Search results with tag "Use tax return"

Nebraska and Local Sales and Use Tax Return FORM

revenue.nebraska.govNebraska Sales Tax Permit and must file a Nebraska and Local Sales and Use Tax Return, Form 10, on or before the due date. Retailers should only report Nebraska sales on this return. How to Obtain a Permit. You must complete a Nebraska Tax Application, Form 20 , to apply for a sales tax permit. After the application has been processed,

2290 Heavy Highway Vehicle Use Tax Return

www.irs.govForm 2290 (Rev. July 2021) Heavy Highway Vehicle Use Tax Return Department of the Treasury Internal Revenue Service (99) For the period July 1, 2021, through June 30, 2022

Sales and Use Tax Return (ST-3) Instructions - Georgia

gtc.dor.ga.govSales and Use Tax Return (ST-3) Instructions ***ATTENTION*** Please note changes have been made to Form ST, -3 effective January 1, 2013lease read .P these instructions carefully.

0-88, Instructions for Form OS-114 Sales and Use …

www.ct.govO-88 Instructions for Form OS-114 Sales and Use Tax Return What’s New Newly Taxable Services – Taxable on or After July 1, 2011 1. Intrastate transportation services provided by livery services,

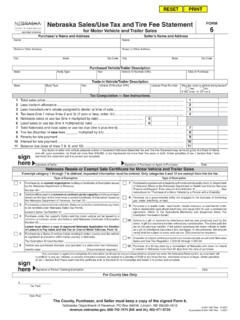

Nebraska Sales/Use Tax and Tire Fee Statement for Motor ...

revenue.nebraska.govbottom of the Form 6 if e-filing Nebraska and Local Sales and Use Tax Return, Form 10, or with Form 10 if filing on paper; and 3. Two signed copies must be given to the purchaser. The sales price on line 1 must include amounts for destination charges, import custom fees, surcharges, service and maintenance agreements,

Form ST-100:6/18:New York State and Local Quarterly Sales ...

www.tax.ny.gov50000108180094 1 1a 1b.00.00.00 New York State and Local Quarterly Sales and Use Tax Return Department of Taxation and Finance Quarterly ST-100 Sales tax identification number