Nonresident Income

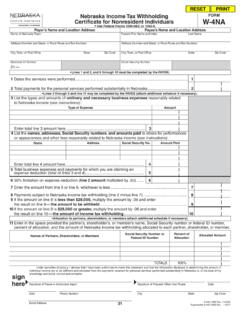

Found 6 free book(s)Nebraska Income Tax Withholding FORM Certificate for ...

revenue.nebraska.govA nonresident alien whose country has a tax treaty with the U.S. may not be subject to nonresident income tax withholding. The payor must obtain a written statement from the payee certifying the existence of a treaty exempting . U.S. income earned by the alien from federal or state income tax.

MARYLAND NONRESIDENT 2021 FORM INCOME TAX …

www.marylandtaxes.govIf you are: (1) a nonresident employed in Maryland and (2) you are a resident of a local jurisdiction that imposes a local income or earnings tax on Maryland residents, then you must file a Form 515 to report and pay a tax on your Maryland wages. Form 515 filers pay a local income tax instead of the Special Nonresident Tax. 18. Local Income Tax.

2021 Form 3514 California Earned Income Tax Credit

www.ftb.ca.govPart VI Nonresident or Part-Year Resident California Earned Income Tax Credit. 21. 21CA Exemption Credit Percentage from Form 540NR, line 38. See instructions. ... 22 . Nonresident or Part-Year Resident EITC. Multiply line 20 by line 21. This amount should also be entered on Form 540NR, line 85 ..... • 22. 1,000..... 00 00 00 00

2020 Form 540NR California Nonresident or Part-Year ...

www.ftb.ca.govCalifornia Nonresident or Part-Year Resident Income Tax Return Fiscal year filers only: Enter month of year end: month_____ year 2021. 1 Single 2 3 Married/RDP filing jointly. See inst. Married/RDP filing separately. 4 Head of household (with qualifying person). See instructions. 5 Qualifying widow(er).

2020 Form 763S, Virginia Special Nonresident Claim For ...

www.tax.virginia.govVirginia Special Nonresident Claim *VA763S120888* For Individual Income Tax Withheld Date of Birthour Birthday Y (MM-DD-YYYY) Primary Taxpayer Deceased (Include Federal Form 1310 if applicable) STEP I - Select Exemption Category Review categories 1 - 4 below and enter the category number for which you are claiming an exemption.

Form 8233 (Rev. September 2018) - IRS tax forms

www.irs.govServices of a Nonresident Alien Individual . ... The beneficial owner is a resident of the treaty country listed on line 12a and/or 13b above within the meaning of the income tax treaty between the United States and that country, or was a resident of the treaty country listed on line 12a and/or 13b above at the time of, or immediately ...