Search results with tag "Divestitures"

DANAHER CORPORATION

filecache.investorroom.comcomplete divestitures and other dispositions, our ability to integrate the businesses we acquire and achieve the anticipated benefits of such acquisitions, contingent liabilities and other risks relating to acquisitions, investments, strategic relationships and divestitures (including tax-related and other contingent liabilities relating to ...

Corporate Divestitures: Spin-Offs vs. Sell-Offs

www.efmaefm.org1 Corporate Divestitures: Spin-Offs vs. Sell-Offs 1. Introduction When a firm decides to divest an asset, it may totally relinquish its ownership or retain a partial

Financial Due Diligence Overview

cdn.ymaws.comFeb 23, 2016 · border acquisitions, divestitures and spin-offs, capital events such as IPOs and debt offerings, and bankruptcies and other business reorganizations. • Allow our clients to expedite deals, reduce risks, and capture and deliver value to stakeholders, while quickly returning to business as usual. • Reduce risk by identifying issues early.

L3harris Overview

www.l3harris.commarket acceptance; the consequences of uncertain economic conditions and future geo- political events; strategic acquisitions and divestitures and the risks and uncertainties related thereto, including the company’s ability to manage and integrate acquired businesses and real ize expected benefits and

Dear IBM Investor

www.ibm.comStrategic Divestitures Over eight years, IBM has sold businesses with more than $10 billion in revenue, including semiconductor manufacturing and x86 servers, in order to allocate capital to innovation. Business Roundtable In 2019, IBM signed the Business Roundtable Statement on the Purpose of a Corporation. The Business Roundtable is

4Q 2021 Earnings Call

s22.q4cdn.comweather, market acceptance, acquisitions and divestitures of businesses, anticipated transaction costs, the integration of new businesses, anticipated benefits of acquisitions, and other factors that impact our businesses and customers. They also may

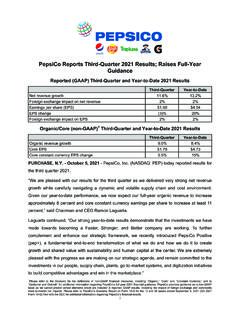

PepsiCo Reports Third-Quarter 2021 Results; Raises Full ...

investors.pepsico.comDivestitures, and Other Structural Changes Food/Snack Beverage Frito-Lay North America 6 (0.5) — 5 1 Quaker Foods North America 2 (1) — 1 (4) PepsiCo Beverages North America 7 (0.5) — 7 3 Latin America 27 (8) — 19 5 9 Europe 9 — — 8 5 7 Africa, Middle East and South Asia 33 (8) (5) 20 5 18 Asia Pacific, Australia and New

Q3 2021 Highlights

investors.bostonscientific.comacquisitions and divestitures for which there are less than a full period of comparable net sales. Emerging Markets: We define Emerging Markets as the 20 countries that we believe have strong growth potential based on their economic conditions, …

Bloomberg Commands - University of Toronto

financelab.rotman.utoronto.catransactions, including deal types such as acquisitions, divestitures, self-tenders, spin-offs, and joint ventures. These details can include total values, payment terms, premiums, advisor information, and deal financials. You can display the largest deals announced today, statistics, terms, and news. You can

The Role of Marketing Research - SAGE Publications Inc

www.sagepub.comstrategic decisions about acquisitions, divestitures, and expansion. It can be used by middle managers to develop production schedules, purchase raw materials, develop departmental budgets, and determine appropriate staffing levels. Functions of Marketing Research

Customer Relationship Management (CRM) System

ittoday.infoIn these times of divestitures, mergers, and acquisitions, this is an important requirement. Unlike some of the earlier enterprise-wide solutions available on mainframes, CRM packages like SAP CRM cater to corporation-wide requirements even if an organization is involved in disparate

Unlocking value through divestitures - EY

www.ey.comThe impact of the global financial crisis and significant capital investment programs has driven increased divestiture activity by many large utilities, in a bid to strengthen

ABC Company Compensation and Benefits Issues Arising from ...

www.erlimited.comABC Company Compensation and Benefits Issues Arising from Divestitures, Mergers and Acquisitions First Discussion Draft Executive Resources Limited

Prepared by : RAHUL BIYANI Registration No : …

rna-cs.com6 "DEMERGER basically means DIVORCE" FORMS OF DEMERGER: Divestitures: Sale of a segment of Company to outsider for cash / securities. Spin off: Holding Company distributes its own shares in controlled subsidiary company to its shareholders on pro-rata basis as a dividend in non cash form. Equity carved out: Only some shareholding of subsidiary company is sold out to public

Breaking Into Wall Street – Investment Banking Interview ...

samples-breakingintowallstreet-com.s3.amazonaws.comNarrator: Hello everyone, and welcome to our first sample deal discussion. In this example, we cover how to discuss a sell-side divestiture transaction in investment banking interviews. When you’re discussing transactions in interviews, you need to think like a reporter