Withheld

Found 7 free book(s)2017 M1W, Minnesota Income Tax Withheld

www.revenue.state.mn.usMN MN MN MN MN MN MN MN MN 1 Minnesota wages and tax withheld from W-2s, other than from W-2G. If you have more than five W-2s, complete line 5 on the back. A B—Box 13 C—Box 15 D—Box 16 E—Box 17 If the W-2 is for: If Retirement Plan Employer’s 7-digit Minnesota State wages, tips, etc. Minnesota tax withheld

PAYABLE TO: 2. Total Local Services Tax (LST) withheld ...

4haverforddocuments.com3. Penalty (10%) if paid after due date 4. Interest (1/2% per month or part thereof) –including any penalty & interest due

Philippine Government Forms - bir

www.formsphilippines.com1601C Monthly Remittance Return of Income Taxes Withheld on Compensation. This BIR return is filed by every Withholding Agent (WA)/payor who is either an individual or non-individual, required to deduct and withhold taxes on compensation paid to employees.

DLN: PSOC: PSIC: Republika ng Pilipinas Annual Information ...

www.lawphil.netBIR Form 1604-CF (ENCS) - PAGE 2 Part III Alphabetical List of Employees/ Payees from whom Taxes were Withheld (format only) Schedule 5 ALPHALIST OF PAYEES SUBJECT TO FINAL WITHHOLDING TAX (Reported Under Form 2306) SEQ Taxpayer NAME OF PAYEES ADDRESS OF * STATUS ATC NATURE OF INCOME AMOUNT OF RATE AMOUNT OF TAX NO.

Annual Information Return of K Creditable Income Taxes ...

www.lawphil.netBIR Form 1604-E (ENCS)-Page 2 Schedule 4 Alphalist of Payees Subject to Expanded Withholding Tax (reported under Form 2307) SEQ TAXPAYER NAME OF PAYEES ATC NATURE OF INCOME AMOUNT OF INCOME RATE OF AMOUNT OF TAX NO. IDENTIFICATION (Last Name, First Name, PAYMENT PAYMENT TAX WITHHELD NUMBER (TIN) Middle Name for Individuals, (Refer to BIR Form …

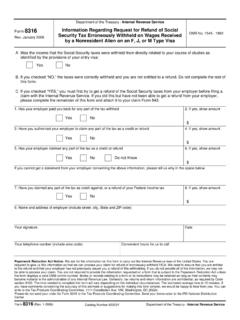

Form 8316 Information Regarding Request for Refund of ...

www.irs.govTitle: Form 8316 (Rev. 1-2006) Author: sean Subject: Information Regarding Request for Refund of Social Security Tax Erroneously Withheld on Wages Received by a …

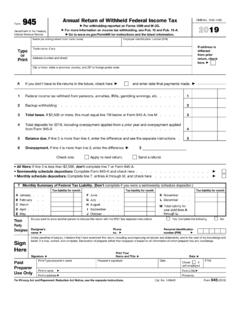

2018 Form 945 - Internal Revenue Service

www.irs.govForm 945 Department of the Treasury Internal Revenue Service Annual Return of Withheld Federal Income Tax For withholding reported on Forms 1099 and W-2G.