Search results with tag "Schedule k 1"

2021 Schedule K-1 (Form 1120-S) - IRS tax forms

www.irs.govCredits . 14. Schedule K-3 is attached if checked . . . . . 15 . Alternative minimum tax (AMT) items . 16 . Items affecting shareholder basis . 17 . Other information . 18. More than one activity for at-risk purposes* 19. More than one activity for passive activity purposes* * See attached statement for additional information.

2021 Partner’s Instructions for Schedule K-1 (Form 1065)

www.irs.govGeneral Instructions Purpose of Schedule K-1 The partnership uses Schedule K-1 to report your share of the partnership's income, deductions, credits, etc. Keep it for your records. Do not file it with your tax return unless you are specifically required to do so. (See the instructions for Code O. Backup withholding, later.) The partnership files a

2021 Schedule K-1 (Form 1041) - IRS tax forms

www.irs.govSchedule K-1 (Form 1041) 2021 Beneficiary’s Share of Income, Deductions, Credits, etc. Department of the Treasury Internal Revenue Service

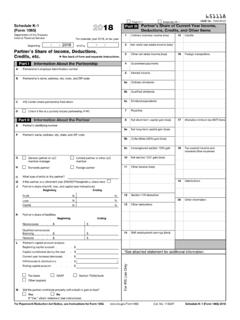

2021 Part III Partner’s Share of Current Year Income,

www.irs.gov651121 . OMB No. 1545-0123 . Schedule K-1 (Form 1065) 2021. Department of the Treasury Internal Revenue Service . For calendar year 2021, or tax year

This list identifies the codes used on Schedule K-1 …

www.pca-cpa.comSchedule K-1 (Form 1041) 2010. Page . 2 . This list identifies the codes used on Schedule K-1 for beneficiaries and provides summarized reporting information for

2017 Shareholder's Instructions for Schedule K-1 …

www.irs.govPage 3 of 20 Fileid: … 120SSCHK-1/2017/A/XML/Cycle05/source 13:23 - 25-Jan-2018 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before print

2017 Schedule K-1 Instructions and Graphic Guide …

www.wncinc.comwww.wncinc.com Schedule K-1 Entries and Where They Go 7) You will need Forms 8586, 8582CR and 3800 to claim the credit. You will also need to complete Form 6251 if …