Search results with tag "Treasury inspector general for tax administration"

IRC §7216 SUGGESTED – SAMPLE CLIENT CORRESPONDENCE …

www.calt.iastate.eduNote: If you believe your tax return information has been disclosed or used improperly in a manner unauthorized by law or without your permission, you may contact the Treasury Inspector General for Tax Administration (TIGTA) by telephone at 1-800-366-4484, or by email at complaints@tigta.treas.gov.

TREASURY INSPECTOR GENERAL FOR TAX …

www.treasury.govTREASURY INSPECTOR GENERAL FOR TAX ADMINISTRATION Processes Are Being Established to Detect ... TREASURY INSPECTOR GENERAL FOR TAX ADMINISTRATION September 9, 2015 ... The primary purpose of the IRS Advisory Council is to provide an organized public forum for discussion of relevant tax administration issues between IRS officials and ...

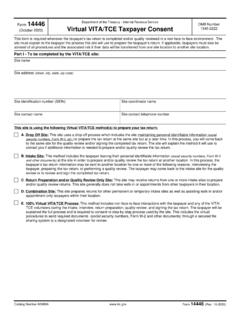

Form 14446 Virtual VITA/TCE Taxpayer Consent - IRS tax …

www.irs.govsignature. If you believe your tax return information has been disclosed or used improperly in a manner unauthorized by law or without your permission, you may contact the Treasury Inspector General for Tax Administration (TIGTA) by telephone at 1-800-366-4484, or by e-mail at complaints@tigta.treas.gov.