Search results with tag "Health flexible spending"

ERISA and, with one exception, the PHS Act.

www.irs.govnot offer a group health plan (including a health reimbursement arrangement (HRA) or a health flexible spending arrangement (FSA)) to any of its employees. A group health plan includes a plan that provides only excepted benefits described in section 9831(c) (for example, a vision or dental health plan that qualifies as an excepted benefit) if that

Section 125 - Cafeteria Plans I. PURPOSE AND OVERVIEW

www.irs.govindexed for inflation) on salary reduction contributions to health flexible spending arrangements (health FSAs) under § 125(i) of the Internal Revenue Code (Code) (the $2,500 limit) and on the deadline for amending plans to comply with that limit.

Health Flexible Spending Account Frequently Asked …

www.benefitadminsolutions.comAT 6007 20101101 1 Health Flexible Spending Account Frequently Asked Questions What is a health flexible spending account? A health flexible spending account (FSA) is an employer-sponsored plan that allows you to set aside a portion of your income

Flexible Spending AccountOver-the-counter Drug List

fhdafiles.fhda.eduFlexible Spending Account Over-the-counter Drug List Over-the-counter drugs now reimbursable — one more good reason to enroll in a health care Flexible Spending Account (FSA)! Non-prescription, over-the-counter (OTC) drugs and medicines are now reimbursable under health Flexible Spending Accounts (FSAs). When you

Health Flexible Spending Account – Frequently Asked …

mybenefits.wageworks.comA health flexible spending account (FSA) is part of your benefits package. This plan lets you use pre-tax dollars to pay for eligible health care expenses for you, your spouse, and your eligible dependents. Here’s how an FSA works. Money is set aside from your paycheck before taxes are taken out. You can then use your pre-tax FSA dollars to ...

Health Plans Tax-Favored Page 1 of 23 12:09 - 6-Jan-2022 ...

www.irs.govthat can be paid or reimbursed under health flexible spending arrangements (health FSAs), health savings ac-counts (HSAs), health reimbursement arrangements (HRAs), or Archer medical savings accounts (Archer MSAs). That is because the cost to diagnose and prevent COVID-19 is an eligible medical expense for tax purpo-ses.

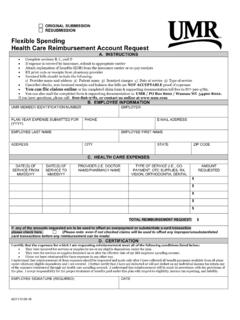

Flexible Spending Health Care Reimbursement Account …

fhs.umr.comFlexible Spending Health Care Reimbursement Account Request. A. INSTRUCTIONS • Complete sections B, C, and D • If expense is covered by insurance, submit to appropriate carrier • Attach explanation of benefits (EOB) from the insurance carrier or co-pay receipts • Rx print outs or receipts from pharmacy provider