Search results with tag "Added"

Value Added Producer Grant Factsheet - USDA Rural …

www.rd.usda.govThe Value Added Producer Grant program helps agricultural producers enter into value-added activities related to the processing and/or marketing of bio-based, value-added products. Generating new products, creating and expanding marketing opportunities, and increasing producer income are the goals of this program. Who may apply for this program ...

Notes for Guidance - VAT Consolidation Act 2010

www.revenue.ieThe Value-Added Tax Consolidation Act 2010 is divided into 14 Parts as follows: Part 1 contains the short title of the Act and definitions and interpretations used throughout the Act. It also contains the charging section for value-added tax. Part 2 contains the provisions relating to persons who are accountable for value-added tax.

VALUE-ADDED TAX ACT 89 OF 1991 - GoLegal

golegal.co.zaVALUE-ADDED TAX 7 Imposition of value-added tax 8 Certain supplies of goods or services deemed to be made or not made 9 Time of supply 10 Value of supply of goods or services 11 Zero rating 12 Exempt supplies 13 Collection of tax on importation of goods, determination of value thereof and exemptions from tax

THE UTTAR PRADESH VALUE ADDED TAX ACT, 2008

tradetaxtribunal.up.nic.inTHE UTTAR PRADESH VALUE ADDED TAX ACT, 2008 (U.P. Act No. 5 of 2008) [As passed by the Uttar Pradesh Legislature] AN ACT to provide for introducing Value Added System of taxation for the levy and collection of tax on sale or purchase of goods in the State of Uttar Pradesh and for matters connected therewith and incidental thereto.

Corporate Tax System in Taiwan - ITR

www.internationaltaxreview.comThe MOF has announced the Income Basic Tax Act (“IBTA”) on January 1, 2006. ... The taxpayer is generally classified as a value-added type entity (“VAT entity”), a non value-added type entity (“Non-VAT entity”) or a dual tax ... provision of services and …

TAXABLE PERSON GUIDE FOR VALUE ADDED TAX

tax.gov.aeThis is the Taxable Person Guide for Value Added Tax (VAT) in the United Arab Emirates (UAE). You might also hear or see it referred to as the VAT Guide 1 or the VATG001. 1.1. Purpose of this guide This guide is the main reference guide to VAT in the UAE. It provides you with: an overview of the main VAT rules and procedures in the UAE and how to

Value Added Tax Act, 2052 (1996) - ird.gov.np

ird.gov.npHis Majesty King Birendra Bir Bikram Shah Dev. 1. Short title and commencement: (1) This Act may be called as the “Value Added Tax Act, 2052 (1996)”. ⍣This Act came into force on 15 Jesth, 2065 (28 May 2008). ⬌Removed by Republic Strengthening and Some Nepal Laws Amendment Act, 2066 (2010).

The Income Tax Act Cap.340 4

www.ugandainvest.go.ugIn reviewing this updated version, the “Reprint of the Income Tax Act and the Value Added Tax Act” [as at 19th October 2012] by the Uganda Law Reform Commission was used as an authentic reference for conformity. The reprint consolidates the Income Tax Act, Cap 340, the Value Added Tax Act, Cap 349 and Statutory Instruments made

Kombucha Brewing & Bottling Guidelines

www.agriculture.pa.govSugar is added at 5% to 15%. The tea is allowed to brew for approximately 10 minutes and the tea leaves are removed. The tea is cooled to room temperature and approximately 10% of fresh-fermented kombucha containing the microbial mat from a previous batch is added to the sweetened tea. It is then covered with a

INTERPRETATION NOTE 70 (Issue 2) ACT : VALUE-ADDED …

www.sars.gov.za3 of the Note, which deals with international VAT and GST principles, any reference to the acronym “VAT” includes reference to the acronym “GST” which may be used in other countries. as a national tax that embodies the basic features of a value-added tax. 5 This is commonly referred to as a “business” or “enterprise”.

Nutrients: Phosphorus, P(mg) - USDA

www.nal.usda.govadded vitamin A and vitamin D 1.0 cups 255 Fish, salmon, coho, wild, cooked, moist heat 3.0 oz 253 Milk, chocolate, fluid, commercial, whole, with added vitamin A and vitamin D 1.0 cups 252 Fast foods, english muffin, with egg, cheese, and 1.0 sandwich 252 Yogurt, plain, low fat 1.0 container (6 oz) 245

ACT : VALUE-ADDED TAX ACT NO. 89 OF 1991 SECTION ...

www.sars.gov.zameans the Value-Added Tax Act No. 89 of 1991; and • any other word or expression bears the meaning ascribed to it in the VAT Act. 1. Purpose This Note sets out the – • interpretation of the definition of “motor car”; • general principle that VAT incurred on the acquisition of …

QUESTION 100 marks All amounts exclude value-added tax ...

www.saica.co.zaAll amounts exclude value-added tax (VAT), unless otherwise indicated. Assume that all persons are South African residents for taxation purposes, unless otherwise indicated. 1 Background Real Pirates (Pty) Ltd (‘RP’) is a soccer club that owns a soccer …

Handbook on GST Annual Return - Amazon Web Services

idtc-icai.s3-ap-southeast-1.amazonaws.comInstitute on the occasion of its foundation day on 5th April, 2019 at New Delhi. Now, considering the importance of filing of Annual Return to provide support and to help tax ... GST is a value-added tax levied at all points in the supply chain, with credit for taxes paid on ... 2017 and Rule 80(1) of the CGST Rules, 2017. Section . 44(1)

Bio-based chemicals a 2020 update final - 200213b

www.ieabioenergy.comchemicals, materials, food and feed can in principle generate the necessary added value to solve the economic challenges. An example is the co-production of distiller's dried grains with solubles (DDGS) and corn oil in a corn ethanol dry-milling …

Merrill Lynch Investment Advisory Program Wrap Fee Program ...

olui2.fs.ml.comMar 22, 2021 · The following disclosure was added on June 15, 2020 to Item 9 at the section “Disciplinary Information”: “On April 17, 2020, the . SEC issued an administrative order in which it found that MLPF&S had willfully violated Section 206(2) of the Advisers Act. Specifically, the order found that from January 1, 2014 to May 31, 2018,

The VAT Brochure - Skatteverket

www.skatteverket.se(tax rate x taxable basis = VAT). Tax year = Corresponds to the financial year in the case of VAT reporting. Taxable basis = The value on which VAT is calculated. Taxable entity = Entity that must pay VAT to the state. Turnover = Sale or self-supply. VAT-return = value added tax return. VAT registration number = Number given to entities regis ...

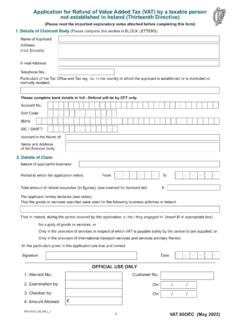

Form VAT 60OEC - Application for Refund of Value Added …

www.revenue.ieIMPORTANT INFORMATION 1. Completion of all fields of this form is mandatory to allow consideration of the claim. 2. Application for repayment of VAT paid on goods (including animals) at a point of entry into this State by a consignee (or by a consignee’s declarant / representative), should be made on a VAT 3 return, where payment of such VAT is made by a customer who is …

Getting Started Guide- VAT

eservices.tax.gov.aeYou are about to apply for Value Added Tax (VAT) registration in the UAE. You should read the following information before proceeding with the completion of your VAT registration application. It will help you understand whether or not you are required or eligible to register for VAT and, if so, what information you will need to

A brief on VAT (Value Added Tax)

www.ctax.kar.nic.inComposition scheme under VAT Act. Registration and payment of taxes under VAT Act can be of two types. First type is the registration and payment of taxes under full VAT and second type is the registration and payment of taxes under composition. The option should be exercised by a dealer, while applying for registration in the prescribed VAT ...

IT-GEN-03-G01 - How to complete the 14SD Supplementary …

www.sars.gov.zaValue-Added Tax Declarations (VAT201’s). Monthly Employer Declaration (EMP201’s). Where the IT14SD is to be submitted manually at a SARS branch, ensure that the various totals from the VAT201’s submitted for the relevant tax periods relating to …

TOP LEVEL COVER

nig.comamount of any claim, or if the Insured is registered for Value Added Tax, the Company’s service provider will invoice the Insured direct for this amount. NOTE: Using any other repairer will not affect the Insured’s right to claim under this Policy. This helpline is provided on the Company’s behalf by the Company’s approved supplier panel.

Mechanisms for the Effective Collection of VAT/GST - OECD

www.oecd.org- Any national tax that embodies the basic features of a value added tax as described in Chapter 1 of the International V AT/GST Guidelines by whatever acronym it is known ( e.g.

AT-REG-02-G02 - Foreign Suppliers of Electronic Services ...

www.sars.gov.zaa. This guide is applicable to Foreign Suppliers of Electronic Services (Foreign Electronic Service Entity) and explains how to : i. Complete the VAT101 - Application for Registration for Value Added Tax - External Form (VAT Application Form) ii. Complete the VAT 201 - VAT Vendor Declaration (VAT201) iii. File the VAT201 and make payment of VAT ...

Field Pea Production - Montana State University

agresearch.montana.eduField pea is often cracked or ground and added to cereal grain rations. Research has shown that field pea is an excellent protein supplement in swine, cow, feeder calf, dairy and poultry rations. ... producer’s location. The indeterminate nature of the long …

Create Your Own MyPlate Menu

myplate-prod.azureedge.net• Limit sodium, saturated fat, and added sugars. Flip over to draw your menu! List your menu items using the tips below: Create Your Own. DRAW YOUR MENU! August 2016 USDA is an equal opportunity provider and employer. USDA . Title: …

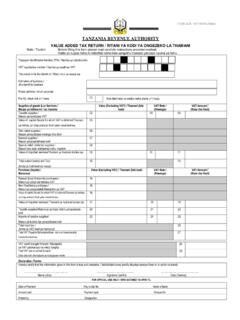

ELECTRONIC TAX RETURNS FILING SYSTEM

gateway.tra.go.tzE-Filer should click on the “Value Added Tax RETURN” link where a ITX240.01.B_VAT form will load. The e-Filer is required to fill the fields on the form appropriately, on completion the e-filer can then confirm by checking the “I have completed filling Part 1 of this return” checkbox.

VAT201 - cdn.ymaws.com

cdn.ymaws.comVAT201 Declaration in the “Step-by-Step Guide for Completion of the Value-Added Tax Vendor Declaration” Complete all the relevant information that is required for the processing of the declaration. Diesel Please submit the original return and retain a copy for your records. (As in BRS and Functional Spec) Vendor Declaration VAT201

2022 OECD Tax and Development Days

www.oecd.orgpressure on Value Added Tax (VAT). This session will discuss the Regional VAT Digital Toolkits that provide detailed guidance for the implementation of a comprehensive strategy to ensure that VAT is effectively collected on e-commerce sales, and the possibilities for technical assistance to support developing economies in implementing this ...

18 - dpsa.gov.za

www.dpsa.gov.zaManagement or other related qualification. A minimum of 35 years’ experience in - Supply Chain Management or Procurement. Knowledge of public sector procurement and SCM regulations and systems is mandatory. Experience in the public service shall be an added advantage. Competencies Required:

Avenue Supermarts Limited

archives.nseindia.comProfit After Tax 234 # of Stores 11/1 # of States and Union Territory 22* # of New Stores Added 8.8 mn sq. ft. Retail Business Area Contents Corporate Overview 01 Good Products Great Value 02 About DMart 03 Core Values, Vision and Mission 04 Presence and Expansion Strategy 06 Key Product Categories 08 Key Performance Indicators 10 Message from ...

Implementation of Proposition 19: Base Year Value Tansfers

www.boe.ca.govFeb 17, 2022 · If the full cash value of the replacement dwelling does not meet the applicable "equal or lesser value" definition above, then it must be of "greater valueIf the replacement dwelling is of ." "greater value," then the amount above the "equal or lesser value" of the original property's full cash value is added to the transferred base year value.

STEPS FOR THE INSTALLATION OF EBM TO VAT REGISTERED ...

www.rra.gov.rw••A copy of RDB Full Registration Certificate or copy of Notice of Taxpayer Identification Number (TIN) registration in case the business is not registered in RDB. ••A copy of Value Added Tax (VAT) Certificate ••A copy of Identification Number or Passport of the person who signed the letter requesting the installation of EBM software

Special Disaster Grant - Severe Weather and Flooding ...

www.raa.nsw.gov.auproducer (s) on that property • they are eligible for the grant in their own right (including the requirement that they derive at least 50%of their gross income from the . primary production enterprise. ... added products (eg wine) made directly from raw produce grown by the applicant.

USDA Rural Development Awards February 2 2022

www.rd.usda.govValue Added Products, Inc. $2,437,800 OR. Cliff Bentz (02) Thrivify, LLC $1,954,000 PA: Conor Lamb (17) Workover Solutions, Inc. $3,500,000 PA Glenn Thompson (15) SNB Hospitality, LLC $650,000 PR: Jenniffer Gonzalez-Colon Fusion Properties Management Group Inc. $78,000 ... State Representative Recipient Loan Grant ...

ESTIMATION OF NATIONAL INCOME - PRE- INDEPENDENCE …

www.lnctu.ac.inThus, national income measures the net value of goods and ... boundaries by nationals is added and depreciation is subtracted ... The states of Uttar Pradesh, Punjab, Haryana, Madhya Pradesh, Andhra Pradesh, Telangana, Bihar, West Bengal,

Specification - Pearson BTEC Level 3 National Extended ...

qualifications.pearson.comSummary of Pearson BTEC Level 3 National Extended Certificate in Applied Psychology specification Issue 5 changes Summary of changes made between the previous issue and this current issue Page number Unit 1: Psychological Approaches and Applications A2 group added to intra group dynamics.

3 What Makes Plants Grow? Plant Connections PURPOSE ...

edis.ifas.ufl.eduThe content of carbon dioxide in the atmosphere is relatively stable at about 0.03 percent, a seemingly small amount but totaling roughly 2,000,000,000,000 tons in the atmosphere surrounding the earth. Carbon dioxide is continually being added to the air by respiration of plants and animals, decaying organic materials, combustion of

Value Added Tax (VAT) Application for registration - …

assets.publishing.service.gov.ukLimited partnership Name of the limited partnership Partnerships must also complete form VAT2 and enclose it with this form. Company registration number (CRN) Self Assessment Unique Taxpayer Reference (SA UTR) Trading name, if applicable If you need more space, use a separate sheet of paper. Partnerships now go to question 4.

DETERMINATION OF VITAMIN C CONTENT IN COMMERCIAL …

keypublishing.orgApr 14, 2021 · 10 mL samples of each selected fruit juices samples was pipetted into a conical flask where was added 5 mL potassium iodide (KI 0.2 M), 2.5 mL hydrochloric acid (HCl 1 M) and a few drops of starch solution. This solution was titrated against standard solution of KIO 3 (0.01 M) until the dark blue color was appeared.

VALUE ADDED TAX RETURN / RITANI YA KODI YA …

www.tra.go.tz01 Should be ticked for NIL return/Weka alama ya tiki endapo ritani haina malipo. 02 Value of taxable supplies/Thamani ya mauzo yanayotozwa kodi. 03 Rate of tax/Kiwango cha kodi. 04 VAT amount/Kiasi cha kodi kilichotozwa. 05 Value of purchases on Capital Goods on which VAT has been deferred /Thamani ya manunuzi kwenye bidhaa za mtaji

BIR Form 2550M (ENCS) - Page 2 ALPHANUMERIC TAX ... - …

www.lawphil.netBIR FORM NO. 2550M - Monthly Value-Added Tax Declaration VM 100 VM 010 VB 113 VB108 VB109 VB 111 Guidelines and Instructions VM 040 VM 110 VM 120 VM 130 VM 140 VM 030 VM 020 VM 150 VM 050 ALPHANUMERIC TAX CODES (ATC) VQ010 VB 102 VH 010 VP 102 INDUSTRIES COVERED BY VAT ATC INDUSTRIES COVERED BY VAT ATC INDUSTRIES …

Business Plan Template - Feed Kitchens

feedkitchens.org4. A State of Wisconsin grant-funded small farmer co-packing service to process excess produce and from farmers and turn it into processed and value-added products that will be sold to farmers’ wholesale and retail customers, increasing small farmers’ incomes and opportunities. This team will also provide prep and processing services to the

Abuja Declaration ten years after - World Health …

www.who.intAngola Comoros United Republic of Tanzania Malawi Sao Tome and Principe Congo Mauritania Lesotho Côte d'Ivoire Togo Djibouti ... following the financial crisis, the dollar value of ODA disbursements fell between 2008 and 2009 for 11 of the 23 countries reporting to the OECD. In 2009, ODA ... added to the existing levels of government spending ...

Opportunities in Food Processing Sector in India

www.mofpi.gov.inUttar Pradesh Rajasthan Tripura Haryana Chandigarh Dadra and Nagar Haveli Diu Daman Kerala ( 4 ) ... value added dairy product processing offer tremendous potential ... • Income Tax deductions on capital expenditure allowed at the rate of 150% for setting up

SUGGESTED ANSWERS TO QUESTIONS - icmai.in

icmai.in2. (a) (i) Goods and Services tax means a tax on supply of goods or services, or both, except taxes on supply of alcoholic liquour for human consumption (Article 366[12A] of Constitution of India). (ii) GST is a value added tax levy on sale of goods or provision of services or both. (iii) GST is a destination based consumption tax.

Provincial Sales Tax (PST) Bulletin

www2.gov.bc.caA mandatory gratuity is a tip that is added automatically to a customer’s restaurant bill. Generally, a mandatory gratuity is calculated by multiplying a certain percentage (e.g. ... charge 10% PST on the fair market value of the liquor and 7% PST on the fair market value for the lease of the keg. If there is a bundle discount, the single ...

Similar queries

Value Added Producer Grant, Value, Added, Producer, Added Tax, Of value-added tax, Of value, UTTAR PRADESH VALUE ADDED TAX, Uttar Pradesh, Value added, Corporate Tax System in Taiwan, Tax Act, Value added tax, Value Added Tax Act, 2052 1996, Bikram, Value Added Tax Act, VALUE-ADDED, International VAT, Value-Added Tax, Added Tax Act, 1991, Delhi, Rules, Chemicals, Added value, The VAT Brochure, Return, VALUE ADDED TAX RETURN, Of Value Added, Of VAT, Completion, Application, Scheme, VAT201, Declaration, Mechanisms for the Effective Collection, OECD, Guide, Registration, Added sugars, VAT201 Declaration, Declaration VAT201, Qualification, Grant, Pradesh, Specification, Level, Summary, Level 3 National Extended Certificate in Applied Psychology specification, CONTENT, Value Added Tax (VAT) Application for registration, Limited, Company, Selected, Guidelines, Abuja Declaration, World Health, United Republic of Tanzania, SUGGESTED ANSWERS TO QUESTIONS, Provincial Sales Tax (PST) Bulletin