Search results with tag "Installment agreement"

Form 433-H Installment Agreement Request and Collection ...

www.irs.govInstallment Agreement Request and Collection Information Statement. Use Form 433-H if you earn wages, you are requesting an installment agreement, and your liability is either greater than $50,000 or cannot be paid within 72 months. Tip

haven’t yet received a tax bill. Go to www.irs.gov/OPA

www.irs.govto apply for an Online Payment Agreement. If you establish your installment agreement using the Online Payment Agreement application, the user fee that you pay will be lower than it would be with Form 9465. Part I Installment Agreement Request. This request is for Form(s) (for example, Form 1040 or Form 941)

Form 433-D Installment Agreement - IRS tax forms

www.irs.gov• If you default on your installment agreement, you must pay a $89 reinstatement fee if we reinstate the agreement. We have the authority to deduct this fee from your first payment(s) after the agreement is reinstated. For low-income taxpayers (at or below 250% of Federal poverty guidelines), the reinstatement fee is reduced to $43.

Form 433-D Installment Agreement - IRS tax forms

www.irs.gov1-800-829-0922 (Individuals – Wage Earners) Or write (City, State, and ZIP Code) Employer (Name, address, and telephone number) Financial Institution (Name and address) Kinds of taxes (Form numbers) Tax periods. Amount owed as of$ I / We agree to pay the federal taxes shown above, PLUS PENALTIES AND INTEREST PROVIDED BY LAW, as follows $ on ...

ELECTRONIC FEDERAL TAX PAYMENT SYSTEM PAYMENT …

fiscal.treasury.gov990 990-BL 990-C 990-PF 990-T 1041 1041-A 1042 1065 730 926 940 941 Phone Payment EFTPS Form No. Valid Tax Period Ending Dates Tax Description Payment Due Information **Financial Institution Tax Form Code No. ... Those tax type codes ending in “7” include Installment Agreement payments.

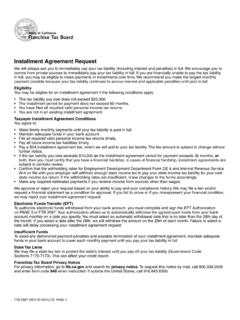

Installment Agreement Request - California

www.ftb.ca.govinstallment agreement terms and conditions on PAGE 1 of this form. If you break any of the installment agreement terms or conditions, we will send you a notice of our ... Future State and Federal Refunds and Interagency Intercept Collections. We will keep any state tax refund you are due and apply it towards your tax liability. This action does ...