Search results with tag "You owe"

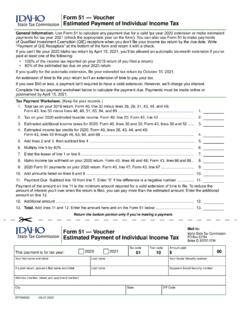

Form 51, Estimated Payment of Individual Income Tax

tax.idaho.govAug 27, 2020 · • 80% of the estimated tax due on your 2020 return If you qualify for the automatic extension, file your extended tax return by October 15, 2021. An extension of time to file your return isn’t an extension of time to pay your tax. If you owe $50 or less, a payment isn’t required to have a valid extension. However, we’ll charge you interest.

Form 9465 Installment Agreement Request - IRS tax forms

www.irs.govinstallment agreement cannot be turned down if the tax you owe is not more than $10,000 and all three of the following apply. Purpose of Form Use Form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Generally, you can have up to 60 months to pay.

TR-320 CR-320 Can't Afford to Pay Fine: Traffic and Other ...

www.courts.ca.govIf you can't afford to pay your fine, fill out this form to ask for a lower fine, a payment plan, more time to pay, and/or community service. Using this form. Use this form . after. the court has decided that you owe the fine. You may use this form even if your fine has been sent to collections. If you have more than one fine, use one form for ...

FORM CO-411 Instructions Corporate Income Tax Return …

tax.vermont.govincome during 2017 and are mistakenly paying Vermont tax in installments, then you must amend your 2017 Vermont return and pay any outstanding tax. You may be subject to penalties and interest on additional tax that you owe. You may also need to amend your Vermont returns that were filed after 2017.

Resource Guide for Understanding federal tax deposits

www.irs.govthese employment tax deposits so you can avoid these penalties. In fact, you could be charged additional penalties if you don’t file your employment tax returns on time and pay the money you owe. Through this course, we intend to make this process easier to understand. We can’t guarantee you’ll never have problems again with tax deposits ...

California Buyer’s Guide to Tax

www.cdtfa.ca.govIf you owe use tax, it will be based upon the purchase price of the car, minus whatever sales tax you paid to another state. You can pay the tax to the DMV when you register the car in California. For more information, visit the Tax Guide for Purchases of Vehicles, Vessels, and Aircraft on the CDTFA website. Do you have to pay tax on car rental or

Instructions for C and S Corporation Income Tax Returns

dor.sc.govElectronic Mandate: If you owe $15,000 or more in connection with any SCDOR return, you must file and pay electronically according to SC Code Sections 12-54-250 and 12-54-210 found at dor.sc.gov/policy. Abbreviated instructions: † If all of the corporation's activities are in South Carolina, use Schedules A and B to make adjustments to federal

The IRS Collection Process

www.irs.govyour correct tax, we record the amount in our records. If you owe, we will send a bill for the amount due, including any penalties and interest.