Search results with tag "Nebraska income"

Amended Nebraska Individual Income Tax Return FORM …

revenue.nebraska.govThe information on the 2020 Nebraska income tax return that was previously filed is not correct. Form 1040XN may only be filed after an original Nebraska income tax return has been filed. An amended Nebraska income tax return must be filed within 60 days after filing an amended federal income tax return.

Nebraska Individual Income Tax Return FORM 1040N for the ...

revenue.nebraska.govState and local income taxes (line 5a, Schedule A, Federal Form 1040 or 1040-SR) 9. Nebraska itemized deductions (line 7 minus line 8) 10. Nebraska standard deduction or the Nebraska itemized deductions, whichever is greater (the larger of line 6 or line 9) 10. 11. Nebraska income before adjustments (line 5 minus line 10) 12

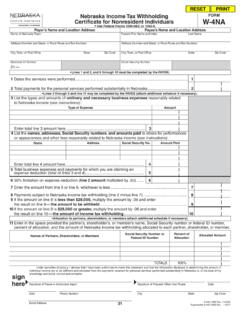

Nebraska Income Tax Withholding FORM Certificate for ...

revenue.nebraska.govA nonresident alien whose country has a tax treaty with the U.S. may not be subject to nonresident income tax withholding. The payor must obtain a written statement from the payee certifying the existence of a treaty exempting . U.S. income earned by the alien from federal or state income tax.