Search results with tag "Claim exemptions"

DC-407 Notice to Debtor - How Claim Exemptions

www.courts.state.va.usNOTICE TO DEBTOR — HOW TO CLAIM EXEMPTIONS The attached paper is a legal process which has been issued by the court clerk …

DC-407 Notice to Debtor - How Claim Exemptions

www.vacourts.govHEARING—EXEMPTION CLAIM form and (ii) deliver or mail the form to the clerk’s office of this court. If the attached paper is an Attachment Summons, you have the right to a prompt hearing within ten business days from the date that you file your request for a hearing with the court.

Property Tax Exemptions for Religious Organizations

www.boe.ca.govFiling for the Church Exemption. Original filing . To apply for the Church Exemption, a claim form must be filed . each year. with the assessor of the county where the property is located . If a church owns and uses property and also allows another church to use that property, both churches. must file Church Exemption claim forms .

NOTICE TO JUDGMENT DEBTOR - Judiciary of Virginia

www.courts.state.va.usNOTICE TO JUDGMENT DEBTOR HOW TO CLAIM EXEMPTIONS FROM GARNISHMENT AND LIEN The attached Summons in Garnishment or Notice of Lien has been issued on request of a ...

California Property Tax - California State Board of ...

www.boe.ca.govLast day to file a timely exemption claim for cemeteries, colleges, exhibitors, free public libraries, free museums, public schools, and churches. Last day to file a timely exemption claim for veterans, disabled veterans, and homeowners. Last day to file timely exemption claims for welfare and veterans’ organizations. April 10

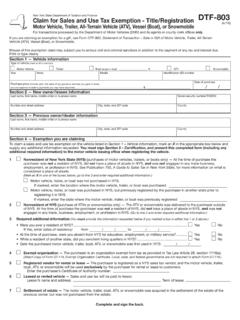

Form DTF-803:4/14: Claim for Sales and Use Tax Exemption ...

www.tax.ny.govMisuse of this exemption claim may subject you to serious civil and criminal sanctions in addition to the payment of any tax and interest due. Print or type clearly. Complete and sign the back. To claim a sales and use tax exemption on the vehicle listed in Section 1 – Vehicle information, mark an X in the appropriate box below and

Disabled Veteran or Surviving Spouse Exemption …

www.oregon.gov150-303-086 (Rev. 12-15) Disabled Veteran or Surviving Spouse Exemption Claim (Page 1 of 5) Disabled Veteran or Surviving Spouse Exemption Claim

Note: The draft you are looking for begins on the next page.

www.irs.govstatus. If you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2022 tax return. To claim exemption from withholding, certify that you meet both of the conditions above by writing “Exempt” on Form W-4 in the space below Step 4(c). Then, complete Steps 1(a), 1(b), and 5.

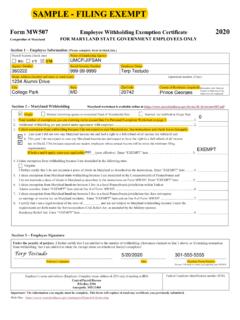

SAMPLE - FILING EXEMPT

jifsan.umd.edu3. I claim exemption from withholding because I do not expect to owe Maryland tax. See instructions and check boxes that apply. a. Last year I did not owe any Maryland income tax and had a right to a full refund of all income tax withheldand b.

November 2014 S-211 Wisconsin Sales and Use …

www.revenue.wi.gov-211 (. 11-1) isconsin epartment of evenue This certificate may be used to claim exemption from Wisconsin state, county, baseball and …

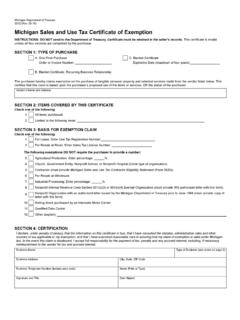

3372, Michigan Sales and Use Tax Certificate of Exemption

www.michigan.gov1. Michigan Department of Treasury 3372 (Rev. 01-21) Michigan Sales and Use Tax Certificate of Exemption. This exemption claim should be completed by the purchaser, provided to the seller, and is not valid unless the information in all four sections

5278, Eligible Manufacturing Personal Property Tax ...

www.michigan.govMichigan Department of Treasury 5278 (Rev. 12-17) Parcel Number 2018 Eligible Manufacturing Personal Property Tax Exemption Claim, Personal Property Statement,

Similar queries

DC-407 Notice to Debtor - How Claim Exemptions, NOTICE TO DEBTOR — HOW, CLAIM EXEMPTIONS, Claim, Exemption Claim, FILING, Exemption, NOTICE TO JUDGMENT DEBTOR, Judiciary of Virginia, For welfare, Tax exemption, Draft, Claim exemption, Form W-4, Wisconsin Sales and Use, Wisconsin, Michigan Sales and Use Tax Certificate of Exemption, Michigan, Property