Search results with tag "The property"

Part 04-08-11 - Pre-letting expenditure in respect of ...

www.revenue.ieTax and Duty Manual Part 04-08-11 ... 4 Cap on deduction ... If the person who incurs the expenditure ceases to let the property as a residential premises within four years of the first letting the deduction will be clawed back in the year in which the property ceases to be let as a residential premises. This

Sales and Use Tax on the Rental, Lease, or R. License to ...

www.floridarevenue.comthe property tax exempt. You must collect sales tax and surtax on the subleased property and pay tax directly to the Department on any portion of the property you retain. Tenant Liability If you lease, rent, or license commercial real property and …

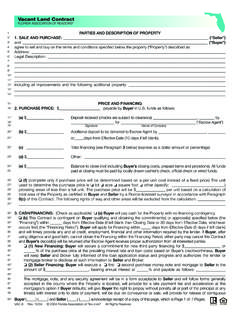

Vacant Land Contract - highlight realty

www.highlightrealty.comamount of property taxes that buyer may be obligated to pay in the year subsequent to purchase. a change of ownership or property improvements triggers reassessments of the property that could result in higher property taxes. if you have any questions concerning valuation, contact the county property appraiser’s office for further information.

RELATIONSHIP BETWEEN FRONT OFFICE AND OTHER DEPT S.

ihmbpl.webs.commaintained in the property management system by the front office. Messages for the marketing and sales department must be relayed completely, accurately, and quickly. The switchboard operator is a vital link in the communication between the prospective client and a salesperson in the marketing and sales department.

Schedule C: The Property Claimed as Exempt

www.uscourts.govOfficial Form 106C Schedule C: The Property You Claim as Exempt page 1 of __ Official Form 106C Schedule C: The Property You Claim as Exempt 04/16 Be as complete and accurate as possible. If two married people are filing together, both are equally responsible for supplying correct information.

Algebra 1 Midterm Study Guide

rmsalgebra.weebly.comName the property of equality that was used for each result step. 2 3 (9x + 6) = 9x – 2 6x + 4 = 9x – 2 [use the distributive property in order to simplify the left side] 4 = 3x – 2 [subtraction property of equality; subtracted 6x from each side] 6 = …

TP-584-NYC-I Instructions for Form TP-584-NYC

www.tax.ny.govSchedule D for more information. Schedule D does not need to be completed if the interest being transferred is anything other than a fee simple interest in real property or a cooperative unit, or if the property is being transferred by anyone or any entity other than an individual, estate, or trust. However, Schedules A, B, and C must still

Functional Obsolescence Considerations in the …

www.willamette.com66 INSIGHTS • WINTER 2012 www .willamette .com Functional Obsolescence Considerations in . the Property Tax Valuation. Scott R. Miller. Property Tax Valuation Insights. The identification and consideration of functional obsolescence is …

Identify the Property: Associative or Distributive? | 3rd ...

www.k12mathworksheets.comTitle: Identify the Property: Associative or Distributive? | 3rd Grade Worksheets Author: www.k12mathworksheets.com Created Date: 2/7/2014 4:28:03 PM

EXEMPT QUESTIONNAIRE INSTRUCTIONS - …

fultonassessor.org8. Is the property owner exempt from Federal or State income tax? If yes, indicate the IRS exempt section number and attach a copy of the IRS letter of exemption.

COMMERCIAL SALE AGREEMENT - TMI Real Estate

www.tmirealestate.comThis is a legally binding contract. Seek competent advice prior to execution. ... Seller agrees to cooperate with Buyer to provide relevant information concerning the Property in Seller’s . ... of the Property damaged or disturbed as a result of Buyer’s exercise of its rights under this Agreement to as near as

siesta 4-rent

www.siesta4rent.com9. BROKER is authorized to accept, receive and hold, any and all monies paid or deposited as a security deposit and monthly rental payments under the terms of any lease to be executed by third party renters for the Property on behalf of

PROPERTY MANAGEMENT OPERATIONS MANUAL

www.mccormickpcs.comThe premiums are paid by the Owner and the property manager is notified in case reimbursements are to be made by the tenants. If the property is damaged the Manager should notify the Owner as soon as possible and submit the Loss Notice form (Exhibit D). If the building has significant damage, the Manager should

PROPERTY TAX BENEFITS FOR ACTIVE DUTY MILITARY AND …

floridarevenue.comProperty Tax Exemptions and Discounts government . Eligibility for property tax exemptions depends on satisfying certain requirements. Information is available from the property appraiser’s office in the county where the veteran or surviving spouse owns a homestead or other property. • An ex-servicemember who was

PROPERTY MANAGEMENT POLICIES & PROCEDURES

images.kw.com1.ualifying Tenants Q: The Property Manager shall use all reasonable efforts to lease the property as described to desirable tenants. Property Manager shall follow preset guidelines for qualifying potential tenants. (Please see attached rental qualifications.) 2. Rent Collections: The Property Manager shall take all reasonable and necessary

PROPERTY CODE TITLE 1. GENERAL PROVISIONS CHAPTER ...

statutes.capitol.texas.gova conveyance of real property or an interest in real property that, because of this chapter, fails as a conveyance in whole or in part is enforceable to the extent permitted by law as a contract to convey the property or interest. Acts 1983, 68th Leg., p. 3480, ch. 576, Sec. 1, eff. Jan. 1, 1984. Sec. 5.003. PARTIAL CONVEYANCE. (a) An ...

THE PROPERTY Max occupancy: 2 adult + 2 children or 1 ...

www.karismatravelagents.comALL SUITES, ALL BUTLER, ALL GOURMET - FAMILY RESORT Address: KM 45, Carretera Cancún - Tulum, Riviera Maya, Q. Roo. C.P. 77710, Mexico Telephone: (52) 998 8728030 ...

Similar queries

THE PROPERTY, The property tax, Property, Contract, Concerning, BETWEEN FRONT OFFICE, Front office, Between, Schedule C: The Property, Form, Study Guide, Distributive property, Form TP-584, Schedule, Functional Obsolescence Considerations in the, Functional Obsolescence Considerations in . the Property, The Property: Associative or Distributive? | 3rd, COMMERCIAL, Concerning the Property, Rental, The Property Manager, Manager, Property tax, PROPERTY MANAGEMENT POLICIES, Property Manager