Search results with tag "Double taxation"

Form DT-Individual Double Taxation Treaty Relief

assets.publishing.service.gov.uktheir tax laws. To avoid ‘double taxation’ in this situation, the United Kingdom (UK) has negotiated Double Taxation (DT) treaties with a large number of countries. The precise conditions that will apply to your income from the UK can ... HM Revenue and Customs publishes the Digest of Double Taxation Treaties (the DT Digest) which contains ...

Digest of Double Taxation Treaties April 2018 - GOV.UK

assets.publishing.service.gov.ukDigest of current double taxation treaties This Digest is only a guide to possible entitlement to double taxation relief for certain types of UK income received by non-residents of the UK who are residents of the territories listed in the table. It does not explain the conditions for relief.

Australia’s double taxation treaties - Deloitte …

www.deloitte.com.auAustralia’s double taxation treaties The table below shows the countries with which Australia has entered into double taxation treaties, together with the source country tax limits applicable to dividends,

ORDER THE DOUBLE TAXATION RELIEF (CARICOM) …

www.ird.gov.ttCARICOM Member State of Guyana arrangements were made inter alia for the avoidance of double taxation: Now, therefore, the President in pursuance of the said subsection (1) of section 93 of the Income Tax Act is pleased to order, and it is hereby orders as follows: 1. This Order may be cited as the Double Taxation Relief (CARICOM) Order, 1994. 2.

International Taxation – Overview of Key Concepts …

www.fenwick.com2. Introduction to U.S. International Taxation U.S. taxation of U.S. persons on worldwide income. The U.S. alleviates double taxation by allowing a foreign tax

Indian regulations for expatriates working in India Ready ...

www2.deloitte.comDouble Taxation Avoidance Agreements (DTAA) India has entered into 94 double taxation avoidance agreements and 10 Tax information exchange agreements. An individual who is resident of a country with which India has entered into DTAA could avail the treaty benefits to either eliminate taxation in one of the countries

United Nations Model Double Taxation Convention

www.un.orgThe United Nations Model Double Taxation Convention between ... treaty—the taxation rights of the host country of investment—as ... of information with a view to preventing avoidance or ...

UK Agreement for avoidance of double taxation and ...

www.taxsutra.comAgreement for avoidance of double taxation and prevention of fiscal evasion with United Kingdom of Great Britain and Northern Ireland ... taxable unit under the taxation laws in force in the respective Contracting States, but, subject to paragraph 2 of this Article, does not include a …

UK/USA DOUBLE TAXATION CONVENTION SIGNED 24 JULY …

assets.publishing.service.gov.ukArticle 24 (Relief from double taxation) Article 25 (Non-discrimination) Article 26 (Mutual agreement procedure) Article 27 (Exchange of information and administrative assistance) Article 28 (Diplomatic agents and consular officers) Article 29 (Entry into force) Article 30 (Termination) Exchange of notes

Jurisdiction’s name: Malaysia Information on residency for ...

www.oecd.orgDual Residence Status And Agreements For The Avoidance Of Double Taxation (DTA) Malaysia has entered into agreements with a number of countries that avoid double taxation by allocating taxing rights over bilateral income flows between the respective treaty partners.

Avoidance of Double Taxation Agreements (DTAs)

www.iras.gov.sgAvoidance of Double Taxation Agreements (DTAs) 3 3.7 DTAs (and other forms of tax treaties for the exchange of information) are also vital in facilitating co-operation between tax authorities in the form of exchange

ARTICLES OF THE MODEL - OECD

www.oecd.orgIntending to conclude a Convention for the elimination of double taxation with respect to taxes on income and on capital without creating opportunities for non-taxation or reduced taxation through tax evasion or avoidance (including through treaty-shopping arrangements aimed at obtaining reliefs provided in this Convention for the indirect

UAE Agreement for avoidance of double taxation and the ...

www.taxsutra.comWhereas the annexed agreement between the Government of the United Arab Emirates and the Government of the Republic of India for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and on …

UK/INDIA DOUBLE TAXATION CONVENTION tax, from 1 …

assets.publishing.service.gov.ukthe Government of the Republic of India; Desiring to conclude a new Convention for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital gains; Have agreed as follows: Article 1 Scope of the Convention (1) This Convention shall apply to persons who are residents of one or both of the

Action Plan on Base Erosion and Profit Shifting - OECD

www.oecd.orgin double taxation Countries have long worked and are strongly committed ... In many circumstances, the existing domestic law and treaty rules governing the taxation of cross-border profits produce the correct results and do not give rise to …

AMERICA AND THE PORTUGUESE REPUBLIC FOR ... - IRS tax …

www.irs.govJan 01, 1996 · The Convention confirms that the country of residence will avoid international double taxation by providing relief for the tax imposed by the source country. The Convention includes an article on limitation on benefits, designed to ensure that the benefits of the Convention are enjoyed only by those persons intended to derive such benefits. It

TAX CONVENTION WITH THE NETHERLANDS GENERAL …

www.irs.govJan 01, 1994 · DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON INCOME, SIGNED AT WASHINGTON ON DECEMBER 18, 1992 LETTER OF SUBMITTAL DEPARTMENT OF STATE, Washington, April 23, 1993. The PRESIDENT, The White House. THE PRESIDENT: I have the honor to submit to you, with a …

GENERAL EFFECTIVE DATE UNDER ARTICLE 28: 1 DECEMBER …

www.irs.govAUSTRALIA FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON INCOME, SIGNED AT SYDNEY ON AUGUST 6, 1982 LETTER OF SUBMITTAL DEPARTMENT OF STATE, Washington, August 17, 1982. THE PRESIDENT, The White House. THE PRESIDENT: I have the honor to submit to …

Status of List of Reservations and Notifications at the ...

www.oecd.org12 Agreement between the Government of The Republic of Panama and The Government of The State of Qatar for the avoidance of double taxation and the prevention of fiscal

Convention signed at Washington December 18, …

www.irs.govmessage from the president of the united states transmitting the convention between the united states of america and the grand duchy of luxembourg for the avoidance of double taxation

Claim by a non-UK resident for relief from UK tax under ...

assets.publishing.service.gov.ukClaim by a non-UK resident for relief from UK tax under the terms of a Double Taxation Agreement (DTA) 1(a) I was not resident in the UK for the whole of 2020 to 2021 and put ‘X’ in box 1 on the Residence, remittance . basis etc pages. 1(b) I have claimed split-year treatment and put ‘X’ in box 3 on the Residence, remittance basis etc ...

CONVENTION BETWEEN THE GOVERNMENT OF THE …

www.irs.gov1 convention between the government of the united states of america and the government of the kingdom of belgium for the avoidance of double taxation and the

NOTICE INCOME TAX ACT, 1962 CONVENTION …

www.sars.gov.zaconvention between the republic of south africa and the united states of america for the avoidance of double taxation and the prevention of fiscal

TREASURY DEPARTMENT BETWEEN THE UNITED …

www.irs.govtreasury department technical explanation of the convention and protocol between the united states of america and the republic of india for the avoidance of double taxation and the prevention

AGREEMENT BETWEEN THE GOVERNMENT OF …

www.chinatax.gov.cn1 agreement between the government of the people’s republic of china and the government of the united states of america for the avoidance of double taxation and

CONVENTION BETWEEN THE GOVERNMENT OF THE UNITED …

www.irs.govJan 01, 1996 · convention between the government of the united states of america and the government of the french republic for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital signed at paris on august 31,1994, together with two related exchanges of notes letter of submittal department of state,

CONVENTION BETWEEN THE GOVERNMENT OF …

download.rd.go.thconvention between the government of the kingdom of thailand and the government of the united states of america for the avoidance of double taxation

Status of List of Reservations and Notifications at the ...

www.oecd.org6 15 Agreement between The Government of the Republic of India and The Government of the Republic of Croatia for the Avoidance of Double Taxation and the

AGREEMENT BETWEEN THE GOVERNMENT OF THE REPUBLIC …

www.iras.gov.sgThere was an earlier Agreement signed between the Government of the Republic of Singapore and the Government of the Republic of India for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income. The text of this Agreement which was signed on 20 April 1981 is shown in Annex D.

AGREEMENT BETWEEN THE GOVERNMENT OF MALAYSIA …

phl.hasil.gov.mydesiring to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income, have agreed as follows: Article 1 PERSONAL SCOPE This Agreement shall apply to persons who are residents of one or both of the Contracting States. Article 2 TAXES COVERED 1.

AGREEMENT BETWEEN THE GOVERNMENT OF …

www.iras.gov.sgagreement between the government of the republic of singapore and the government of malaysia for the avoidance of double taxation and the prevention of

AGREEMENT BETWEEN THE GOVERNMENT OF THE …

www.iras.gov.sgagreement between the government of the republic of singapore and the government of japan for the avoidance of double taxation and the prevention of fiscal evasion

ITALY - OECD.org

www.oecd.org6 21 Convention between Italy and Finland for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on

Convention Signed at Washington July 1, 1957; Ratification ...

www.irs.govthe President approve thereof, a convention between the United States of America and Pakistan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income, signed at Washington on July 1, 1957. The convention was formulated as a result of technical discussions between representatives

Notification No. 135/2021

www.incometaxindia.gov.inDesiring to amend the Agreement between the Government of the Republic of India and the Government of Kyrgyz Republic for the Avoidance of Double Taxation and for the Prevention of Fiscal Evasion with respect to taxes on income signed at New Delhi on 13th April, 1999 (hereinafter referred to as “the Agreement”). Have agreed as follows:

CONVENTION BETWEEN THE GOVERNMENT OF …

www.iras.gov.sg1 convention between the government of the republic of singapore and the government of the french republic for the avoidance of double taxation and

TAX REFORM THAT WILL MAKE AMERICA GREAT AGAIN

assets.donaldjtrump.comremain in place because no company should face double taxation. 4. Reducing or eliminating some corporate loopholes that cater to special interests, as well as deductions made unnecessary or redundant by the new lower tax rate on corporations and business income. We will also phase in a reasonable cap on the deductibility of business

The Concept of National Citizenship in the Contemporary ...

gcasper.stanford.eduthan of citizenship. The duty to pay taxes is frequently the subject of double taxation treaties. The duty to obey other laws falls mostly on citizens and noncitizens alike. The United States passport includes language that reminds American citizens: “[W]hile in a foreign country, you are subject to its laws.”

THE UNITED STATES OF AMERICA AND GREECE

www.irs.govAmerica and Greece for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income, signed at Athens on February 20, 1950. This convention, together with another relating to taxes on estates of deceased persons, was formulated as a result of technical discussions between representatives of each of the two

Info Capsule

www.icsi.edudouble taxation and for the prevention of fiscal evasion with respect to taxes on income which was signed at New Delhi on 13th April, 1999, has been signed at Bishkek, Kyrgyz Republic on 14th June, 2019, as set out in the Annexure. The date of entry into force of the said amending Protocol is the 22nd October, 2020, being the

Double Taxation Treaty - Revenue

www.revenue.ieDouble Taxation Treaty between Ireland and USA (1997) Convention between the government of Ireland and government of the United States of America for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital gains

Double Taxation Avoidance Agreements

www2.deloitte.comJuridical double taxation –the taxation of the same income, in the hands of the same taxpayer, ... agreement concluded between States and governed ... o Entry into force o Termination This provides the methods through which

Double tax agreements - ACCA Global

www.accaglobal.comDouble tax relief The over-riding objective of a DTA is the avoidance or minimisation of double taxation. This is achieved mainly by the granting of double tax relief by the country of residence. Illustration 4 Based on the above-mentioned scenario of the $100 profit made from

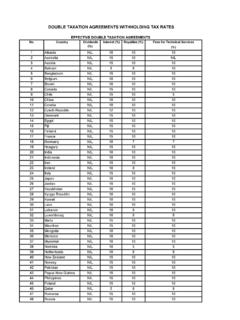

DOUBLE TAXATION AGREEMENTS WITHHOLDING TAX …

www.hasil.gov.myDOUBLE TAXATION AGREEMENTS WITHHOLDING TAX RATES No. Country Fees for Technical Services (%) 1 Albania NIL 10 10 10 2 Australia NIL 15 10 NIL 3 Austria NIL 15 10 10

Double Taxation Agreements are reproduced under the …

assets.publishing.service.gov.ukDesiring to conclude a Convention for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and on capital gains, Have agreed as follows: ARTICLE 1 Persons covered This Convention shall apply to persons who are residents of one or both of the Contracting States.

Similar queries

Double Taxation, Treaties, Digest of Double Taxation Treaties, Digest, Double taxation treaties, Australia’s double taxation treaties, ORDER THE DOUBLE TAXATION RELIEF (CARICOM), CARICOM, Order, The Double Taxation Relief (CARICOM) Order, International Taxation – Overview of Key Concepts, Taxation, Treaty, United Nations, Between, Avoidance, Agreement, In force, Force, Agreements, ARTICLES OF THE MODEL, OECD, AGREEMENT BETWEEN, INDIA DOUBLE TAXATION, India, Action Plan, Base Erosion and Profit Shifting, IRS tax, Relief, List of Reservations and Notifications at the, Convention between the government of, United states of america, United states, UNITED, Convention, Agreement between the government of, Agreement between the government of the, The government of the, List of Reservations and Notifications, Italy, Pakistan, Passport, Prevention, Double Taxation Avoidance Agreements, Double, Double taxation and the prevention