Example: bachelor of science

Search results with tag "Mortgage registry tax"

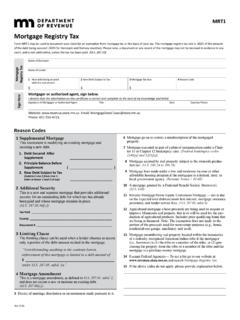

MRT1, Mortgage Registry Tax

www.revenue.state.mn.usMortgage . R egistry Tax (Rev. 9/18) MRT1. Name of Borrower Name of Lender . 1 . New debt being secured . 2 . New Debt Subject to Tax . 3 . Mortgage Tax Due . 4 . Reason Code

Real Estate Customs by State Yes No Customary Standard Fee ...

www.republictitle.comMortgage Registry Tax Yes Unless duration is tantamount to a conveyance, e.g., 99 years Unless lease exceeds 5 years No: Unless there is a determinable consideration other than the future duty to pay rent (for example, assignment of leasehold) Applied where unexpired term is for 5