Search results with tag "Schedule e"

INCOME CALCULATION WORKSHEET - DUdiligence.com

www.dudiligence.comINCOME CALCULATION WORKSHEET PART I - INCOME TYPE Section Borrower Co-Borrower 1) Hourly: See Part II, Section 1a, 1b, 1c or 1d (seasonal worker) ... Step 1 Enter year 1 rental income from line 3 on the Schedule E $ Step 2 Enter year 2 rental income from line 3 on the Schedule E $

Income Calculations - Freddie Mac

sf.freddiemac.com6. Schedule E1 – Supplemental Income or Loss (Royalties) (Chapter 5305) Royalties received (+) (+) Total expenses (-) (-) Depletion (+) (+) Subtotal Schedule E, from royalties $ $ 1Refer to Form 92 for net rental income calculations using IRS Schedule E 7. Schedule F – Profit or Loss from Farming (Chapter 5304)

Cash Flow Analysis

c317119.r19.cf1.rackcdn.comThe following self-employed income analysis worksheet and accompanying guidelines generally apply to individuals: Who have 25% or greater Who are employed by Who are paid Who own rental property interest in a business family members commissions ... Schedule E - Supplemental Income and Loss 26. Gross Rents and Royalties Received (+) (+)

Income and Loss Supplemental - IRS tax forms

www.irs.gov2021 Instructions for Schedule ESupplemental Income and Loss Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. You can attach your own schedule(s) to report income or loss from any of these sources.

Supplemental Income and Loss (From rental real estate ...

www.irs.govSCHEDULE E (Form 1040) Department of the Treasury Internal Revenue Service (99) Supplemental Income and Loss (From rental real estate, royalties, partnerships, S corporations, estates, trusts, REMICs, etc.)

Supplemental Income and Loss (From rental real estate ...

www.irs.govSCHEDULE E (Form 1040) Department of the Treasury Internal Revenue Service (99) Supplemental Income and Loss (From rental real estate, royalties, partnerships, S corporations, estates, trusts, REMICs, etc.)

2021 Schedule E (Form 990) - IRS tax forms

www.irs.govthe organization has publicized its racially nondiscriminatory policy on its primary publicly accessible Internet homepage at all times during its tax year in a manner reasonably expected to be noticed by visitors to the homepage. Purpose of Schedule. Schedule E (Form 990) is used by an organization that files Form 990 or

Supplemental Income and Loss (From rental real estate ...

www.irs.govSCHEDULE E (Form 1040) Department of the Treasury Internal Revenue Service (99) Supplemental Income and Loss (From rental real estate, royalties, partnerships, S corporations, estates, trusts, REMICs, etc.)

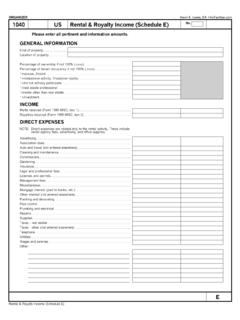

ORGANIZER Kevin E. Lewis, EA HiloTaxMan.com 1040 US …

www.hiloagent.comORGANIZER 1040 US Rental & Royalty Income (Schedule E) E Rental & Royalty Income (Schedule E) Please enter all pertinent and information amounts. GENERAL INFORMATION

Rental Income/Schedule E Calculation Worksheet

www.stmpartners.comRental Income/Schedule E Calculation Worksheet Property Address: _____ Schedule E - Rental Income

Similar queries

INCOME CALCULATION WORKSHEET, Income, Rental income, Schedule E, Freddie Mac, Schedule, Worksheet, Rental, Supplemental, IRS tax forms, Instructions, 1040, Rental real estate, royalties, partnerships, S corporations, estates, Kevin E. Lewis, EA HiloTaxMan, Rental & Royalty Income Schedule E, Rental Income/Schedule E Calculation Worksheet