Search results with tag "Homestead exemption"

CRS 38-41-201 Homestead Exemptions

advisorfinancialservices.comPART 2 HOMESTEAD EXEMPTIONS Law reviews: For article, "Homestead Marshalling", see 14 Colo. Law. 1612 (1985). 38-41-201. Homestead exemption - definitions. (1) Every homestead in the state of Colorado shall be exempt from execution and attachment arising from any debt, contract, or civil

OTC Form 921 Application for Homestead Exemption

www.rogerscounty.orgone homestead exemption in the State of Oklahoma. J. Any property owner who fails to give notice of change to the county assessor and permits the allowance of homestead exemption for any succeeding year where such homestead exemption is unlawful and improper shall owe the county treasurer: 1.

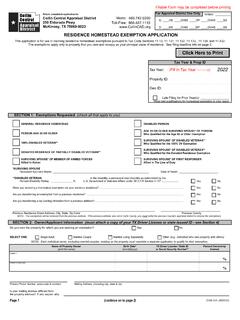

APPLICATION FOR RESIDENCE HOMESTEAD EXEMPTION

www.waller-cad.orgAPPLICATION DEADLINES: For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in Tax Code §11.13(c) and (d), you must file the completed application with all required documentation between January 1 and no later than April 30 of the year for which you are requesting an exemption.

100% Disabled Veterans' Property Tax Exemption Q&A

senate.texas.govdistricts are required to provide a disability homestead exemption, though many other taxing entities do. The new exemption will apply to all taxing units and will exempt the total value of your home. Q. Can I apply the new exemption to my main home and get the general homestead exemption on my vacation home? No.

RESIDENCE HOMESTEAD EXEMPTION APPLICATION

www.collincad.orgPerson exemption, you must file the application no later than the first anniversary of the date you qualify. You may file a late application for a Residence Homestead Exemption, including a 100% Disabled Veteran Homestead Exemption, no …

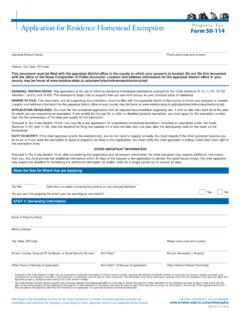

Residence Homestead Exemption Application

comptroller.texas.govA late application for a residence homestead exemption may be filed up to two years after the deadline for filing has passed. (Tax Code Section 11.431). A late application for residence homestead exemption filed for a disabled veteran (not a surviving spouse) under Tax Code sections 11.131 or 11.132 may be filed up to

Application for Residence Homestead Exemption Property …

appraisaldistrictguide.comperson homestead exemption provided in Tax Code §11.13(c) or (d), you must apply for the exemption no later than the first anniversary of the date you qualify for the exemption. Pursuant to Tax Code §11.431, you may file a late application for a …

West Virginia State Tax

tax.wv.govparticipating in the Homestead Exemption Program: They must owe and pay a property tax liability on the Homestead Exemption eligible home (i.e., the assessed value of the eligible home must be greater than $20,000 prior to the application of the Homestead Exemption). Their federal adjusted gross income must meet the low-income test.

Application for Residence Homestead Exemption Property …

appraisaldistrictguide.comperson homestead exemption provided in Tax Code §11.13(c) or (d), you must apply for the exemption no later than the first anniversary of the date you qualify for the exemption. Pursuant to Tax Code §11.431, you may file a late application for a …

Application for Residence Homestead Exemption Property …

www.dallascad.orgperson homestead exemption provided in Tax Code §11.13(c) or (d), you must apply for the exemption no later than the first anniversary of the date you qualify for the exemption. Pursuant to Tax Code §11.431, you may file a late application for a …

Residence Homestead Exemption Application

www.bcad.orgSECTION 5: Provide Additional Information Here (If any) ... residence homestead exemption can be claimed by the property owner on any other property. Disabled Person Exemption (Tax Code Section 11.13(c) and (d)) Persons under a disability for purposes of payment of disability insurance benefits

SENIOR PROPERTY TAX HOMESTEAD EXEMPTION

www.denvergov.orgSENIOR PROPERTY TAX HOMESTEAD EXEMPTION A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. The three basic requirements are: 1) the qualifying senior must be at least 65 years old on January 1 of the year of application; 2) he or she must be

50-114 Application for Residence Homestead Exemption

www.mclennancad.orgPursuant to Tax Code Section 11.431, you may file a late application for a residence homestead exemption, including an exemption under Tax Code Sections 11.131, 11.132 and 11.133, after the deadline for filing has passed if it is filed not later than one year after the delinquency date for the taxes on the

Application for Residence Homestead Exemption Property …

www.brazoriacad.org** Tax Code Section 11.43(m) allows a person who receives a general homestead exemption in a tax year to receive the age 65 or older exemption for an individual 65 years of age or older in the next tax

Application for Residence Homestead Exemption

kaufman-cad.orgPursuant to Tax Code Section 11.431, you may "le a late application for a residence homestead exemption, including an exemption under Tax Code Sections 11.131, 11.132 and 11.133 after the deadline for "ling has passed if it is "led not later than one …

Residence Homestead Exemption Application

www.galvestoncad.orgA late application for a residence homestead exemption may be filed up to two years after the deadline for filing has passed. (Tax Code Section 11.431) If the chief appraiser grants the exemption(s), property owner does not need to reapply annually, but must reapply if the chief appraiser requires it, unless seeking

PROPERTY TAX SAVINGS - Greenville County

www.greenvillecounty.orgHomestead Exemption (SC Code of Laws 12-37-250) The S. C. Homestead Tax Exemption Program is for homeowners who are age 65 or older, and/or totally disabled, and/or totally blind as of December 31 preceding the tax year of exemption. The program exempts up to $50,000 of the value of the home including up to five contiguous acres of property. The

PROPERTY TAX EXEMPTION FOR HOMESTEAD PROPERTY

floridarevenue.comher dependent, the property owner may be eligible to receive a homestead exemption up to $50,000. The first . $25,000 applies to all property taxes, including school district taxes. The additional exemption up to $25,000 applies to the assessed value between $50,000 and $75,000 and only to non-school taxes. ...

PROPERTY E TAX EXEMPTION R QUIREM NTS GUIDE

www.miamidade.govPROPERTY ETAX EXEMPTION R QUIREM NTS GUIDE HOMESTEAD EXEMPTION Legal/equitable title as of January 1. st (If title is held in a Trust, provide a copy of the trust document) Permanent residence on the property as of January 1

Fulton County Guide to Homestead Exemptions

fultonassessor.orgWHAT DOCUMENTATION DO I NEED TO PROVIDE? The first time you apply for homestead exemption, someone listed on the deed must complete an application form.

50-114 Residence Homestead Exemption Application

www.hidalgoad.orgResidence Homestead Exemption Application _____ Appraisal District’s Name Appraisal District Account Number (if known)

Application for Appraisal District Residential Homestead ...

www.hctax.netApplication for Residential Homestead Exemption •Re-filing: If the chief appraiser grants the exemptions, you do not need to reapply annually. You must reapply, however, if the chief appraiser requires you to do so by sending you a new application

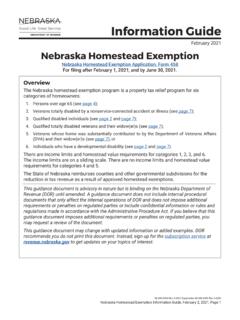

Information Guide - Nebraska

revenue.nebraska.govto those qualifying for a 100% exemption (see December). v November 1. DOR must send approved and denied rosters to the county assessors. v December. All applicants, including those qualifying for a 100% exemption, will see tax and homestead exemption amounts reflected on the tax statements sent by county treasurers.

DETERMINING RESIDENCY CONTACT INFORMATION

www.revenue.pa.gov• claims a homestead exemption • is listed in the telephone directory • obtains homestead exemption • gathers for family and social events • maintains TV and Internet connections • registers to vote What is a statutory residence? A statutory residence is the place where an individual spends the most time during the year.

Nebraska Homestead Exemption Application • Application …

revenue.nebraska.govThis form must be completed in its entirety, signed, and filed after February 1 and on or before June 30 with your county assessor. It is the applicant’s responsibility to secure the necessary application forms. Failure to timely file is a waiver of the homestead exemption. Late Filings. An applicant may file a late application no later than ...

Senior Citizens Assessment Freeze Homestead Exemption …

www.kanecountyassessments.orgSenior Citizens Assessment Freeze Homestead Exemption for 2021 KANE COUNTY ASSESSMENT OFFICE 719 Batavia Avenue (630) 208-3818 Geneva, Illinois 60134-3000 www.KaneCountyAssessments.org Please file this form immediately for the 2021 (taxes payable 2022) assessment year.

96-1740 Texas Property Tax Exemptions

comptroller.texas.govof deciding locally to offer a separate residence homestead exemption of up to 20 percent of a property’s appraised value, but not less than $5,000. 20. Counties are also required to of-fer a $3,000 exemption if the county collects farm-to-market roads or flood control taxes. 21.

Moving to SC - South Carolina

dor.sc.govin South Carolina for a full calendar year, you are eligible for a homestead exemption of $50,000 from the value of your home. The assessment ratio on a second home owned by you is 6%. Property tax relief does not apply to a second home. The exemption for school operating purposes does not apply to a second home.

Homeowner's Guide to Legal Residence in South Carolina

dor.sc.govThe application for exemption must be made to the auditor in the county where the dwelling is located. For more information about property taxes and legal residence, contact the assessor in the county where you live. For more information on the homestead exemption, contact the auditor in the county where you live.

General Exemption Information - Upshur CAD

www.upshur-cad.orgGeneral Residential Homestead Exemption To qualify, the property must be designed or adapted for human residence and the homeowner must own the property on January 1 of the year application is made.

Veterans with disabilities 2018 - Kane County

www.kanecountyassessments.org2018 Application for Veterans’ with Disabilities Standard Homestead Exemption KANE COUNTY ASSESSMENT OFFICE 719 South Batavia Avenue, Building C

Applicant - Oklahoma

www.ok.govA. To receive a homestead exemption, a taxpayer shall be required to file an application with the county assessor. Such application may be filed at any time; provided, the county assessor shall, if such applicant otherwise qualifies, grant a

Hays Central Appraisal District Application for Lex Word ...

www.hayscad.comHays Central Appraisal District Lex Word Building 21001 IH 35 North Kyle, Texas 78640 512) 268-2522 Fax: (512) 268-1945 Application for Residential Homestead Exemption

PTAX-340 2018 Senior Citizens Assessment Freeze

dekalbcounty.orgThe Senior Citizens Assessment Freeze Homestead Exemption (35 ILCS 200/15-172) allows you, as a qualified senior citizen, to have your home’s equalized assessed value (EAV) “frozen” at a

APRIL 1ST ABSOLUTELY NO EXCEPTIONS!!

www.pearlrivercounty.netonly the owner, spouse or power of attn may apply . deadline for filing . homestead exemption is . april 1. st. absolutely no exceptions!! information needed to file for

HOMESTEAD EXEMPTION ELIGIBILITY REQUIREMENTS …

okaloosapa.comHomestead exemption provides a tax exemption up to $50,000 for persons who are permanent residents of the State of Florida, who hold legal or equitable title to the real property, and who occupy the property as their permanent residence. The first $25,000 applies to all property taxes, including school district taxes. The additional exemption

HOMESTEAD EXEMPTION

www.wvseniorservices.govpreceding the tax year for which the Homestead Exemption is sought. When a member of the United States military forces maintains West Virginia as his state of residence throughout his military service and returns to this State and purchases a homestead upon his retirement or earlier separation

HOMESTEAD DECLARATION Protecting the Equity in Your …

saclaw.orgproof is on the homeowner to prove to the court that an automatic homestead exemption exists. Related Guide Exemption from the Enforcement of Judgements ALERT: COVID-19 has temporarily changed the way courts are providing services. Our guides do not reflect these temporary changes. Contact the

Similar queries

201 Homestead Exemptions, Homestead exemptions, HOMESTEAD, Application for Homestead Exemption, Homestead exemption, Oklahoma, Disabled, Property Tax Exemption, Exemption, General homestead exemption, RESIDENCE HOMESTEAD EXEMPTION APPLICATION, Application, Residence Homestead Exemption, Homestead Exemption Application, West Virginia, Additional, Senior, Senior citizens, Application for Residence Homestead Exemption, Greenville County, Exemption Program, Program, Property, HOMESTEAD PROPERTY, Application for Appraisal District Residential Homestead, Form, Assessment, KANE COUNTY ASSESSMENT OFFICE, Guide, Information, General Exemption Information, Veterans with disabilities, Veterans’ with Disabilities, Applicant, 340 2018 Senior Citizens Assessment Freeze, Senior citizen, Absolutely no exceptions, Additional exemption, Guide Exemption