Search results with tag "1099 c"

Instructions for Forms 1099-A and 1099-C (Rev. January 2022)

www.irs.gov1099-A and Form 1099-C, Cancellation of Debt, for the same debtor. You may file Form 1099-C only. You will meet your Form 1099-A filing requirement for the debtor by completing boxes 4, 5, and 7 on Form 1099-C. However, if you file both Forms 1099-A and 1099-C, do not complete boxes 4, 5, and 7 on Form 1099-C. See the

Form 1099-C (Rev. January 2022) - IRS tax forms

www.irs.govCREDITOR’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. CREDITOR’S TIN. DEBTOR’S TINDEBTOR’S name Street address (including apt. no.) City or town, state or province, country, and ZIP or foreign postal code Account number (see instructions) 1. Date of identifiable event. 2

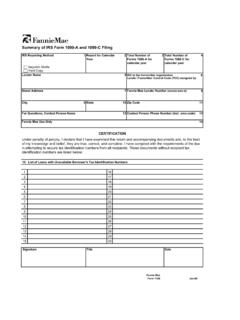

Summary of IRS Form 1099-A and 1099-C Filing (Form …

www.fanniemae.comInstructions. Instructions Page. Summary of IRS Form 1099-A and 1099-C Filing . Every servicer must prepare this form either to notify us that it submitted original, corrected, or voided IRS Forms 1099-A and 1099-C directly to the IRS on