Transcription of 2017 Publication OR-17 - oregon.gov

1 150-101-431 (Rev. 12-17)2017 OREGONP ublication OR-17 Individual Income Tax GuideThis Publication supplements the oregon income tax instruction booklet and the Internal Revenue Service Tax Guide: Publication 17, Your Federal Income Tax For is a guide, not a complete statement of oregon laws and rules. Law or rules may have changed after printing. Refer to the oregon Revised Statutes (ORS) and oregon Administra-tive Rules (OAR), available at and publicationsFor tax forms and publications go to or write:Forms oregon Department of Revenue PO Box 14999 Salem OR 97309-0990Do you have questions or need help? (503) 378-4988 or (800) @ us for ADA accommodations or assistance in other professionalsQuestions. If you're a tax professional, you can email us for assistance. Please research your question. We ca n assist you with oregon income tax law and policy questions, but we can't provide or discuss specific taxpayer information, prepare returns, or make calculations for you.

2 You can include .txt files in your email, but we are unable to open any other type of attachments. In the email, include your question with your name, business name, and phone (with area code). We'll get back to you within three business days. Personal and partnership income tax: @ Corporate income or excise tax: @ Corporate minimum tax: @ Payroll and business tax: @ Inheritance/estate tax: @ To receive emailed information from us, subscribe to Revenews, at and navigate to Revenews. 150-101-431 (Rev. 12-17)4 ContentsFederal tax law ..7 New information ..7 Important reminders ..7 General information ..9Do I have to file an oregon income tax return? ..9 Electronic filing for oregon ..102-D barcode filing for oregon ..11 Why oregon needs a federal return ..11 Record-keeping requirements ..11 Filing an oregon return ..13 Residency ..13 Extensions of time to file ..15 Which form do I file? ..15 Filing domestic partners (RDPs).

3 19 Individual Taxpayer Identification Number ..19 Military personnel filing information ..20 Payments and refunds ..25 Payment options ..25 Direct deposit of refund ..25 Application of refund ..25 Refund processing ..26 Injured spouse refund claims ..26 oregon statute of limitations on refunds ..27 Amended returns ..28 How do I amend my oregon return? ..28 Interest and ..30 Penalties ..31 Audits and appeals ..33 What to do if your return is audited ..33 Appeals ..34 Failure to file an oregon income tax return ..37 Filing a return after tax is assessed ..37 Income ..39 What income is taxable in oregon ? ..39 Air carrier employees ..39 Alimony received ..40 Business income or loss ..40 Federal Schedule E and F income ..40 Gain, loss, and distributions ..40 Hydroelectric dam workers ..40 Individual Retirement Account (IRA) distributions ..41 Interest and dividend income ..41 Interstate Transportation Wages (Amtrak Act ) ..41 Like-kind exchange or involuntary conversion.

4 43 Retirement income ..43 Social Security and Railroad Retirement Board benefits ..44 State and local income tax refunds ..44 Unemployment insurance benefits and other taxable income ..44 Wages, salaries, and other pay for work ..45 Waterway workers ..45 Adjustments ..46 Alimony paid ..46 Certain business expenses of reservists, performing artists, and fee-basis government officials ..46 Domestic production activities deduction ..47 Educator expenses ..47 Health Savings Account deduction ..47 Interest penalty on early withdrawal of or self-employed SEP and savings incentive match plan for employees (SIMPLE) contributions ..48 Moving expenses ..48 Self-employed health insurance ..49 Self-employment tax ..49 Student loan interest ..49 Write-in adjustments on federal Form 1040, line 36 ..49 Additions ..50 Accumulation distribution from certain domestic trusts ..50 Achieving a Better Life Experience (ABLE) Account nonqualified withdrawal.

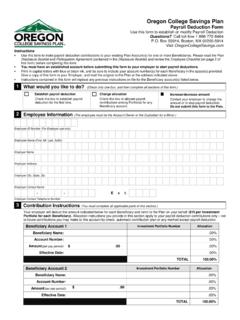

5 50 Capital loss carryover difference ..50 Child Care Fund contributions ..50 Claim of right income repayments ..51 Depletion ..51 Discharge of indebtedness from reacquisition of debt instrument ..51 Disposition of inherited oregon farmland or forestland ..51 Disqualified charitable donations ..52 Domestic production activities deduction ..52 Federal election on interest and dividends of a minor child ..52 Federal estate tax ..52 Federal income tax refunds ..53 Federal subsidies for employer prescription drug plans ..54 Gambling losses claimed as an itemized deduction ..54 Income taxes paid to another state ..54 Individual Development Account ..55 Interest and dividends on government bonds of other states ..56 Lump-sum distributions ..56 oregon 529 College Savings Network ..57 oregon Production Investment Fund (auction) ..57 Renewable Energy Development contributions (auct ion) ..57 University Venture Development Fund contributions.

6 58 Unused business credits ..58 WFHDC medical expenses ..58 Subtractions ..59 ABLE Account deposit ..59 American Indian ..59 Artist s charitable contribution ..60 Capital Construction Fund ..61 Construction worker and logger commuting expenses ..61 Conversions and exchanged property ..62 Domestic international sales corporation (DISC) dividend payments ..62150-101-431 (Rev. 12-17)5 Discharge of indebtedness from reacquisition of debt instrument ..62 Federal income tax liability ..62 Federal Tax Worksheet ..63 Federal pension income ..64 Federal tax credits ..66 Foreign income tax ..66 Income on a composite return ..66 Individual Development Account (IDA) ..67 Interest and dividends on bonds and notes ..67 Land donations to educational institutions carryforward ..68 Local government bond interest ..68 Lottery winnings ..69 Manufactured dwelling park capital gain exclusion ..69 Manufactured dwelling park business expenses ..69 Mortgage interest credit.

7 70 oregon 529 College Savings Network ..70 oregon income tax refund ..71 oregon Investment Advantage ..71 Previously taxed employee retirement plans ..72 Previously taxed IRA conversions ..72 Public Safety Memorial Fund Retirement Board benefits ..73 Scholarship awards used for housing expenses ..73 Social Security benefits ..73 Special oregon medical subtraction ..73 Taxable benefits for former RDPs ..77 Tuition and fees .. government interest in IRA or Keogh distribution ..77 Other items ..79 Net operating losses (NOLs) for oregon ..79 Depreciation and amortization ..82 Partnership and S corporation modifications for oregon and Business tax credits from PTE ..83 PTE reduced tax of business assets transferred into oregon ..84 Sale of assets ..85 Gain on the sale of an oregon residence ..85 Fiduciary adjustment ..86 Passive activity losses (PALs) ..86 oregon percentage ..87 Deductions and modifications ..87 Limit on itemized deductions.

8 88 Interest on certain installment sales ..91 Farm liquidation long-term capital gain tax rate ..91 Farm income averaging ..91 Credits ..92 Types of Credits ..92 Standard credits ..93 Exemption credit ..93 Income taxes paid to another state ..94 Exception for oregon resident partners and S corporation shareholders ..98 Mutually-taxed gain on the sale of residential property ..98 oregon Cultural Trust contributions ..99 oregon Veterans Home Physicians ..99 Political contributions ..99 Reservation enterprise zone ..100 Retirement income ..101 Rural emergency medical service providers ..102 Rural health practitioners ..102 Carryforward credits ..104 Agriculture workforce housing ..104 Alternative Fuel Vehicle Fund carryforward ..105 Alternative qualified research activities ..105 Biomass production/collection ..105 Business energy carryforward ..106 Child and dependent care carryforward ..106 Child Care Fund of computers or scientific equipment for research carryforward.

9 107 Crop donation ..107 Electronic commerce zone investment ..108 Employer-provided dependent care assistance ..108 Employer scholarship ..108 Energy conservation project ..108 Fish screening devices ..109 Lender s credit: affordable housing ..109 Lender s credit: energy conservation enterprise zone facilities ..110 oregon IDA Initiative Fund donation ..110 oregon Low-Income Community Jobs Initiative/New Markets ..110 oregon Production Investment Fund (auction) ..111 Pollution control facilities carryforward ..111 Qualified research activities ..111 Renewable energy development contribution (auction) ..111 Renewable energy resource equipment manufacturing facility ..112 Residential energy ..112 Rural technology workforce development ..113 Transportation projects carryforward ..113 University venture development fund contributions ..113 Refundable credits ..115 Claim of right income repayment ..115 Earned income credit ..115 Manufactured home park closure.

10 115 Working Family Household and Dependent Care (WFHDC) ..115 Interest on underpayment of estimated tax ..117 Who must pay ..117 Figure your required annual payment ..117 Figure your required installment payment ..117 Exceptions to paying interest on an underpayment of estimated tax ..117 Estimated tax ..118 Who must pay ..118 Farmers and commercial fishermen ..118 Nonresidents and part-year ..118 Nonresident aliens ..118 Fiduciaries ..118 Appendix ..119150-101-431 (Rev. 12-17)7 Federal tax lawNo extension to pay. oregon doesn t allow an exten-sion of time to pay your tax, even if the IRS is allowing an extension. Your 2017 oregon tax is due April 17, law connection. oregon is tied to December 31, 2016 federal income tax laws. oregon has a rolling tie to federal changes made to the definition of taxable income, with two exceptions: Internal Revenue Code (IRC) Section 139A for fed-eral subsidies for employer prescription drug plans.