Wages When You Receive Supplemental Security Income

Found 9 free book(s)How Ohio’s Unemployment Insurance Benefit Amounts Are ...

unemployment.ohio.govYou must report all weekly income, including payments other than wages. In certain cases, the entire amount may be deducted from your benefits. ... Social Security Supplemental unemployment benefits (S.U.B.) ... exempted from any earnings you may receive before a deduction is made. An example of how this is computed appears below.

Receive rental assistance at another property RHIIP

www.hud.govyou must include all sources of income you or any member of your household receives. Some sources include: • Income from wages • Welfare payments • Unemployment benefi ts • Social Security (SS) or Supplemental Security Income (SSI) benefi ts • Veteran benefi ts • Pensions, retirement, etc. • Income from assets

Applying for Affordable Housing: Applicant Income Guide

a806-housingconnect.nyc.govsupplemental security income (SSI), pension Do you receive money from… There are different ways you might receive income. Some examples: • A paycheck every 2 weeks • Tips in cash at each shift • Any kind of weekly or monthly payment, such as child support, pension, or unemployment benefits • Holiday bonus every year Income might be called

Form RP-459-c-Ins:8/11:General Information and ...

www.tax.ny.govSupplemental Security Income moneys received pursuant to the Federal Foster Grandparent Program welfare payments gifts, inheritances or a return of capital. 10. If an owner is an inpatient in a residential health care facility, the owner’s other income is not considered income in determining exemption

2022 Social Security Reference Guide - MFS

www.mfs.com(not their joint income). Social Security only considers wages earned after you start Social Security. Earnings test is based on earned income only. Dividend, capital gains, rental income, distributions from IRAs and workplace retirement plans, etc. may not be counted as earned income. Severance pay is counted as earned income, unemployment ...

IT-2104 Employee’s Withholding Allowance Certificate

www.tax.ny.govIncome from sources other than wages – If you have more than $1,000 of income from sources other than wages (such as interest, dividends, or alimony received), reduce the number of allowances claimed on line 1 and line 2 (if applicable) of the IT-2104 certificate by one for each $1,000 of nonwage income. If you arrive at negative

2021 Publication 525 - IRS tax forms

www.irs.govyou receive a Form W-2, Wage and Tax State-ment, or Form 1099 from the foreign payer. This applies to earned income (such as wages and tips) as well as unearned income (such as inter-est, dividends, capital gains, pensions, rents, and royalties). If you reside outside the United States, you may be able to exclude part or all of your for-

2022 Publication 15-A

www.irs.govthe tax rate on these wages is 6.2%. The social security wage base limit is $147,000. The Medicare tax rate is 1.45% each for the employee and employer, unchanged from 2021. There is no wage base limit for Medicare tax. Social security and Medicare taxes apply to the wages of household workers you pay $2,400 or more in cash wa-ges in 2022.

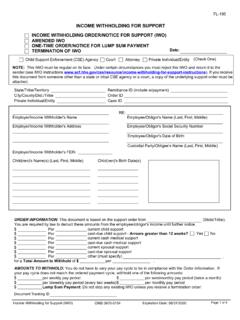

INCOME WITHHOLDING FOR SUPPORT

childsupport.ca.govYou must send child support payments payable by income withholding to the appropriate SDU or to a tribal CSE agency. If this IWO instructs you to send a payment to an entity other than an SDU (e.g., payable to the custodial party, court, or attorney), you must check the box above and return this notice to the sender. Exception: If this