Search results with tag "Form 5500"

EFAST2 Form 5500 Processing - DOL

www.dol.govfile the Form 5500- EZ; you can no longer use the Form 5500-SF. If you are not subject to the IRS e-filing requirements in 26 CFR 301.6058-2, then you may file a Form 5500-EZ on paper with the IRS. Otherwise, file the Form 5500-EZ electronically through EFAST2. See the Form 5500-EZ Instructions and IRS’s . Form 5500 Corner . for more information.

Instructions for Form 5500-SF - DOL

www.dol.govto file Form 5500-SF mayelect to file Form 5500-SF electronicallywith EFAST2 rather than filing a Form 5500-EZ on paper with the IRS. A “one-participant plan” or a certain foreign plan that is not eligible to file Form 5500-SF must file Form 5500-EZon paper with the IRS. For more information on filing with the IRS, go to . www.irs.gov

Remember To File Your 2009 Form 5500, 5500-SF, or 5500 …

www.irs.gov• Eligible one-participant plans can file electronically using the Form 5500-SF on EFAST2. One-participant plans who are not eligible or choose not to file Form 5500-SF must file Form 5500-EZ on paper directly with

Instructions for Reviewing, Signing, and E-Filing Form 5500

www.trpcweb.comInstructions for Reviewing, Signing, and E‐Filing Form 5500 Please follow the below instructions to review, sign, and e‐file your Form 5500. Note: to skip the review

How to Correct Missed or Late Contributions (Employee and ...

wwwrs.massmutual.comthese Form 5500 questions. If the delinquent participant contributions reported on Form 5500 for Year 1 is not corrected until Year 2, then the total amount of delinquent contributions is carried over from Year 1 and reported again for Year 2’s Form 5500 . The late deposit of contributions withheld from

2018 Form 5500-EZ - irs.gov

www.irs.govForm 5500-EZ Department of the Treasury Internal Revenue Service Annual Return of A One-Participant (Owners/Partners and Their Spouses) Retirement Plan or A Foreign Plan

2017 Instructions for Form 5500-EZ

www.irs.govPage 3 of 11 Fileid: … ns/I5500EZ/2017/A/XML/Cycle03/source 11:29 - 28-Dec-2017 The type and rule above prints on all proofs including departmental reproduction ...

THE UNITED STATES ARMY RECRUITING …

jointhemilitary.orgDA Form 5500-R, Body Fat Content Worksheet (Male) or DA Form 5501-R, Body Fat Content Worksheet (Female) (if applicable)

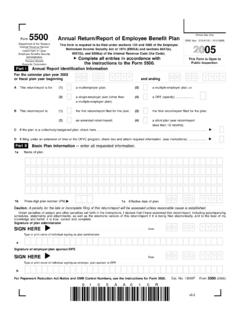

Part I Annual Report Identification Information

www.irs.govOfficial Use Only 4 If the name and/or EIN of the plan sponsor has changed since the last return/report filed for this plan, enter the name, EIN and the plan number from the last return/report below: a Sponsor's name b EIN c PN 2a Plan sponsor's name and address (employer, if for single-employer plan) (Address should include room or suite no.) Form 5500 …

3.2 Form 5500 Q&A - HCW Employee Benefit Services

www.hcwbenefits.comNOTICE: This information is not to be considered specific legal advice and should not be relied upon in lieu of advice from your attorney. Hill, Chesson & Woody does not engage in the practice of law, accounting, or medicine. Therefore, the contents of this communication should not

Alternative Investments in Employee Benefit Plans

perkinsaccounting.com3 Identifying alternative investments in a plan investment portfolio can often times be challenging. Depending on the timing of the Form 5500 preparation, reviewing the

Form 5500 Annual Return/Report of Employee Benefit Plan ...

www.iuoelocal137.comForm 5500 (2015) Page . 3 Part III Form M-1 Compliance Information (to be completed by welfare be nefit plans) 11a. If the plan provides welfare benefits, was the plan subject to the Form M-1 filing requirements during the plan year?

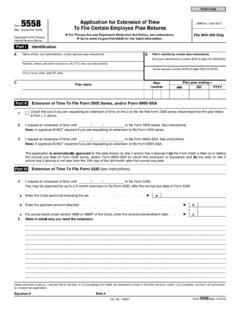

Form To File Certain Employee Plan Returns

www.irs.govForm 5558 (Rev. 9-2018) Page . 2 General Instructions Section references are to the Internal Revenue Code unless otherwise noted. What's New An extension of time to file Form 5500 Series