Search results with tag "Liabilities"

Prof. George S. Mentz, JD, MBA, CWM ® Counselor of Law …

cdn.ymaws.comavailable for sale, such as trucks, office furniture and other property. Liabilities are generally listed based on their due dates. Liabilities are said to be either current or long-term. Current liabilities are obligations a company expects to pay off within the year. Long-term liabilities are obligations due more than one year away.

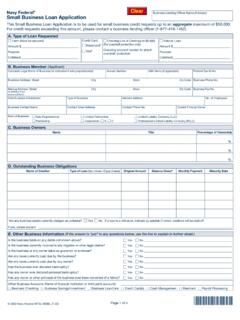

Navy Federal® Small Business Loan Application

www.navyfederal.orgTotal Liabilities : Net Worth (Assets minus liabilities) Total Liabilities Plus Net Worth : Schedule 1 : Investment Stocks and Bonds : Description; Broker No. of Shares or PAR Total Market Value Pledged . Yes : No Yes : No Schedule 2 : …

Business Plan Template Download PDF - iPlanner

www.iplanner.netliabilities, this provides a way for the two categories to balance. When totaled the assets and liabilities with owner's equity should equal each other. What one finds with this financial is where the business capital and liabilities are placed. Cash Flow Statement The cash flow statement shows how cash is flowing in and out of the business. It ...

A Roadmap to Accounting for Business Combinations

www2.deloitte.com4.14 Liabilities for Exit or Restructuring Activities 147 4.15 Instruments Indexed to or Settled in Shares and Classified as Liabilities 147 4.16 Conforming Accounting Policies 147 4.17 Subsequent Measurement of Assets Acquired and Liabilities Assumed 149 Chapter 5 — Measurement of Goodwill or Gain From a Bargain Purchase, and

Draft GDPR contracts guidance v1 for consultation ...

ico.org.ukGDPR – contracts and liabilities between controllers and processors v1.0 draft for consultation 20170913 At a glance Whenever a controller uses a processor it needs to have a written contract in place. The contract is important so that both parties understand their responsibilities and liabilities.

HELP WITH FILLING OUT THE Personal Financial Statement1

mdot.ms.govonly report his 50% interest, $50,000, on his Personal Net Worth Statement. If you do not reside in a community property state, assets and liabilities may be halved if jointly owned. If assets and liabilities are separately owned, these items should only be …

Financial Planning for Small Business

images.template.netOn the balance sheet, total assets will equal the total of liabilities plus the owner’s equity. For example, suppose assets are $20,000 and liabilities are $10,000. Your equity, as owner, would be $10,000. Owner’s equity can also be described as the net worth of …

International Accounting Standard 36 - Hong Kong Institute ...

www.hkicpa.org.hk(b) the initial measurement of the identifiable assets acquired and liabilities and contingent liabilities assumed in a business combination; (c) the recognition of provisions for terminating or reducing the activities of an acquiree; (d) the treatment of any excess of the acquirer’s interest in the fair values of

Business Plan, Cash Flow and Assets and Liabilities

s3-eu-west-1.amazonaws.comvalue, ISAs (savings), pensions, shares, stocks, bonds, securities, vehicles. ... Business Plan, Cash Flow and Assets and Liabilities Page 3 of 3 Declaration (please sign and complete) Applicant 1 Full name Signature Date Applicant 3 Full name Signature Date Applicant 2

Accounting Entries Related to Debt

www.wgfoa.com• Short-term debt – BAN, NAN, TAN, RAN, GAN • Long-term debt – Identify projects funded by debt – Recognize distinction between fund liabilities and general long-term liabilities – Governmental vs. proprietary funds When do you report general obligation debt in …

The I Theory of Money - Princeton University

scholar.princeton.edunet worth (as shown in Brunnermeier and Sannikov (2014)). On the liabilities side, inter-mediaries are hurt by the Fisher disin ation. As lending and inside money creation shrink, money demand rises and the real value of nominal liabilities expands. The \Paradox of Prudence" arises when intermediaries shrink their balance sheet and households ...

How to wind up your own company - Citizens Advice

www.citizensadvice.org.ukstate that the directors have made a full inquiry into the company's affairs and are of the opinion that the company can pay its debts and interest within a maximum of 12 months; and include an up-to-date statement of the company's assets and liabilities.

Building a 3 Statement Financial Model in Excel

corporatefinanceclub.nd.eduCash flow statement Supporting schedules Historical ratios and figures which drive the forecast Summarizes the company’s profit and loss Displays the company’s assets, liabilities and shareholders’ equity Reports the cash generated and spent by a company Breaks down longer calculations such as PP&E and debt schedule

WHO OWNS THE ASSETS? - BlackRock

www.blackrock.comHigh Net Worth Individuals (HNWI)d $52.4 Mass Affluent $59.5 . ... liabilities in an attempt to reduce the volatility of the pension deficit and potential impact on the sponsor’s balance sheet. ... value of their assets. For example, a plan’s Chief Investment Officer (CIO) might be directed by the pension’s investment ...

BUSINESS PLAN - Comunidad de Madrid

www.madrid.org9A Business Plan is a document in which a business opportunity, or a business ... assets exceed the current liabilities. ... 9The Cash Flow measures the value of each business project through the amount of liquidity that it generates within a period of time, normally one year. ...

Duties of Directors - Deloitte

www2.deloitte.comperform their duties to a certain standard, and it is a reasonable assumption of the shareholders that every individual director will apply his or her particular skills, experience and intelligence appropriately and to the best advantage of the ... borrowings as “non-current liabilities ...

PAPER 1: PRINCIPLES AND PRACTICE OF ACCOUNTING …

d2cyt36b7wnvt9.cloudfront.net3. (a) Pass a journal entry in each of the following cases. (i) A running business was purchased by Mohan with following assets and liabilities: Cash ` 2,000, Land ` 4,000, Furniture ` 1,000, Stock ` 2,000, Creditors ` 1,000, Bank Overdraft ` 2,000. (ii) Goods distributed by way of free samples, ` 1,000.

FIDUCIARY DUTIES, EXCULPATION, AND INDEMNIFICATION …

www.baylor.eduduties and liabilities of managerial or governing persons. The power to define duties, eliminate liability, and provide for indemnification is addressed somewhat differently in the statutes governing the various forms of business entities. II. CORPORATIONS A. Fiduciary Duties of Corporate Directors, Officers, and Shareholders

Understanding the new Companies Act

www.pwc.co.zaThe Companies Act, No. 71 of 2008 (the Act) significantly changes the landscape of company law in South Africa. The Act was signed by the President on 8 April 2009, but ... Directors’ duties, responsibilities and liabilities Business rescue Fundamental transactions, valuations and shares The impact of the Act on state-owned entities

2021 Vietnam Tax Guide

vietnam.acclime.comprofessional accounting, tax, payroll, compliance, company establishment and advisory services in ... Direct Method: VAT liabilities for each specific goods and ... records, invoices and supporting documents in line with prevailing regulations,

ACCOUNTING RECORDS AND SOURCE DOCUMENTATION

www.dhs.wisconsin.govaccounting records must contain information pertaining to grant or subgrant awards and authorizations, obligations, unobligated balances, assets, liabilities, outlays or expenditures, and income; and documents must be adequate to provide …

Sample Test for Financial Accounting

www.csun.eduJohnny’s Car Repair Shop started the year with total assets of $60,000 and total liabilities of $40,000. During the year the business recorded $100,000 in car repair revenues, $55,000 in expenses, and dividends of $10,000. ____ 3. The net income reported by Johnny’s Car Repair Shop for the year was a. $35,000. b. $45,000. c. $20,000. d ...

Notary Public Handbook - ctas.tennessee.edu

www.ctas.tennessee.eduPowers, Duties, Fees, Records, and Liabilities Powers. A Tennessee notary public is authorized to act in any county in Tennessee and has the power to acknowledge signatures upon personal knowledge or satisfactory proof, to administer oaths, to take depositions, qualify parties to bills in chancery, and to take affidavits. T.C.A. § 8-16-112.

Exploring the new investment world of REIT

www2.deloitte.com• Insurance companies / insurer (subject to certain conditions) ... • Valuation of the projects • Valuation of assets and liabilities ... dividend policy, borrowing limits, valuation, board structure, meetings, filing of documents with SEBI and Stock exchange, etc.

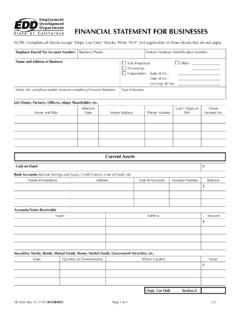

FINANCIAL STATEMENT FOR BUSINESSES - Employment …

edd.ca.govSecurities – List all stocks, bonds, mutual funds, money market funds, government securities, etc. Include the quantity or denomination, where it is located, and the current value. Current Liabilities. List all creditors and their addresses, the balances due, and the monthly payments, if applicable. You may be requested to

Financial AccountingPilot Paper - ACCA Global

www.accaglobal.com4 Annie is a sole trader who does not keep full accounting records. The following details relate to her transactions with credit customers and suppliers for the year ended 30 June 20X6: $ ... D Current assets $16,240 Current liabilities $6,000 7 A company’s income statement for the year ended 31 December 20X5 showed a net profit of $83,600 ...

GUIDE TO COMPANIES ACT NO 71 OF 2008 - STBB

stbb.co.zaNotes on the guide to Companies Act No 71 of 2008 2 1. Introduction 3 2. Categorisation of companies 4 3. Company formation and registration 6 ... C. Codified regime of directors duties 55 D. Solvency and liquidity test 56 ... the debts and liabilities of the company that were contracted during their respective terms of office}.

SECURITIES AND EXCHANGE COMMISSION 17 CFR Parts 210, …

www.sec.govin Federal Register], except for the rescission to 17 CFR 229.801(c) and 229.802(c), which ... under the Securities Act of 1933 (“Securities Act”) 1 and the Securities Exchange Act of 1934 ... Liabilities and Stockholders’ Equity; Interest Rate and

Director’s liability for breach of their duties - CIPC

www.cipc.co.za2. Directors Duties Sources Common law Companies Act 2008 3.Directors Liability Sources Companies Act, 2008 Memorandum of Incorporation King III / King IV™ 3. Director Liability (cont) Reckless trading −Piercing the corporate veil −Derivative action −Impositions −Liabilities checklist 4. Questions and Answers

COMPANIES ACT GUIDE - Moore Stephens

southafrica.moorestephens.comCOMPANIES ACT 2008 Notes on the guide to Companies Act No 71 of 2008 2 1. Introduction 3 2. Categorisation of companies 4 ... C. Codified regime of directors duties 55 D. Solvency and liquidity test 56 ... the debts and liabilities of the company that were contracted during their respective terms of office}.

Chapter 10 Questions Multiple Choice - Harper College

www.harpercollege.eduChapter 10 Question Review 8 Chapter 10 Solutions Multiple Choice Solutions 1. C 2. B 3. C 4. D 5. B 6. B 7. C 8. D 9. A 10. D 11. B 12. D 13. C 14. A 15. C Exercise Solutions 1. STEINER SALES COMPANY Current Liabilities Current portion of long-term debt $ 15,000 Notes payable, 3-month 50,000 Accounts payable 65,000 Sales taxes payable 38,000

Leading health and safety at workActions for directors ...

www.hse.gov.uka summary of legal liabilities; a checklist of key questions for leaders; a list of resources and references for implementing this guidance in detail. The agenda consists of: core actions for boards and individual board members that relate directly to the legal duties of an organisation. These actions are intended to set a standard;

QuickBooks Enterprise Solutions User Guide

http-download.intuit.comThe Payroll Center is a hub for managing all payroll activities. The Payroll Center reminds you of important payroll dates so you pay employees, pay your payroll liabilities, and file forms on time. To visit the Payroll Center, click the Employee …

Working Capital and Cash Conversion Cycle

ctl.mit.edu3 Working capital • Working Capital = Current Assets - Current Liabilities – Cash conversion cycle: Accounts Receivable, Inventory, Accounts Payable – Other: Cash, short term investments, short term debt • Working capital requirements are an …

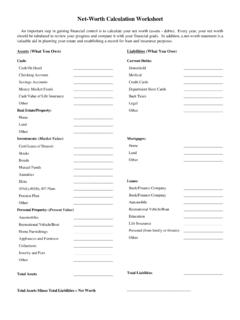

Net-Worth Calculation Worksheet - Rutgers University

njaes.rutgers.eduLiabilities _____ Net-Worth Calculation Worksheet. An important step in gaining financial control is to calculate your net worth (assets - debts). Every year, your net worth should be tabulated to review your progress and compare it with your financial goals. In …

Financial Statements (trend analysis) Solvency ratios ...

www.tsu.eduQuick ratio is a stricter measure of liquidity of a company than its current ratio. Quick ratio is most useful where the proportion of illiquid current assets to total current assets is high. Formula Quick Ratio = (Cash + Marketable Securities + Receivables)/Current Liabilities

THIS AGREEMENT FOR CONSULTANCY SERVICES made on …

www.aact.org.ukliabilities, charges and dues for which the Consultant is liable. 5. ... the duties assigned to him hereunder, the Client shall be entitled to give notice to the Consultant to ... earlier, the Consultant or his personal representative as the case may be, shall immediately deliver up to the Client all correspondence, reports, documents ...

Bylaws - Nolo

www.nolo.comThe directors shall not be personally liable for the debts, liabilities, or other obligations of the corporation. Section 16. Indemnification by Corporation of Directors and Officers The directors and officers of the corporation shall be indemnified by the corporation to the fullest extent permissible under the laws of this state.

Frequently Asked Questions1 on the Statement of Assets ...

www.csc.gov.phIt is the statement of assets, liabilities and net worth, and the disclosure of financial connections or business interests and identification of relatives within the fourth degree of consanguinity or affinity. Further, it also requires the declarant to name his/her bilas, balae and inso who are in government service. ...

Sri Lanka Accounting Standard - SLFRS 16 Leases

www.casrilanka.comrecognised and measured applying LKAS 37 Provisions, Contingent Liabilities and Contingent Assets. Initial measurement of the lease liability 26 At the commencement date, a lessee shall measure the lease liability at the present value of the lease payments that are not paid at that date.

HR PAYROLL SYSTEM - NC

files.nc.govRecovery of Liabilities Time evaluation checks for time entry errors, updates the time/leave records that were entered and approved and these results are used to generate your pay. Step A Step B Step C HR Payroll Sy Evaluation to update & check Time/Leave is entered in stem Note: ESS employees must

Companies Act No. 71 of 2008 Duties and Liabilities of ...

www.werksmans.comappointment and removal of directors of a company; restrictions imposed on who may become a director; and quorum for a meeting of a company’s board of directors. Background The Act was signed into law on 8 April 2009 and become operative from 1 May 2011.

A PRACTICAL GUIDE TO THE CLASSIFICATION OF FINANCIAL ...

www.grantthornton.com.auNor does it deal with the classification of non-financial liabilities. A ‘financial instrument’ is defined under IAS 32 as: “any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity.” Further, not all financial instruments fall within the scope of IAS 32.

DUTIES AND LIABILITIES OF DIRECTORS OF ... - Baker …

www.bakermckenzie.comcompany. This Guide outlines the duties of directors of an Australian company. Matters covered in this Guide include common law and statutory duties, delegation, reliance on others, insider trading, disclosure requirements and directors’ insurance and indemnities. A Glossary of key terms is included at the end of the Guide.

DoD 7000.14 - R DEPARTMENT OF DEFENSE FINANCIAL …

comptroller.defense.govIt represents the entity’s assets, liabilities, and net worth (or fund equity). *2.3 Chart of Accounts (010203) The chart of accounts is a list of ledger accou nt names, descriptions, and numbers arranged in the order in which theycustomarily appear in the financial statements. The chart serves as a

Similar queries

And other, Liabilities, Net worth, Assets, Business Plan, Assets and liabilities, Business, And liabilities, Cash Flow, Cash, Roadmap to Accounting for Business Combinations, Accounting, Draft, Guidance, For consultation, Contracts and liabilities between controllers and processors, Draft for consultation, Statement, Accounting Standard 36, Contingent liabilities, Provisions, Business Plan, Cash Flow and Assets and Liabilities, ISAs, Debt, Term debt, Long, General long, Term liabilities, General, Money, Directors, Cash flow statement, BlackRock, Duties of Directors, Duties, The following, Duties and liabilities, 71 of 2008, Vietnam Tax Guide, Payroll, Records, ACCOUNTING RECORDS AND SOURCE DOCUMENTATION, Sample Test for Financial Accounting, Insurance, Valuation, Policy, Employment, Securities, Of directors duties, Federal, Under, Directors Duties, 2008, Of 2008, Chapter, Leading health and safety at, Payroll liabilities, Net-Worth, Quick, Personal representative, Nolo, Of Directors, Liabilities and net worth, 37 Provisions, Contingent Liabilities and Contingent, Of 2008 Duties and Liabilities of, Removal, Director, DUTIES AND LIABILITIES OF DIRECTORS, Guide, Statutory duties, And net worth