Wisconsin Use Tax

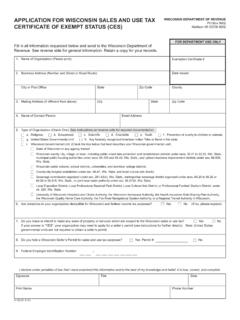

Found 7 free book(s)February 2021 S-103 Application For Wisconsin Sales and ...

www.revenue.wi.govIn lieu of providing suppliers a CES number, a federal or Wisconsin gov-ernmental unit may provide a Wisconsin sales and use tax exemption certificate (Form S-211) or a purchase order identifying the governmental unit as the purchaser. 3. Tribes: A CES number will be issued to the federally recognized American Indian tribe or band in Wisconsin. 4.

Directory of Adult Family Homes of Wisconsin

www.dhs.wisconsin.govdeclaration rem wisconsin iii inc (0016590) 1610 w 10th ave ashland wi 54806 (715) 292-6333 lori wright county: ashland rem wisconsin inc 4033 123rd st, ste a chippewa falls wi 54729 type: class: low/high rate: afh (608) 276-1191 lori wright 8,035/9,083 m/f - 4 developmentally disabled emotionally disturbed/mental irreversible dementia/alzheim ...

April 2020 S-012 ST-12 Wisconsin Sales and Use Tax Return ...

www.revenue.wi.govWisconsin Sales and Use Tax Return Form ST-12 Wisconsin Department of Revenue State, County and Stadium Sales and Use Tax Use BLACK INK Only Check if this is an amended return Check if address or name change (note changes at …

Support Payment Coupon - Wisconsin

dcf.wisconsin.govIf you have questions about how to use a coupon, please call the Wisconsin Support Collections Trust Fund, Monday through Friday, 8:00 a.m. – 5:00 p.m. (central time), at: …

Record the Odometer Reading: DAILY VEHICLE MILEAGE AND ...

wisconsindot.gov4. Name of the IRP registrant or fuel tax licensee. 5. Fuel Filer - complete if different than 4. 6. Driver(s) Name(s). MILEAGE INFORMATION 7. Trip Date 8. Highways used - e.g.; I90, STH 69 9. Jurisdiction Name - abbreviation of the jurisdiction in which your vehicle is traveling, e.g., WI for Wisconsin, etc. 10. Odometer Reading: a.

Wisconsin All-Terrain and DNR Txn # Department of Natural ...

dnr.wi.govtax due. If tax was paid in another state, subtract the state, county or similar tax from the Wisconsin state, county/stadium tax. Enter the remaining amount of Wisconsin tax payable. Code 5. Purchased by a nonresident at least 90 days before registrant became a Wisconsin resident and brought and/or registered the item in this state Code 6

WISCONSIN SALES AND USE TAX EXEMPTION CERTIFICATE

dpi.wi.govpermit or use tax certificate number. However, a supplier may not accept the resale exemption from a business not holding a Wisconsin seller’s permit or use tax certificate, if the sale involves the supplier’s delivery of goods to a consumer in Wisconsin (i.e., drop shipment). A resale exemption may be granted if the purchaser is