Search results with tag "Vat registration"

Interactive Guideline E-Services

zatca.gov.saVAT Registration 15 This service enables you to register as a VAT-compliant Company, and upon registration, you will be assigned a VAT number. Service Steps Registration for VAT Enter service via the ZATCA website Go to the “General Services” tab. Go …

Value-Added Tax VAT 414 - South African Revenue Service

www.sars.gov.zaAll references to the “VAT Act” are to the Value-Added Tax Act 89 of 1991 and references to ... such person may apply for a VAT Ruling as envisaged in section41B of the VAT Act read with Chapter 7 of the TA Act. Refer ... Describes the VAT registration requirements in general and how it applies to

Implementing rules and regulations of the TRAIN Law - …

www2.deloitte.comP3,000,000 may continue to be VAT-registered taxpayer and avail of the “Optional Registration for Value-Added Tax of Exempt Person”. Once availed, the taxpayer shall not be entitled to cancel the VAT registration for the next three years. 2. A VAT-registered taxpayer who opted to register as non-VAT as a

European VAT refund guide 2019 - Deloitte

www2.deloitte.comto register for VAT purposes in respect of the resale and will recover VAT through the VAT registration. Direct VAT recovery, therefore, will apply only to goods delivered and consumed for business purposes within the charging member state (e.g. the purchase and use of local office supplies). Making claims Minimum amounts

Participant Register User's Guide - European Commission

ec.europa.euThis user guide is designed to assist the users of the Participant Register application for funding opportunities. ... address and national registration number 2. copy of the VAT registration document (required only if the organisation is VAT registered ... The registration process finishes on completion of six steps which follow a logical ...

Guide to Developed FATOORA Compliant QR Code

zatca.gov.saVAT registration number 2 15 310122393500003 020F333130313232333933353030 303033 Time stamp 3 20 2022-04-25T15:30:00Z 0314323032322d30342d323554313 53a33303a30305a Invoice total (with VAT) 4 7 1000.00 0407313030302e3030 VAT total 5 6 150.00 05063135302e3030

VALUE-ADDED TAX Application for registration

ggovender.co.zaApplication for registration Magisterial district Area code Nature of person VAT registration number VALUE-ADDED TAX FOR OFFICE USE 4 101

Value-Added Tax - SARS

www.sars.gov.zaValue-Added Tax Application for separate registration of Enterprise / Branch / Division www.sars.gov.za VAT 102e FOR OFFICE USE Branch VAT registration number

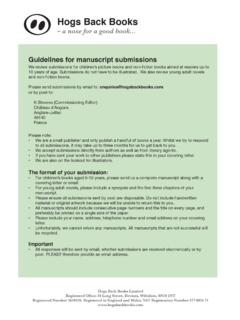

Hogs Back Books

www.hogsbackbooks.comGuidelines for manuscript submissions. We review submissions for children’s picture books and non-fiction books aimed at readers up to 10 years of age. Submissions do not have to be illustrated. We also review young adult novels ... VAT Registration Number 977 6056 71 www.hogsbackbooks.com. Created Date:

eFILING USER GUIDE FOR VALUE-ADDED TAX - …

www.vatcalculator.co.za9 | eFILING USER GUIDE FOR VALUE-ADDED TAX Step 3 The form will already be pre-populated with the following information for first submission: ú Trading or Other Name ú VAT Registration Number

VAT-REG-02-G01 - Guide for Completion of VAT …

www.sars.gov.zaGUIDE FOR COMPLETION OF VAT REGISTRATION APPLICATION FORMS VAT-REG-02-G01 Revision: 5 Page 4 of 19 Use BLOCK LETTERS and print one character in each block. Example: M A G S N A I D O O Where a container in the Application requires an election to be made, place an X in the relevant block of that container.

Similar queries

VAT REGISTRATION, Registration, Value-Added Tax VAT, Value-Added Tax, Apply, Implementing rules and regulations of, Registration for Value-Added Tax, For VAT, Participant, Guide, European Commission, Completion, VALUE-ADDED TAX Application for registration, Application for registration, Guidelines, EFILING USER GUIDE FOR VALUE-ADDED TAX, For Completion of VAT