Search results with tag "Sales and other dispositions"

Pub 103 Reporting Capital Gains and Losses for Wisconsin ...

www.revenue.wi.govInternal Revenue Service . Publication 544, Sales and Other Dispositions of Assets. The amount of capital gain and loss to include in Wisconsin taxable income is figured on . Schedule WD, Capital Gains and Losses, or Schedule 2WD for estates and trusts. You can get Schedule WD or Schedule 2WD from any Department of Revenue office or our website ...

Compliance and reporting: recent developments …

www.ey.comPage 6 Eighth annual domestic tax conference Form 8949 Sales and other dispositions of capital assets: New for corporations and partnerships to report sales and exchanges of

2021 Publication 537 - Internal Revenue Service

www.irs.govInternal Revenue Service Publication 537 Cat. No. 15067V Installment Sales For use in preparing 2021 Returns ... 544 Sales and Other Dispositions of Assets 550 Investment Income and Expenses 551 Basis of Assets 4895 Tax Treatment of Property Acquired From a …

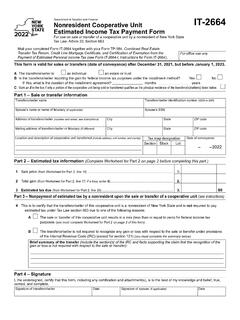

From IT-2664 Nonresident Cooperative Unit Estimated Income ...

www.tax.ny.govPublication 544, Sales and Other Dispositions of Assets; and Publication 551, Basis of Assets. These publications are available on the Internal Revenue Service’s website at www.irs.gov. 0441220094 Note: You must complete Form IT-2664-V (below), even if there is no payment of estimated personal income tax due.

Religious Corporations: Sales and other Disposition of Assets

www.charitiesnys.comof its assets, regardless of their form, including intangible property such as bonds, stocks or certificates of deposit, Article 2-b of the RCL should be consulted. Quick Statutory Reference Guide Sale, mortgage and lease of real property of religious corporations. RCL § 12 Disposition of all or substantially all assets.