Search results with tag "197a"

FORM NO. 15G a company or firm) claiming certain …

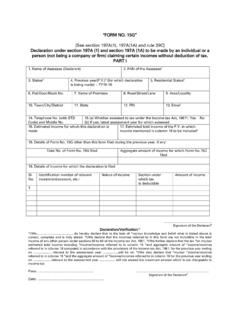

www.lichousing.comFORM NO. 15G [See section 197A(1), 197A(1A) and rule 29C] Declaration under section 197A (1) and section 197A(1A) to be made by …

FORM NO. 15G [See section 197A(1), 197A(1A) and rule 29C ...

www.icicibank.com2Declaration can be furnished by an individual under section 197A(1) and a person (other than a company or a firm) under section 197A(1A). 3The financial year to which the income pertains. 4Please mention the residential status as per the provisions of section 6 of …

Printed from www.incometaxindia.gov.in Page 1 of 2

www.dbs.com[See section 197A(1), 197A(1A) and rule 29C] PART I 7. Assessed in which Ward/Circle Declaration under section 197A(1) and section 197A(1A) of the Income‐tax Act, 1961 to be made by an individual or a person (not being a company or firm) claiming certain receipts without deduction of tax.

Signature of the declarant - Tamilnad Mercantile …

www.tmb.in"FORM NO. 15G [See section 197A(1), 197A(1A) and rule 29C] Declaration under section 197A (1) and section 197A(1A) to be made by an individual or a person (not

FORM NO. 15G - stfc.in

www.stfc.in1As per provisions of section 206AA(2), the declaration under section 197A(1) or 197A(1A) shall be invalid if the declarant fails to furnish his valid Permanent Account Number (PAN). 2Declaration can be furnished by an individual under section 197A(1) and a person (other than a company or a firm) under section 197A(1A). 3The financial year to which the income pertains.

FORM NO. 15G - OnlineSBI

www.onlinesbi.comDeclaration under section 197A(1) and section 197A (1A) of the Income tax Act, 1961 to be made ‐ by an individual or Person (not being a company or firm) claiming certain receipts without deduction of tax.

FORM NO. 15G

www.nielit.gov.in1. The declaration should be furnished in duplicate 2. *Delete whichever is not applicable 3. #Declaration can be furnished by an individual under section 197A(1) and a person (other than a company or a firm) under section 197A(1A) 5. Before signing the declarion/verification, the declarant should satisfy himself that the information furnished in

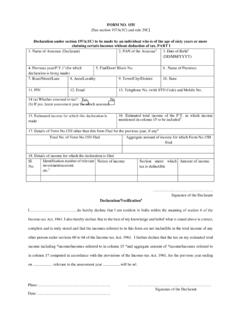

Declaration under section 197A(1C) to be made by an ...

www.incometaxindia.gov.in1. As per provisions of section 206AA(2), the declaration under section 197A(1C) shall be invalid if the declarant fails to furnish his valid Permanent Account Number or Aadhaar Number. 2. Declaration can be furnished by a resident individual who is of the age of 60 years or more at any time during the previous year. 3.

FORM NO. 15H claiming certain incomes without deduction …

www.bankofindia.co.in[See section 197A(1C) and rule 29C] Declaration under section 197A(1C) to be made by an individual who is of the age of sixty years or more claiming certain incomes without deduction of tax. PART I 1. Name of Assessee (Declarant) 3. Date of Birth2. PAN of the Assessee1 2 (DD/MM/YYYY) 4. Previous year(P.Y.)3 (for which declaration is being made) 5.

FORM NO. 15H claiming certain incomes without deduction of ...

www.lichousing.comFORM NO. 15H [See section 197A(1C) and rule 29C] Declaration under section 197A(1C) to be made by an individual who is of the age of sixty years or more

AT-197A/GR - RadioManual

www.radiomanual.infoT A E RAI PONE TO FREE AT-197A/GR PRODUCT SPECIFICATIONS PRODUCT DESCRIPTION Application Ground-Air Communications Frequency 225–400 MHz

KY 196A, 196B, & 197A - Complete Avionics

www.completeavionics.comOffering outstanding ergonomics, our entire line of Silver Crown Plus avionics features more extensive control backlighting and larger, sturdier knobs for easier use.

Criminal Code - EJTN

www.ejtn.euSection 1 1. No act or omission which did not constitute a criminal offence under the law at the time of its commission shall be punishable by law. 2. ... 192c, 197a, 197b, 197c, 206, 237, 272 and 273 and – insofar as the serious offence is an

TAX DEDUCTION AT SOURCE [TDS]

taxguru.in3 Individual gives declaration in 197A but without PAN 20% 4 Company make application to AO under section 197 but without PAN AO will ignore Application 5 Payment to NR & as per DTAA, TDS rate is 10% 20% (Notwithstandi ng anything contained….) Index C A A bh i j i t S a w a r k a r. www.taxguru.in

Key Features Return Preparation Utility (RPU) version 3

www.tin-nsdl.com12. Changes in validations of Section 194K of Form 26Q Existing Remark “B” (In case of no deduction on account of declaration under section 197A) will also be applicable for this section These changes will be applicable for regular and correction statements pertaining to FY …

State Bank of India

retail.onlinesbi.comIAS per provisions of section 206AA(2), the declaration under section 197A(1C) shall be invalid if the declarant fails to fumish his valid Permanent Account Number (PAN) 2Declaration can be fumished by a resident individual who is of the age of 60 years or more at any time during the ?revlous year. The financial year to which the income pertains.

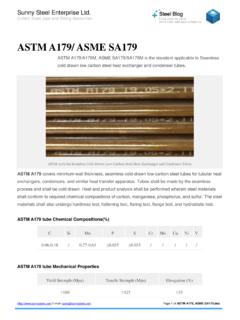

ASTM A179/ ASME SA179 - Sunny Steel

www.sunnysteel.comSunny Steel Enterprise Ltd. Collect Steel pipe and fitting Resources Http://www.sunnysteel.com E-mail: sales@sunnysteel.com Page:2 of ASTM A179, ASME SA179.doc ASTM A179 is a brief summary of the referenced standard.

ASTM A106/A 106M GR. B SEAMLESS CARBON STEEL PIPES - …

www.ctstubes.com⚫ ASTM A179 / ASME SA179 Seamless tubes ⚫ ASTM A192 / ASME SA192 Seamless boiler tubes ⚫ ASTM A210 / ASME SA210 GRADE A1 Seamless tubes ⚫ ASTM A210 / ASME SA210 GRADE C Seamless tubes ⚫ Alloy steel ⚫ ASTM A213 T11 T12 T22 Seamless alloy tubes ⚫ ASTM A 213/A 213M T2, T5, T5b, T9, T91 Seamless Alloy Steel tubes

![TAX DEDUCTION AT SOURCE [TDS]](/cache/preview/9/f/0/5/3/6/e/1/thumb-9f0536e1f15bf9dfca51b550636c04d3.jpg)