Search results with tag "Schedule j"

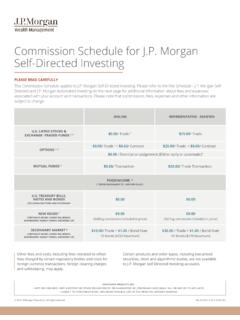

Commission/Fee Schedule for J.P. Morgan Self-Directed ...

www.chase.comCommission Schedule for J.P. Morgan Self-Directed Investing PLEASE READ CAREFULLY This Commission Schedule applies to J.P. Morgan Self -Directed Investing. Please refer to the Fee Schedule – J.P. Morgan Self-Directed and J.P. Morgan Automated Investing on the next page for additional information about fees and expenses

2021 Schedule J (Form 1040) - IRS tax forms

www.irs.gov2a. Enter your . elected farm income (see instructions). Do not . enter more than the amount on line 1 . . 2a Capital gain included on line 2a: b. ... 18 19. If you used Schedule J to figure your tax for: • 2020, enter the amount from your 2020 Schedule J, line 12.

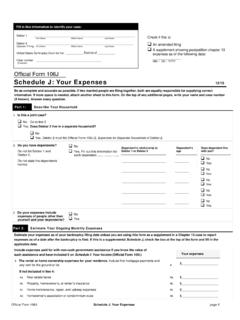

First Name Middle Name Last Name Check if this is: First …

www.uscourts.govOfficial Form 106J Schedule J: Your Expenses page1 Official Form 106J Schedule J: Your Expenses 12/15 Be as complete and accurate as possible. If two married people are filing together, both are equally responsible for supplying correct

Instructions - United States Courts

www.uscourts.govSchedule H: Your Codebtors (Official Form 106H) ..... 27 Schedule I: Your Income (Official Form 106I) ..... 28 Schedule J: Your Expenses (Official Form 106J)..... 30 Summary of Your Assets and Liabilities and Certain Statistical Information (Official Form ...

REV-1513 EX+ (02-15) SCHEDULE J - PA Department of …

www.revenue.pa.govSCHEDULE J BENEFICIARIES ESTATE OF: FILE NUMBER: RELATIONSHIP TO DECEDENT AMOUNT OR SHARE NUMBER NAME AND ADDRESS OF PERSON(S) RECEIVING PROPERTY Do Not List Trustee(s) OF ESTATE TOTAL OF PART II– ENTER TOTAL NON-TAXABLE DISTRIBUTIONS ON LINE 13 OF REV-1500 COVER SHEET.$ If more space is …

PA-20S/PA-65 2006010058 PA S Corporation/Partnership

www.revenue.pa.gov7 Estates or Trusts Income from PA Schedule J . . . . . . . 7a l 00 7b l 00 8 Gambling and Lottery Winnings (Loss) from PA Schedule T 8a ... and Accumulated Earnings and Profits (AE&P) SECTION IX. Ownership in Pass Through Entities If the entity received income (loss) from an S corporation, partnership, estate or trust, limited liability ...

2021 Schedule J (Form 990) - IRS tax forms

www.irs.govrelated organization to establish compensation of the CEO/Executive Director, but explain in Part III. Compensation committee. Written employment contractIndependent compensation consultant. Compensation survey or studyForm 990 of other organizations. Approval by the board or compensation committee4

2017 Form 1120 - IRS tax forms

www.irs.govSchedule J: Tax Computation and Payment (see instructions) Part I–Tax Computation: 1 : ... excess of the corporation’s current and accumulated earnings and profits? See sections 301 and 316 . . . . . . . . If “Yes,” file : Form 5452, Corporate Report of Nondividend Distributions. See the instructions for Form 5452.