refundable.

BUILDING PERMIT APPLICATION

eservice.pwcgov.orgordinances. the permit holder is the responsible party for compliance with the vusbc and other ordinances. i request that a certificate of use and occupancy be issued upon completion of the work authorized by the permit, provided all other requirements have …

SALES TAX ELIGIBLE NONREGISTERED TAXPAYER …

www.nj.govTAXPAYER REGISTRATION NUMBER* The undersigned certifies that there is no requirement to pay the New Jersey Sales and/or Use Tax on the purchase or purchases covered by this Certificate because the tangible personal property or services purchased will be used for an exempt purpose under the Sales & Use Tax Act.

V. FEE SUMMARY (for office use only) CONSTRUCTION …

www.state.nj.usV. FEE SUMMARY (for office use only) $ 1. Number of Stories VI. BUILDING/SITE CHARACTERISTICS (office use only) 3. Area — Largest Floor sq. ft. 4. New Building Area sq. ft. 5. Volume of New Structure cu. ft. 2. Height of Structure ft. VII. DESCRIPTION OF BUILDING USE A. RESIDENTIAL (primary use) 1. State Specific Use: 2. Use Group, Proposed: 3.